|

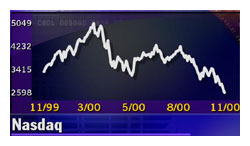

A November to forget

|

|

November 30, 2000: 5:05 p.m. ET

Warnings spark heavy tech sell-off, sending U.S. stocks plunging

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stock markets suffered triple-digit losses Thursday after revenue warnings from two key companies and weak economic data sparked a massive sell-off in technology stocks that sent the Nasdaq composite index to its lowest level in 15 months.

The Dow Jones industrial average also fell to its lowest level in one month as its technology components, Microsoft, Intel and IBM, took a beating in the wake of the warnings from computer maker Gateway and chip maker Altera.

|

|

VIDEO

|

|

Brian Finnerty of C.E. Unterberg, Towbin, chats with CNNfn about tech selloff. Brian Finnerty of C.E. Unterberg, Towbin, chats with CNNfn about tech selloff. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

"People are really starting to worry about earnings again," said John Forelli, senior vice president and portfolio manager with Independence Investment Associates. "This is a pattern that started in September when the tech market started selling off pretty hard. We're going to have a tough quarter – it's hard to see what will get people excited about the markets over the next couple of months."

The Nasdaq has been on a steady decline since the end of August amid growing concern about the extent of the economic slowdown and its effect on corporate revenue growth. Wall Street's bearish sentiment was compounded by a presidential election that has dragged on since Nov. 7 and whose outcome remains uncertain.

By the time the dust had settled Thursday, the Nasdaq was down 108.93 points, or more than 4 percent, to 2,597.98.

The index now has plunged nearly 50 percent below its March 10 high of 5,048 and is 36 percent below where it started the year. If the Nasdaq ended the year at current levels, this would be the worst year for the tech-laden index since it started in 1971. Since the Nov. 7 U.S. presidential election, the composite has shed 24 percent.

Click here for a history of the Nasdaq composite index.

This time last year, the Nasdaq was chugging higher, on its way to a record 86-percent gain for 1999. However, a combination of weaker technology earnings, higher interest rates and slower economic growth has prompted many investors to head for the exits. Over the last 12 months, the index is down 22 percent.

The Dow Jones industrial average plunged 214.62 points, or more than 2 percent, to 10,414.49, and the S&P 500 fell 26.98 to 1,314.95.

A searing rally in technology stocks gave the Nasdaq a 32 percent gain during the fourth quarter of 1999.

"People that are overexposed in tech should rethink the thesis that many seem to hold that since stocks are down (significantly), they are going to shoot to the sky," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "Last year was an anomaly."

Bears running rampant

Investors seemed to buy Meehan's point of view more than that of

influential Goldman Sachs strategist Abby Joseph Cohen. Cohen, one of Wall Street's best known bulls, reiterated her 12-month forecast for the S&P at 1,650.

"It certainly doesn't hurt," said Art Hogan, chief market analyst at Jefferies & Co. "It always helps to hear her say that she's still confident but it's 12 months out."

Analysts say there are a bunch of key factors that have the hurt the markets over the past few months:

- Earnings and the economy: Worries and warnings that tech companies will not sustain a stellar pace of revenue growth in the wake of a slowing U.S. economy.

- Interest Rates: The Fed has raised interest rates six times over the last year and a half but has held the line in recent months amid signs of a slowdown. With evidence mounting that the rate hikes have done their job, many market watchers are now hoping the Fed will either cut rates or at least shift its stance toward a more neutral position. "I think what a lot of people would like to see out of that December (19 Fed) meeting is, is a change in the bias," Linda Jay, NYSE floor trader with RPM Specialists, told CNNfn's Market Call.

- Election Impasse: "What the election does is scare people and what people do when they're scared is stop buying," Jon Burnham, chairman and CEO with Burnham Securities, told CNNfn's market coverage.

What goes down must come up

But some analysts say "don't despair." One strategist said the Nasdaq finally seems to be reaching a bottom and may be poised to turn around and move higher.

"I think you are near (capitulation) at the moment and you are getting close to the bottom," Richard Cripps, chief market strategist with Legg Mason Wood Walker, told CNNfn's In the Money. "Technology stocks are driven on the expectation and we're in a period now where expectations are being lowered. What you'll have happen is stocks will react to the fact that expectations are too low."

David Briggs, head of equity trading at Federated Investors, told CNNfn's market coverage that he's worried that, sometime in the next two months, the oversold tech stocks will swing back up -- taking down some of the gainers of the past few months. (446K WAV) (446K AIFF)

And yet another analyst said any change in the Federal Reserve's stance on interest rates could be supportive.

"If you have any kind of cut or a neutral bias, the markets will move higher," Phil Dow, stock market strategist with Dain Rauscher Wessels, told CNNfn's market coverage.

Market breadth Thursday was negative. Decliners beat advancers on the New York Stock Exchange 1,884 to 1,009 as more than 1.5 billion shares changed hands. On the Nasdaq, losers topped winners 2,761 to 1,308 as more than 2.6 billion shares were traded.

In other markets, Treasury securities were mostly higher. The dollar faltered against both the euro and the yen.

Warnings take a toll on techs

The entire technology sector crumbled under selling pressure after Gateway and Altera issued warnings after the closing bell Wednesday.

Computer maker Gateway (GTW: Research, Estimates) dived $10.50 to $19 after it warned late Wednesday that its fourth-quarter earnings would be half what Wall Street forecasts projected, mainly because of weak holiday sales. Computer maker Gateway (GTW: Research, Estimates) dived $10.50 to $19 after it warned late Wednesday that its fourth-quarter earnings would be half what Wall Street forecasts projected, mainly because of weak holiday sales.

Chip maker Altera (ALTR: Research, Estimates) tumbled $2 to $23.94 after it said that its fourth-quarter revenue would miss Wall Street's estimates by more than 11 percent because digital subscriber line, or DSL, customers who overbought in the first three quarters have pulled back purchases. DSL is a phone cable that permits high-speed Internet access.

Click here for the latest analyst reactions

The warnings were enough to spark widespread selling in a market that is already highly sensitized to any hint of negativity. Technology stocks bore the brunt of the sell-off.

Gateway rival Dell (DELL: Research, Estimates) fell $2.56 to $19.25, IBM (IBM: Research, Estimates) tumbled $6.31 to $93.50 and Hewlett-Packard (HWP: Research, Estimates) shed $2.94 to $31.63, even though it issued a statement confirming its current financial results guidance.

Hurting both the Dow and the Nasdaq, Microsoft (MSFT: Research, Estimates) plunged $7.69 to $57.38 while Intel (INTC: Research, Estimates) skidded $4.69 to $38.06.

Click here for a look at other tech sectors

While techs were taking a beating, investors sought solace in drug and financial issues, some of which are found among the Dow industrials.

Economy still cooling

With investors digesting all incoming economic news, the latest reports pointed to a continuing slowdown, which will take its toll on corporate revenue growth if it deepens.

The Commerce Department reported that consumer spending edged up 0.2 percent in October, in line with forecasts, while Americans' incomes came in weaker than expected, falling 0.2 percent.

The savings rate hit another record low of negative 0.8 percent. Separately, new jobless claims jumped to 358,000 last week, the highest in more than two years.

"This suggests the economy is due for a slowdown, much like the one we had in 1995," economist Paul Christopher told CNNfn's Before Hours. But he said he does not think a recession is looming after more than nine years of growth, the longest expansion in U.S. history.

Investors will be keenly waiting for the November manufacturing report from the National Association of Purchasing Management index, due at 10 a.m. ET Friday. Briefing.com estimates the number will edge higher to 48.9 percent from the prior 48.3 percent. A figure above 50 points to growth in manufacturing, while one below that indicates contraction.

Further muddying the market outlook is the election impasse.

In the latest developments in the race between Democrat Al Gore and Republican George W. Bush, Gore asked the Florida Supreme Court to order an immediate hand recount of some 14,000 disputed ballots in the contested presidential election. This is while thousands of ballots were being trucked to Tallahassee from Palm Beach in preparation for a possible recount.

A special joint committee of 14 Florida legislators met Thursday to determine if a special session of the GOP-dominated state legislature should be called to appoint the state's 25 electors in the Electoral College. The action would be taken to ensure that Florida is represented by electors when the Electoral College meets next month to vote for president. A special joint committee of 14 Florida legislators met Thursday to determine if a special session of the GOP-dominated state legislature should be called to appoint the state's 25 electors in the Electoral College. The action would be taken to ensure that Florida is represented by electors when the Electoral College meets next month to vote for president.

|

|

|

|

|

|

|