|

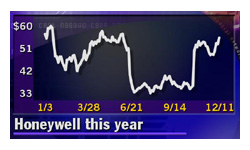

Honeywell warns on 4Q

|

|

December 11, 2000: 7:45 p.m. ET

Company says bottom line hurt both by GE deal and units it was divesting

|

NEW YORK (CNNfn) - Honeywell International said Monday its fourth-quarter profit will be well below Wall Street's current expectations.

Excluding an expected $375 million-to-$425 million one-time charge, Honeywell (HON: Research, Estimates) said it expects its fourth-quarter earnings per share to range from 70 cents to 74 cents.

The most recent estimate of analysts polled by earnings tracker First Call was for Honeywell to turn a fourth-quarter profit of 86 cents per share, compared with 76 cents per share during the same period last year.

Honeywell, a New Jersey-based industrial conglomerate, said its fourth-quarter sales will come in about 3 percent above the $6.2 billion it logged in the third quarter, driven by aerospace, fire & security, electronic materials, turbochargers and sensing & control products.

Sales growth is expected to be partially offset by lower sales of truck brakes, industrial automation, polymers, friction materials and consumer products, the company said.

The company also said continued high energy and raw materials costs will affect income growth in its performance polymers & chemicals businesses.

In October, Honeywell agreed to be acquired by General Electric (GE: Research, Estimates). The company said actions it has taken as a result of the that deal will drag down fourth-quarter earnings. Those decisions were based on a review of pooling of interest limitations, strategic interests of the combined company and business reviews conducted with GE, Honeywell said. In October, Honeywell agreed to be acquired by General Electric (GE: Research, Estimates). The company said actions it has taken as a result of the that deal will drag down fourth-quarter earnings. Those decisions were based on a review of pooling of interest limitations, strategic interests of the combined company and business reviews conducted with GE, Honeywell said.

Honeywell also said it expects earnings to be affected by the performance of business units it was in the process of divesting as well as sharply lower income in its 50 percent-owned UOP joint venture.

The planned divestitures, which Honeywell recently cancelled, include its friction materials division, automotive consumer products group, U.S. security monitoring business and pharmaceutical fine chemicals business.

When Honeywell decided last month to cancel those divestitures, executives said they did so to help expedite its purchase by General Electric, which agreed in October to acquire Honeywell for $45 billion.

"While our fourth-quarter earnings will be below expectations, based on our business reviews with GE, we are confident that the combination of our two companies will enhance the value of our businesses and lead to greater growth and shareowner value creation going forward," Michael R. Bonsignore, Honeywell's Chairman & chief executive, said in a statement.

Shares of Honeywell closed Monday up 69 cents at $55.19. GE shares rose 12 cents to $55.31.

|

|

|

|

|

|

|