|

Rx for an idyllic life

|

|

December 14, 2000: 6:05 a.m. ET

A 54-year-old man, facing unemployment, wonders if he's too aggressive

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - "Bob" has an idyllic life in a small town nestled in the cornfields of Illinois. He lives in a brick ranch – he says it's nothing special – close to his family and friends.

Up until he lost his accounting job when he refused to relocate to another state, he was on track for a comfortable retirement. But now, at 54, he's looking for a job to tide him over for a few years until he starts dipping into his savings.

"I've lived here for 23 years, and we're not going to let some corporation uproot us," he said recently. "We're just far enough from the city where the pace and quality of life are different."

Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

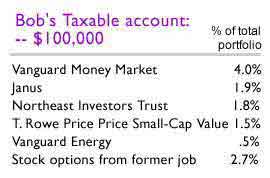

Bob, who asked that he not be identified, has about $100,000 in a taxable investing account and another $677,000 in IRAs. His investments are spread between about 71 percent stocks, 25 percent bonds and 4 percent cash.

"Given the fact that I want to use the money in two to three years, time may prove I'm a little aggressive," he said. He wants to take early IRA withdrawals using an IRS rule allowing "substantially equal withdrawals."

Joel Bruckenstein, a certified financial planner from Pleasantville, N.Y., said Bob will need to keep a fair amount of his money in stocks to make his money last, especially when you take into account inflation. Joel Bruckenstein, a certified financial planner from Pleasantville, N.Y., said Bob will need to keep a fair amount of his money in stocks to make his money last, especially when you take into account inflation.

"He's a young guy, and he's got a long retirement ahead of him," Bruckenstein said. "He's going to need some inflation protection, and stocks are the way to go."

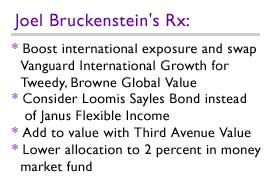

Bruckenstein isn't crazy about Bob's international funds, and would swap Vanguard International Growth for Tweedy, Browne Global Value. Bruckenstein isn't crazy about Bob's international funds, and would swap Vanguard International Growth for Tweedy, Browne Global Value.

"I don't think he has enough in international funds," Bruckenstein said.

Likewise, Bruckenstein thinks the portfolio is a little heavy in U.S. growth stocks.

"I'd like to see him have more pure value exposure," Bruckenstein said. Bruckenstein would move money out of T. Rowe Price Equity Income Fund in favor of Third Avenue Value Fund.

On the fixed income side of the portfolio, Bruckenstein would recommend Loomis Sayles Bond Fund instead of Janus Flexible Income. Bruckenstein would also double the high yield exposure in Northeast Investors (NTHEX: Research, Estimates) by moving money out of Janus Fund. High yield has had a tough year but is poised for a turnaround, Bruckenstein said.

"He knows what he's doing, but he needs to fine-tune things a little," Bruckenstein said. "He knows what he's doing, but he needs to fine-tune things a little," Bruckenstein said.

By contrast, Bob Veasey, a certified financial planner from Providence, R.I., would give up some high-yield exposure to diversify more into international markets.

"For higher returns, stocks are better than bonds," Veasey said.

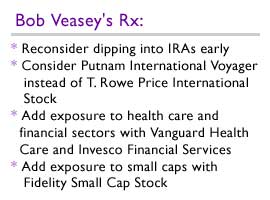

Veasey would take half of the money out of Northeast Investors and move it into Vanguard International Growth. He would take $8,000 out of the money market account and move it into Putnam International Voyager Fund.

(Putnam International Voyager is a load fund, but Veasey said you can buy C shares through a financial adviser with no upfront sales charge and no redemption fee after one year).

"At 54, with two to three years until retirement, the criteria isn't whether you should be more or less aggressive," Veasey said. "The question is how long do you want the money to last. At 54, he's got a 30-year life expectancy." "At 54, with two to three years until retirement, the criteria isn't whether you should be more or less aggressive," Veasey said. "The question is how long do you want the money to last. At 54, he's got a 30-year life expectancy."

Veasey would increase exposure in the T. Rowe Price Science & Technology Fund to 5 percent and would introduce two new sectors, health and financial services. Veasey recommends Vanguard Health Care and Invesco Financial Services, with a 5 percent weighting in each.

"These sectors will be the engines of the economy for the next 10 to 15 years," Veasey said.

Veasey would move out of T. Rowe Price New Horizons Fund because he thinks it has strayed into different investing styles, and allocate the money to Sentinel Mid Cap Growth. He'd also put some money in Fidelity Small Cap Stock Fund.

A warning about early withdrawals

Both Veasey and Bruckenstein have questions about whether Bob should dip into his IRAs early.

Typically, when you take withdrawals out of a retirement plan before 59-1/2, you pay a 10 percent tax penalty. But you can avoid the tax by taking what are called "substantially equal withdrawals" from your retirement assets by following IRS code 72t. (Click here to read more about IRS rule 72t.) Under the rule, you take distributions from your retirement plan over a minimum of five years, or until you reach age 59-1/2. So if you began 72t distributions at, say, age 48, you would need to continue the distributions until age 59-1/2, which is 11-1/2 years.

"He'll be locked in," Veasey said.

One strategy for people who need money early from an IRA is to divide their nest egg, Bruckenstein said. For example, Bob could figure out how much he needs to live on in the short term, put that amount in an IRA to tap early, and leave the rest of the money untouched in another IRA.

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. Please include a daytime phone number so that we may reach you. If we choose your portfolio, we will use your information, including your name in an upcoming story.

* Disclaimer

|

|

|

|

|

|

|