|

Apple cores PC sector

|

|

December 6, 2000: 6:04 p.m. ET

Apple's revenue warning sparks downgrade of PC sector; IBM, HP hit

|

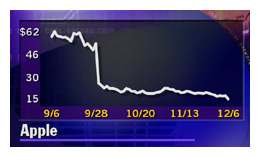

NEW YORK (CNNfn) - Apple Computer Inc. stock plunged more than 15 percent Wednesday and took down the tech sector with it after the personal computer maker stunned investors with news that a substantial shortfall in revenue will result in the first quarterly loss for the company in three years.

Apple's warning, delivered after the market closed Tuesday, sent shockwaves through the entire stock market, with both the Dow industrials and the Nasdaq composite posting substantial losses only one day after the Nasdaq notched its best day ever.

|

|

VIDEO

|

|

CNNfn's Bruce Francis takes a look at Apple's revenue warning. CNNfn's Bruce Francis takes a look at Apple's revenue warning. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Apple (AAPL: Research, Estimates) tumbled $2.69, or 15.8 percent, to close at $14.31. The Nasdaq fell 3.2 percent to 2,796.50 while the Dow dropped 2.1 percent to 10,664.38.

After Tuesday's closing bell, Apple announced that it expects to post only $1 billion in revenue for its fiscal first quarter ending Dec. 30, versus the Wall Street consensus estimate of $1.6 billion. The company also said it expects a loss, excluding investment gains, of between $225 million and $250 million when results are announced on Jan. 17, 2001.

Analysts had expected the Cupertino, Calif.-based company to report a profit of about $10 million, or 3 cents per share, for the quarter. The company also said it expects fiscal 2001 revenue to come in between $6 billion and $6.5 billion, down from the $7.5 billion to $8 billion forecast previously.

PC sector sliced and diced

Apple's darkened outlook dragged down the entire hardware sector and prompted Credit Suisse First Boston to reduce industry growth rates for the fourth quarter and for 2001 for the second time in two weeks. Apple's darkened outlook dragged down the entire hardware sector and prompted Credit Suisse First Boston to reduce industry growth rates for the fourth quarter and for 2001 for the second time in two weeks.

"We believe the size of Apple's pre-announcement of fiscal first-quarter results, its second for the quarter, underscores the fundamental, macro-driven deterioration in the consumer PC segment," said Credit Suisse First Boston analyst Kevin McCarthy in a research note. "Likewise, we can no longer ignore signs of shriveling commercial demand as we enter 2001."

McCarthy not only downgraded Apple's stock rating to "hold," but also reduced his recommendations on Compaq (CPQ: Research, Estimates) and Gateway (GTW: Research, Estimates) to "hold." He also cut estimates for IBM (IBM: Research, Estimates), Dell (DELL: Research, Estimates) and Hewlett-Packard (HWP: Research, Estimates).

"Most demand weakness seems concentrated in the consumer markets, but we are beginning to hear rumblings of commercial spending cutbacks as well," McCarthy said.

McCarthy also blamed the troubles at dot.com companies for the PC slowdown and said sales of portable computers also appear to be softening.

Shares of Compaq plunged $3.89, or 16 percent, to $20.51; Dell fell $2.25, or 11 percent, to $18; Gateway tumbled $1.77, or 9.4 percent, to $17.01; IBM dropped $5.81, or 5.6 percent, to $97.56 and Hewlett-Packard declined $2.50, or 7 percent, to $32.50.

Intel (INTC: Research, Estimates), the dominant provider of microprocessors that power PCs, suffered as well. Its shares dropped $4, or 11 percent, to $32 in afternoon trading. The chip giant's stock also was hurt by negative comments from Salomon Smith Barney analyst Jonathan Joseph.

"All our inputs suggest Intel's fourth quarter is shaping up to be its worst

quarter in over a decade," Joseph said in a research note issued Wednesday.

Last week, Joesph reduced his revenue and earnings estimates for the company, cutting his revenue outlook to $8.9 billion from $9.1 billion and his earnings per share forecast to 39 cents from 42 cents.

"Given the weaker outlook, we expect the 2001 consensus estimate of $1.76 to come down substantially," Joseph said.

Worms plaguing Apple

Apple attributed its revenue woes to several factors, including weak selling in its channel inventories across all geographies, aggressive pricing environment and broad-based global PC sales slowdown

While the entire hardware sector has been fraught with high inventory levels and flagging consumer demand, analysts said some problems Apple is experiencing are company-related as well.

"The extent of Apple's pre-announcement and the laundry list of problems that the company cited lead us to believe that its woes are as much company specific as they are industry related and the demand for products is just not there," said Bear Stearns analyst Andrew Neff in a research note.

Merrill Lynch analyst Steve Fortuna told CNNfn that for many years Apple grew at a solid pace through consistent upgrades to its products, but that

the well seems to have run dry.

"Our view is that Apple has had very good growth over the past couple of years, largely driven by upgrade cycle to its existing installed base," Fortuna said.

"We see the upgrade cycle as clearly fatiguing at this point and I think the experience in consumer slowdown and weakness, as is with Gateway and others, but Apple's got some additional problems that are more Apple-specific and are related to the fact that a lot of the growth coming from the installed base is now drying up and the company really has to reinvent itself now and focus on new products," Fortuna said.

When will hardware heal?

Salomon Smith Barney analyst Andrew Barrett told CNNfn that slowing consumer spending as well as a lack of new, high-profile technology applications is squeezing the computer sector and he doesn't foresee recovery until the second quarter at the earliest.

"Greenspan is raising rates, and he is targeting the consumer. This is a natural reflection of what is happening out there," Barrett said.

"The other part of it is there is no new applications, there is no great new killer app that somebody has to own. So until we get into the environment where Intel's (INTC: Research, Estimates) gig chip is shipping in volume, whether some great application or broadband proliferates to a greater degree, I don't think you're going to see it before the second quarter," Barrett said. "The other part of it is there is no new applications, there is no great new killer app that somebody has to own. So until we get into the environment where Intel's (INTC: Research, Estimates) gig chip is shipping in volume, whether some great application or broadband proliferates to a greater degree, I don't think you're going to see it before the second quarter," Barrett said.

"I think that the PC, the PC peripheral, and the semiconductor space is in a pretty big slowdown period right now, and I don't see this abating anytime before the summertime. Maybe the PC market picks up a little bit in the second quarter, but really you are looking at summer before it starts to come back," Barrett said.

Merrill Lynch Global Technology Strategist Steven Milunovich had views on PC demand that were similar to Barrett's. Milunovich told CNNfn.com that he sees no near-term catalyst that will revive consumer and corporate PC demand.

"Many corporations upgraded their PCs in preparation for Y2K, which boosted demand last year," Milunovich said. "If you figure on a three-year upgrade cycle, companies will not feel a need to upgrade in 2001. Corporate IT budgets are focused more on adapting to the Internet, which includes networking hardware, storage, and e-commerce software."

"The PC is not the driver of technology anymore," Milunovich added. "We are big believers, however, in handheld devices, such as those made by Palm and Research in Motion. A lot of applications are going to migrate to handhelds."

Over the longer term, the rise of peer-to-peer computing could help boost PC demand, Milunovich said. Peer-to-peer is the sharing of files between individual computer users, instead of accessing files stored on a central server. The Napster music sharing service is one of the most prominent examples of peer-to-peer computing in operation today.

Like his colleague Fortuna, Milunovich thinks that Apple has problems that are unique to the company and not common to the PC industry as a whole.

"I'm surprised Apple came back as well as it did," he said, referring to Apple's rise after Jobs took over as CEO. "They haven't pushed information appliances as well as they could have. They gave up after the Newton. I wish they had kept with it."

|

|

|

|

|

|

Apple Computer

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|