|

Tokyo hits 21-month low

|

|

December 19, 2000: 5:45 a.m. ET

Nikkei drops 2.4% as chip stocks retreat; U.S. rate outlook bolsters HK

|

LONDON (CNNfn) - Tokyo's benchmark share index plunged to close at a 21-month low Tuesday on growing unease over persistent weakness in U.S. technology stocks.

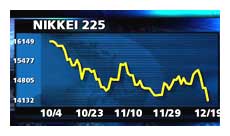

The Nikkei 225 dropped 351.53 points, or more than 2.4 percent, to 14,132.37, with NEC, the world's second-largest chipmaker, and consumer electronics powerhouse Sony among the biggest losers.

"The market's looking uglier by the day," said Tetsuya Ishijima, chief strategist at Okasan Securities. "Of course, there's a chance the Fed might help the U.S. market rebound, but the market's so unhappy it will take really strong hints suggesting interest rate cuts to liven up the mood." "The market's looking uglier by the day," said Tetsuya Ishijima, chief strategist at Okasan Securities. "Of course, there's a chance the Fed might help the U.S. market rebound, but the market's so unhappy it will take really strong hints suggesting interest rate cuts to liven up the mood."

The U.S. Federal Reserve policy-setting committee meets later Tuesday and is expected announce or hint at a shift towards a neutral stance on interest rates from its current tightening bias, paving the way for future rate cuts.

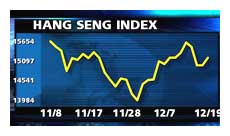

That prospect pushed Hong Kong's benchmark index higher. The Hang Seng climbed 163.51 points, or 1.1 percent, to end the session at 15,188.04. Interest-rate-sensitive property and banking stocks were among the biggest gainers, led by global bank HSBC Holdings and the territory's biggest property company Cheung Kong (Holdings).

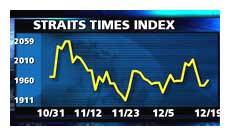

Singapore's Straits Times index lost 15.49 points, or 0.8 percent, to reach 1,954.24. Chartered Semiconductor, which makes chips on behalf of other semiconductor manufacturers, fell 4.3 percent, while Venture Manufacturing, an electronic component maker, dipped 2.1 percent. Singapore's Straits Times index lost 15.49 points, or 0.8 percent, to reach 1,954.24. Chartered Semiconductor, which makes chips on behalf of other semiconductor manufacturers, fell 4.3 percent, while Venture Manufacturing, an electronic component maker, dipped 2.1 percent.

In Sydney, the S&P/ASX 200 index edged up 21.5 points, or 0.7 percent, to 3,258.1, with investors taking some comfort from a blue-chip rally on Wall Street ahead of the Federal Reserve meeting. Among stocks benefiting from the more positive tone were media giant News Corp., up 2.2 percent.

In the currency market, the yen firmed to ¥111.99 per U.S. dollar from ¥112.12 in late New York trade on Monday.

Tokyo tech stocks head south

In Tokyo, shares of computer chip and related technology companies were among the biggest decliners.

Disco, the world's largest maker of semiconductor grinding and cutting equipment, plunged 12.4 percent after lowering its group net profit forecast by 11 percent. Rival Shinkawa fell 6.7 percent, while Tokyo Electron lost 3.8 percent and Advantest, a maker of semiconductor testing equipment, dropped 6.1 percent.

Among chipmakers, Japan's biggest semiconductor firm NEC dropped 3.1 percent and Rohm tumbled 7.1 percent.

Electronics bellwether Sony, the maker of Vaio laptop computers, fell 1.2 percent, while its biggest rival Toshiba slipped 1.1 percent and Hitachi declined 2 percent.

Internet investor Softbank plummeted 7.1 percent. The company is heavily invested in several firms listed on the Nasdaq market, where the composite index fell 1.1 percent on Monday.

Nippon Telegraph and Telephone, the country's biggest phone company, fell 1.7 percent and its majority owned mobile phone company NTT DoCoMo dipped 3.5 percent. Japan Telecom lost 5.2 percent.

Discount clothing retailer Fast Retailing dropped 10.6 percent after the Nihon Keizai Shimbun financial daily reported that textile industry groups would ask the government to restrict textile imports from China to protect the domestic industry. Fast Retailing imports much of its competitively priced clothing from China.

"Old-economy" stocks in sectors such as rubber, fisheries and mining were among the few posting modest gains in Tokyo.

In Hong Kong, global bank HSBC Holdings rose 3.2 percent, paring a drop of 5 percent over the previous three sessions, amid optimism the U.S. Federal Reserve will cut interest rates next year. Banks and property companies benefit when the falling cost of borrowing money stimulates demand for loans and real estate. In Hong Kong, global bank HSBC Holdings rose 3.2 percent, paring a drop of 5 percent over the previous three sessions, amid optimism the U.S. Federal Reserve will cut interest rates next year. Banks and property companies benefit when the falling cost of borrowing money stimulates demand for loans and real estate.

"The market is focusing on interest rates, and banking stocks stand to gain if there is a cut early next year," said Eddie Chan, head of trading at Century City Securities. Hong Kong follows U.S. interest rates closely because of the territory's currency peg to the U.S. dollar.

Bank of East Asia climbed 2.9 percent and Hang Seng Bank rose 1.5 percent.

Property conglomerate Cheung Kong (Holdings) added 1.2 percent and Sun Hung Kai Properties, the territory's second-biggest property company, rose 4.1 percent.

Internet and telecom company Pacific Century CyberWorks was down 4.7 percent, extending Monday's loss, following media reports that Deputy Chairman Norman Yuen will soon quit. In addition, reports said the company had trimmed the size of a loan it is seeking to fund an Internet venture with Australian telecom giant Telstra. Dealers said reduced funding could lower the company's growth prospects.

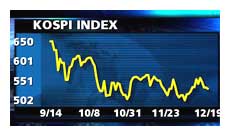

In other markets, Seoul's KOSPI index fell 1.6 percent, Taiwan's Weighted index in Taipei slipped 0.3 percent, while Bangkok's SET index, KLSE composite in Kuala Lumpur, and Jakarta's JSX gained all closed little changed from the previous day's levels. In other markets, Seoul's KOSPI index fell 1.6 percent, Taiwan's Weighted index in Taipei slipped 0.3 percent, while Bangkok's SET index, KLSE composite in Kuala Lumpur, and Jakarta's JSX gained all closed little changed from the previous day's levels.

Manila's PHS composite inched up 0.4 percent and the BSE Sensex in Mumbai edged up 0.5 percent.

--from staff and wire reports

|

|

|

|

|

|

|