|

U.S. jobless rate edges up

|

|

December 8, 2000: 11:51 a.m. ET

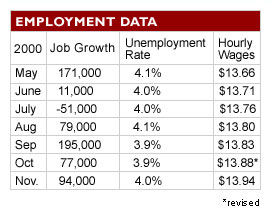

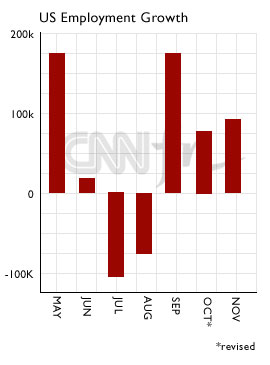

94,000 jobs created in November; wages rise 6 cents; jobless rate at 4%

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. unemployment rose for the first time since August last month as the economy generated new jobs at a slower-than-anticipated pace and average hourly wages crept higher, a government reported released Friday showed -- providing more evidence that the economy is slowing down.

|

|

VIDEO

|

|

Alexis Herman, Labor Secretary, chats with CNNfn about job growth. Alexis Herman, Labor Secretary, chats with CNNfn about job growth. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Some 94,000 new jobs were added to the economy in November, the Labor Department said, far fewer than the 150,000 forecast by Briefing.com though just slightly above the revised 77,000 positions created in October. October's figure initially was reported as a 137,000 increase.

Average hourly earnings -- a harbinger of inflation pressure -- gained 6 cents, or 0.4 percent, to $13.94 an hour in November, a shade higher than analysts' forecasts of a 0.3 percent increase. The jobless rate, however, rose last month for the first time since August, gaining 0.1 point to 4 percent, in line with expectations.

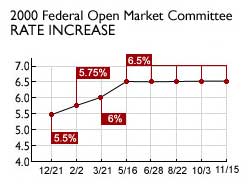

While the slower pace of job creation suggests the Federal Reserve's series of interest rate increases is damping hiring intentions, the increase in hourly wages indicates companies are paying their workers more, which could spark faster inflation as firms lift prices to offset their rising labor costs, and as workers spend their fatter paychecks.

All the same, most on Wall Street chose to focus on the positive aspects of the report, which show that the red-hot labor market -- a concern for Fed Chairman Alan Greenspan -- is beginning to show signs of cooling.

Only the positives: markets

"Economic growth is moderating, employment growth is softening from last year's pace, but given that average hourly earnings number it tells us the Grinch is still hovering nearby," Anthony Chan, chief economist with Banc One Investment Advisors, told CNNfn's Before Hours, adding that he is confident the Fed will signal an end to its inflation fight at its Dec. 19 meeting, but may not lower rates in January. (277KB WAV) (277KB AIFF)

Financial markets registered positive reaction to the report as investors reasoned that, no matter what the numbers say, the Fed will ease its inflation-fighting stance by shifting its assessment of economic conditions away from concerns about overheating and toward a more balanced view that would include acknowledging the possibility of excessive slowing. Financial markets registered positive reaction to the report as investors reasoned that, no matter what the numbers say, the Fed will ease its inflation-fighting stance by shifting its assessment of economic conditions away from concerns about overheating and toward a more balanced view that would include acknowledging the possibility of excessive slowing.

Federal Reserve Chairman Alan Greenspan gave a slight hint of that earlier this week, indicating that he may not be as concerned about the country's tight labor markets as he has been in the recent past. Labor markets "have remained tight," he said in his speech, but a recent increase in initial jobless claims and the level of insured unemployment "may be an early harbinger of an easing of these conditions."

Anecdotally, at least, that seems to be the case. Dot.com layoffs continue to pick up steam as companies find they aren't making the profits they were anticipating. Retailers are hiring fewer seasonal workers as consumer demand continues to taper off. And manufacturers, while not handing out pink slips, per se, have scaled back the number of hours their workers put in, leaving employees with a smaller pay check at the end of each week.

Fewer hours worked

"The one thing that companies can do quickly without laying people off is reduce the number of hours per week; as the economy slows, that's the natural place for a company to cut back," said Ethan Harris, an economist with Lehman Brothers. "It's a little harder to pull back quickly on job hiring."

Labor Secretary Alexis Herman had a different assessment of the shorter work week, pointing to advances in technology that allow workers to get the job done is less time. "I don't see any evidence that companies are cutting back on hours at all," Herman told CNNfn.com. "If anything its advances in productivity that are shortening the work week." Labor Secretary Alexis Herman had a different assessment of the shorter work week, pointing to advances in technology that allow workers to get the job done is less time. "I don't see any evidence that companies are cutting back on hours at all," Herman told CNNfn.com. "If anything its advances in productivity that are shortening the work week."

Average weekly hours worked fell to 34.3 in November from 34.4 in October, the Labor Department reported. Manufacturing overtime fell to 4.3 hours in November from 4.5 hours in October.

For the month, private payrolls grew 148,000 in November while government jobs fell 54,000. Manufacturers added 1,000 jobs after a 3,000 drop a month earlier. It was the first increase in five months. Construction jobs decreased 6,000 in November after rising 22,000 in October. Retail employment climbed 46,000 as companies began adding temporary workers for the holiday shopping season. Employment at financial services firms rose 11,000 in November.

The pool of available workers -- which includes the number of unemployed job seekers and those not looking for work in the last 12 months who said they would take a job -- rose to 10 million in November from 9.9 million in October.

Wages still relatively tame

A big issue for Greenspan and for financial markets has been compensation costs for companies, which can be a double whammy on the inflation front -- putting more money in workers' pockets, which increases their spending power, and forcing companies to raise prices to offset higher wage costs.

But so far that's not really happening. On a year-to-year basis, wages have risen 4 percent, according to Labor Department figures, the biggest gain since January 1999. However, to put that in context, wages have risen within a range of 3.2 percent to 4 percent during the past three years, suggesting that compensation costs aren't rising as quickly as some may think.

"The rise in wages of 6 cents might cause jitters, but wage inflation is less of a worry now, especially with productivity still growing at a healthy clip," said Bill Cheney, chief economist with John Hancock Financial Services in Boston. "As the economy slows, the unemployment rate will continue to inch up and wage pressures should ease further." "The rise in wages of 6 cents might cause jitters, but wage inflation is less of a worry now, especially with productivity still growing at a healthy clip," said Bill Cheney, chief economist with John Hancock Financial Services in Boston. "As the economy slows, the unemployment rate will continue to inch up and wage pressures should ease further."

The Fed raised rates six times between June 1999 and May 2000 but has held rates steady at four meetings since. It is expected to do so again when it next meets Dec. 19, though it is widely expected to declare the risks facing the economy are balanced between inflation and too much of a slowdown in growth. That stance may put the Fed one step closer to reducing rates in the new year if the economy continues to cool.

|

|

|

|

|

|

|