|

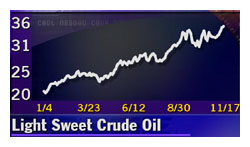

Oil prices skid below $30

|

|

December 5, 2000: 5:08 p.m. ET

Oil prices fall on hopes that U.N. proposal might resolve Iraq's halt on exports

|

NEW YORK (CNNfn) - Crude oil prices fell below $30 a barrel Tuesday, hitting their lowest level in nearly four months, on speculation that Iraq's five-day stoppage on exports may soon be resolved after the U.N. advanced a "compromise" price proposal in an effort to end the dispute over pricing.

Iraq's U.N.-supervised oil sales — some 5 percent of global oil exports -- have been at a halt since late last week after the U.N. rejected Baghdad's claim that December oil prices were too low.

The dispute stems from a surcharge of 50 cents per barrel that Iraq wants; however, no formal proposal has been made. Details on the U.N. proposal were unavailable.

"A lot of people were expecting that Saddam Hussein would pull a trick before year-end because he was trying to put pressure on the U.N. to lift sanctions or try to alter the position of the sanction, so he threatened two weeks ago to stop exporting oil," said Fadel Gheit, oil analyst at Fahnestock & Co. "The traders panicked in anticipation of a supply shortage, but Iraq never stopped producing oil."

Crude for January delivery on the New York Mercantile Exchange (NYMEX) fell $1.67 at Tuesday's close to $29.55 a barrel, a $4.27 drop since Thursday.

That extended the day's heavy losses to $1.47 on the day, as traders saw signs that a lengthy bull run could be ending, with expectations of ample supply in crude stocks in the near term.

Brent crude closed a sharp $1.50 weaker at $27.84 a barrel and has fallen by $4.04 a barrel in the last three trading days.

"We created a panic situation by reading too much into the empty threats, and when these threats started moving prices higher in anticipation, then the U.S. put its foot down and said even if Iraq stops world export, we are prepared to take all the necessary measures to make sure there is plenty of supply," said Gheit. "We created a panic situation by reading too much into the empty threats, and when these threats started moving prices higher in anticipation, then the U.S. put its foot down and said even if Iraq stops world export, we are prepared to take all the necessary measures to make sure there is plenty of supply," said Gheit.

Hopes for a breakthrough came after Iraqi Oil Minister Amir Rasheed told OPEC Secretary General Rilwanu Lukman that he was optimistic that the dispute could be resolved.

"Rasheed confirmed to the Secretary-General that Iraq was engaged in urgent negotiations with the U.N. with a view to resolving the issue, a resolution which Iraq hoped would be achieved in the next day or two," the OPEC news agency reported. But U.N. sources said there had been no further substantive contact.

"Iraq is unpredictable," said Tina Vital, oil and gas analyst with S&P Equity Group. "It's always a possibility that something extended could occur but most people believe this is a temporary interruption but it should be taken seriously."

Also tempering oil prices is the cooling economy. Federal Reserve chairman Alan Greenspan drew a distinction between today's economy and the financial turmoil of the fall of 1998. "In the face of energy price spike and the erosion of optimism in financial markets, consumer confidence, or sentiment, appears to be holding up reasonably well to date, though there have been some mixed signals of late," Greenspan told a conference sponsored by America's Community Bankers in New York.

"Any cooling in economic growth immediately will take oil demand down so one would expect the price will come down," said Gheit.

--from staff and wire reports

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|