|

U.S. inflation edges up

|

|

December 15, 2000: 10:16 a.m. ET

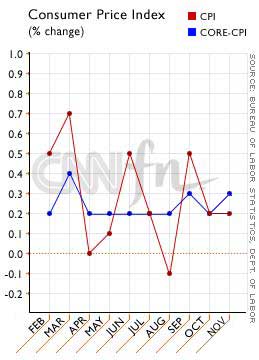

November CPI rises 0.2%, in line with forecasts; core rate gains 0.3%

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. consumer prices edged slightly higher last month, the government reported Friday, further evidence that the slowing economy isn't fueling faster inflation at the retail level and another signal that could prompt Federal Reserve officials to back off from their inflation-fighting stance.

The Consumer Price Index, the government's main inflation gauge, rose 0.2 percent in November, the Labor Department said, matching economists' forecasts and October's increase. Most of the month's gains came from higher prices for airfares and tobacco. The core rate, which excludes volatile food and energy costs, rose 0.3 percent last month, a shade above forecasts and a 0.2 percent increase the month before. The Consumer Price Index, the government's main inflation gauge, rose 0.2 percent in November, the Labor Department said, matching economists' forecasts and October's increase. Most of the month's gains came from higher prices for airfares and tobacco. The core rate, which excludes volatile food and energy costs, rose 0.3 percent last month, a shade above forecasts and a 0.2 percent increase the month before.

The report is one of the last pieces of data Fed officials will have in hand before meeting to discuss the pace of the economy and the direction of interest rates next Tuesday. A majority of Wall Street analysts expect that the Fed will leave rates on hold, but will shift its stance toward weighing concern about an economic slowdown equally with concern about inflation.

"The inflation threat clearly seems to be fading as the economy cools," said Oscar Gonzalez, an economist with John Hancock Financial Services in Boston. Today's figures "signal that the Fed may now shift its emphasis to growing the economy rather than fighting inflation. It allows them to start thinking about a rate cut sooner rather than later."

Higher airfare, tobacco prices

Through November, the overall CPI rose at a 3.4 percent annual rate, compared with a 2.7 percent increase for the same 11 months in 1999. The CPI's core rate rose at a 2.6 percent annual rate, compared with a 2 percent increase for the same period last year.

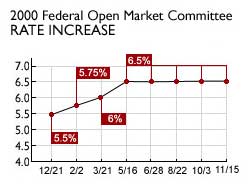

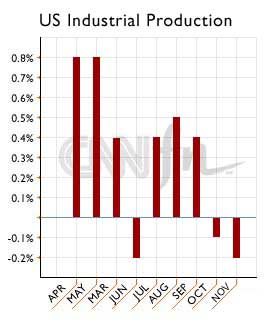

The numbers were the latest piece of evidence pointing to moderating economic growth and tame inflation, a combination the Fed has been looking to achieve through its series of rate increases between May 1999 and June of this year. Other reports have shown faltering job growth, rising inventories, slower manufacturing output and lackluster retail sales.

Indeed, Robert Brusca, chief economist with Ecobest Consulting, told CNNfn's Before Hours that Fed policy makers have a lot more statistical ammunition than just tame inflation if they want to change policy and embark on a rate-cutting path next year. (428KB WAV) (428KB AIFF) Indeed, Robert Brusca, chief economist with Ecobest Consulting, told CNNfn's Before Hours that Fed policy makers have a lot more statistical ammunition than just tame inflation if they want to change policy and embark on a rate-cutting path next year. (428KB WAV) (428KB AIFF)

The big question for financial markets is whether the Fed has already done too much. The Fed's policy-setting arm, the Federal Open Market Committee, lifted short-term rates 1.75 percentage points in 13 months to boost the cost of borrowing for consumers and businesses and encourage them to save, rather than spend.

So far that appears to have worked in spades. After expanding at a 5.6 percent pace in the second quarter, the economy grew 2.4 percent in the third quarter and is on track for sub-3-percent growth in the fourth, according to a consensus of analysts polled by Briefing.com. All the same, most analysts agree that timing is key if the Fed is going to steer the economy to a soft landing, where moderate growth and tame inflation prevail.

Justified in easing

"This report underscores or emphasizes that the Fed would be quite well justified for easing policy as early as next week," said Paul Christopher, an economist with A.G. Edwards in St. Louis. "I'm not saying to expect a cut in rates, but perhaps they'll start with a move to a neutral bias, with a rate cut the next logical step in January."

Much of November's increase was fueled by higher prices for airline fares and tobacco. Air ticket prices rose 0.7 percent last month and have gained 5.1 percent in the past year. UAL Corp.'s United Airlines led American Airlines and Continental Airlines in raising some U.S. air fares by as much as $200 per round-trip due to higher costs for fuel and wages. Much of November's increase was fueled by higher prices for airline fares and tobacco. Air ticket prices rose 0.7 percent last month and have gained 5.1 percent in the past year. UAL Corp.'s United Airlines led American Airlines and Continental Airlines in raising some U.S. air fares by as much as $200 per round-trip due to higher costs for fuel and wages.

Tobacco prices rose 3.6 percent in November after falling 2.8 percent in October. R. J. Reynolds Tobacco Holdings Inc. and other tobacco companies have raised cigarette prices to help pay for legal settlements, and merchants continue to pass on those price increases to customers.

However, other categories showed little monthly change. Energy prices, which account for about a one-tenth of the CPI index, rose 0.1 percent last month, the smallest increase since August. And food prices, which account for about one fifth of the index, were unchanged last month. The price of clothing fell 0.4 percent in November after rising 0.3 percent in October.

Separately, the Federal Reserve reported that industrial output fell 0.2 percent last month, weaker than Wall Street forecasts for a small increase. Manufacturers used 81.6 percent of capacity, down from 82.1 percent in October. The numbers were the latest pointing to a slowdown in the manufacturing sector.

|

|

|

|

|

|

|