|

Auto buyers hit brakes

|

|

December 1, 2000: 5:47 p.m. ET

Ford warns on 4Q profit, joins Chrysler in production cuts in face of weak sales

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Weak November auto sales reports Friday led two automakers to put the brakes on December production and prompted Ford Motor Co. to warn it will post disappointing results for the current period.

Ford joined troubled German automaker DaimlerChrysler in announcing it would cut production this month as a way of dealing with excess inventories. That news cheered investors despite other bad news, as some took it as a sign that the automakers would move away from profit-eating incentives as a way to clear dealers' lots.

Still, analysts said they were unsure whether the plant closings announced Friday would be enough to deal with growing inventories and soft sales. Still, analysts said they were unsure whether the plant closings announced Friday would be enough to deal with growing inventories and soft sales.

"It may or may not be," said Bill Seltenheim, the vice president of Autodata, a firm that tracks auto sales. "It's a good initial step to do it (cut inventories). I commend them for taking this early action rather than letting it drag out."

John Casesa, auto analyst with Merrill Lynch, said the industry is moving to stem the incentives that have been cutting into profitability.

"The massive cuts reflect high inventory levels, falling new vehicle sales and a shift in automaker tactics from price cuts to production cuts," said Casesa.

Ford officials told analysts during an afternoon conference call that profits are likely to be 10 cents a share less than the consensus of 85 cents a share published by earnings tracker First Call.

A year earlier it earned 83 cents a share in the period, adjusted for a stock split and the exclusion of its Visteon parts unit, which was spun-off as a separate company earlier this year.

Ford blamed the shortfall on fourth-quarter North American production cuts, as well as a 7,000-vehicle reduction in imports of its Volvo, Jaguar, Land Rover and Fiesta models.

The company also cited weaker-than-expected overseas sales. Much of that cut is due to lower production of its Mondeo model because of a component shortage.

Shares of Ford (F: Research, Estimates) gained $1.44 to $24.19 in regular-hours trading, although shares slipped to $24 in after-hours trading as news of the warning started being carried by media reports.

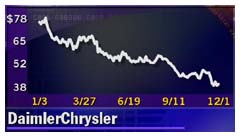

Meanwhile General Motors (GM: Research, Estimates) gained 81 cents to $50.31 in trading, and shares of the American depositary receipts of DaimlerChrysler (DCX: Research, Estimates) rose 87 cents to $39.31 in U.S. trading.

GM mum on production plans

General Motors Corp., also announced a drop in November sales, but officials with the world's leading automaker would not comment on their production plans.

Ford and GM tried to put the best face on the sales drop in November, saying that despite the decline the overall industry should post record or near-record sales this year. Ford and GM both forecast that 2001 industry sales, while declining, would be the third best year in history after 2000 and 1999.

"While demand is moderating, sales remain healthy on an historical basis," said Bill Lovejoy, GM's group vice president, in the company's sales statement. He projected the company should see record light-truck sales this year. "While demand is moderating, sales remain healthy on an historical basis," said Bill Lovejoy, GM's group vice president, in the company's sales statement. He projected the company should see record light-truck sales this year.

Analysts on the conference call with GM officials urged the company to consider production cuts of its own, and company officials would not rule any moves in or out.

"We're not going to announce any production changes in this call," said Paul Ballew, general director of global market and industry analysis for GM. "All of us in the industry continue to look at where sales are going, where incentives and inventories stand.

"Our inventory level stands a bit higher than we'd like it to be," he said at a different point in the call. "But I want to stress we view it as manageable."

Overall GM saw car sales fall 9 percent to 157,778 for the month, while light-truck sales dropped 8 percent to 161,889. Adding in heavy-truck sales, total vehicle sales fell 8 percent to 320,992.

All of its brands other than Saab and Saturn posted lower sales.

Importers see gains in soft market

Importers generally faired better than the Big Three automakers, with gains in U.S. sales reported at German automakers Volkswagen, BMW, and Audi, as well as from Korean car makers Hyundai and Kia.

Among Japanese manufacturers, Toyota Motor Sales and American Honda Motor Co. both reported gains in November sales due primarily to the introduction by each of a sports/utility vehicle model within the last year.

Toyota sales gained 4.6 percent to 126,013 vehicles sold. About 90 percent of its increased sales came from the Sequoia, which was not available a year earlier. Toyota sales gained 4.6 percent to 126,013 vehicles sold. About 90 percent of its increased sales came from the Sequoia, which was not available a year earlier.

That helped lift S/UV sales at Toyota by 23 percent, while its car sales fell 2.0 percent and its minivan sales fell 17 percent. Without the Sequoia, Toyota sales would have edged up less than 0.5 percent.

Honda and Acura, which make up American Honda Motor Co., posted combined U.S. sales of 80,849 vehicles, up 3.5 percent. But Honda-brand vehicle sales slipped 2 percent to 67,947, while Acura sales gained 45 percent to 12,902, with almost all of the gain due to the introduction of its MDX S/UV.

Acura sold 3,833 of the luxury S/UV, which was not on the market a year ago.

Ford cutting 4Q production by 3 percent

Ford's overall U.S. vehicle sales fell 7 percent to 300,665 in November, as the company said its fourth-quarter production will be more than 3 percent lower than the month-ago forecast.

Ford said car sales fell to 111,086, off 16 percent from November 1999, when the company posted its best sales in that segment since 1977. Sales of light trucks, which include minivans, sport/utility vehicles and pickups, slipped 1 percent to 189,579.

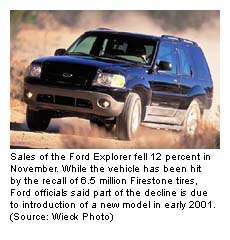

Sales of the Ford Explorer, the best-selling S/UV that has been hit by the recall of 6.5 million Firestone tires and tied to the deaths of more than 100 people using those tires, fell about 12 percent to 33,430. Sales of the Ford Explorer, the best-selling S/UV that has been hit by the recall of 6.5 million Firestone tires and tied to the deaths of more than 100 people using those tires, fell about 12 percent to 33,430.

Ford said it now plans to build 367,000 cars and 705,000 trucks in North America in the fourth quarter. That's a reduction of 38,000 vehicles from levels projected a month ago, with half the cuts coming in trucks and half in cars. The new schedule will put fourth-quarter production almost 7 percent below year-earlier production levels of 1,149,000, with car production down 14 percent and light-truck production down 2 percent.

George Pipas, Ford's U.S. sales analysis manager, said the about one-third of the cut in production came in November, and that most of the cuts would come through reduced overtime, rather than plant closings.

The company does plan some car plant closings the last two weeks of the year, but Pipas would not give details of those plans. The cut in truck production would be in F-series and Ranger pickup truck models.

DaimlerChrysler temporarily closing seven plants

Chrysler Group, the North American unit of troubled German-American automaker DaimlerChrysler that includes the Chrysler, Dodge and Jeep brands, reported that U.S. vehicle sales fell 5 percent to 184,065 in November.

The company also announced temporary closures at seven of its 12 U.S. and Canadian manufacturing plants during the next three weeks. The company also announced temporary closures at seven of its 12 U.S. and Canadian manufacturing plants during the next three weeks.

Chrysler car sales fell 15 percent to 45,959, while truck sales -- including S/UVs and minivans -- slipped 2 percent to 138,106.

Although the sales of its sport/utility vehicles edged up 6 percent, that was due to sales of its popular PT Cruiser, a new model not offered a year ago. Without the sale of 11,371 Cruisers, S/UV sales would have fallen about 14 percent, as Jeep sales were off 18 percent from November 1999.

Chrysler's sales of minivans, a segment the company invented and once dominated, fell 16 percent to about 28,902, despite introduction of a new design of its various minivan models.

"The industry is dealing with a highly competitive, saturated marketplace," said Dieter Zetsche, president and chief executive of DaimlerChrysler Corp., who was put in place earlier this month after the firing of James Holden. "The combination of a softening market and an excess of inventory requires immediate action."

Regarding production cutbacks, the company said it would operate 10 of 12 plants next week, 11 plants the following week, and seven plants the week of Dec. 18. The plants being closed produce such formerly strong models as the Jeep Cherokee and Wrangler S/UVs, and the Dodge Durango pickup truck.

|

|

|

|

|

|

|