LONDON (CNNfn) - Asian markets were mixed Monday, with technology and auto stocks dragging Japan's main index lower amid concerns the world's economy is slowing.

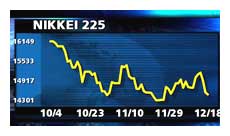

In Tokyo, the Nikkei 225 fell 68.39 points, or 0.5 percent, to close at 14,483.90, led by personal computer maker Fujitsu and Japan's largest automaker Toyota Motor.

"Fears that Japan may follow the United States into an economic slowdown and downward earnings revisions are likely to worry investors for a while,"  said Takashi Yamazaki, chief investment officer at Tokio Marine Asset Management. said Takashi Yamazaki, chief investment officer at Tokio Marine Asset Management.

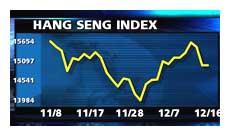

The Hang Seng in Hong Kong edged up 0.3 percent, or 49 points, at 15,024.53, with property stocks, such as Cheng Kong (Holdings) and Sun Hung Kai Properties, offsetting losses by global bank HSBC Holdings and telecom company Pacific Century CyberWorks.

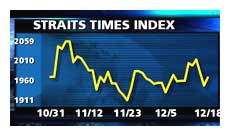

In Singapore, the Straits Times index gained 21.55 points, or 1.1 percent, to close at 1,969.73.

Sydney's S&P/ASX 200 added 7.4 points, or 0.2 percent, to reach 3,236.6. Rupert Murdoch's media empire News Corp. rallied 4.5 percent, clawing back much of Friday's sharp fall.

On the currency market, the yen weakened slightly to ¥112.62 per U.S.  dollar from ¥112.38 in late U.S. trade on Friday. dollar from ¥112.38 in late U.S. trade on Friday.

A profit warning Thursday from global software No. 1 Microsoft (MSFT: Research, Estimates), its first in a decade, sparked a sharp tech sell-off in the U.S. Friday and bruised Tokyo for a second session on Monday. Cautious trading ahead of the U.S. Federal Reserve's policy-setting meeting on Tuesday added to the market's bearish mood.

"The market's been hoping the Fed will announce a shift toward a neutral bias (towards future interest-rate changes), which could help the U.S. market recover," said Toshihiko Matsuno, an investment advisory manager at Sakura Friend Securities.

Fujitsu, Japan's largest computer maker, fell 2.9 percent, laptop computer maker Toshiba dropped 1.3 percent and NEC, the world's second-largest chipmaker behind Intel, slipped 1.5 percent.

DDI, Japan's second-biggest telecoms carrier, slipped 5 percent. The company said it will gain complete ownership of its wireless unit through a share swap, strengthening its position in Japan's fiercely competitive mobile phone market.

Toyota Motor fell 0.8 percent. Toyota President Fujio Cho said the company expected its European vehicle sales to fall 4 percent in 2001 from the estimated figure for the current year because of the euro's weakness. Nissan Motor, which has a plant in Sunderland, northeast England, fell 1.5 percent.

Defensive stocks in the electric utility and transportation sectors benefited as investors sought a safe haven from volatility in other sectors. Japan's largest electric power utility Tokyo Electric Power rose 1.3 percent, while West Japan Railway gained 4.8 percent.

Hong Kong stocks suffer

In Hong Kong, interest-rate-sensitive banking and property stocks rose amid expectations that the Fed will announce an easing in monetary policy when it meets Tuesday. That would pave the way for an interest-rate cut early next year.

Cheung Kong (Holdings), the territory's biggest property company, rose 1 percent and second-ranked Sun Hung Kai jumped 2.8 percent, while Hang Seng Bank added 1.8 percent and the Bank of East Asia gained 1.1 percent.

HSBC Holdings slipped 0.9 percent following declines Friday in most European financial stocks after a warning from the Bank of England on the extent of banks' lending to the telecom sector. Dao Heng Bank dipped 3.4 percent.

"HSBC is leading stocks down after a knee-jerk reaction to losses in shares of most overseas banks," said Miles Remington, head of Asian sales at SG Securities.

Internet and telecom company Pacific Century CyberWorks fell 2.7 percent on news that the company has reduced the size of a loan it is  seeking to fund an Internet venture with Australian telecoms giant Telstra. Bankers told Reuters that PCCW has trimmed the loan to $1.5 billion from $2.0 billion. seeking to fund an Internet venture with Australian telecoms giant Telstra. Bankers told Reuters that PCCW has trimmed the loan to $1.5 billion from $2.0 billion.

In Singapore, banking stocks led the way with DBS Group rising 5.1 percent, United Overseas Bank up 2.3 percent and OCBC Bank climbing 1.6 percent amid expectations that the U.S. Federal Reserve will this week change its public position of inclining towards raising interest rates.

Singapore Airlines, which owns 49 percent of Richard Branson's Virgin Atlantic Airlines, rose 2.4 percent. Virgin agreed Friday to buy six Airbus Industrie A3XX super jumbos and take options on six more in a deal worth $3.8 billion.

In other markets, Seoul's KOSPI index rose almost 1 percent, the KLSE composite in Kuala Lumpur gained 1.5 percent, and Manila's PHS composite inched up 0.3 percent. The BSE Sensex in Mumbai rose 0.8 percent.

Jakarta's JSX slipped 1.2 percent, the Taiwan Weighted index in Taipei fell 1.5 percent and Bangkok's SET dipped 0.7 percent.

--from staff and wire reports

|