|

Fed to cut rates?

|

|

December 18, 2000: 6:12 a.m. ET

Central bank, concerned the economy is slowing, eyes rate cut - report

|

NEW YORK (CNNfn) - The U.S. economy has slowed so quickly that the Federal Reserve may cut interest rates when the central bank's policy-makers meet Tuesday, the Wall Street Journal reported Monday.

While it is widely expected that the Fed will move into "neutral," away from leaning toward another interest rate increase, the central bank could also say that the risks of recession now exceed those of inflation, or go so far as to cut rates, the paper said, citing unnamed Fed insiders.

| |

RATE CUT COMING SOON? RATE CUT COMING SOON?

|

|

| |

|

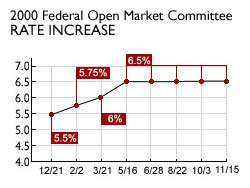

The federal-funds rate, the Fed's primary economy-tweaking tool, is at 6.5 percent currently.

|

|

|

Fed Chairman Alan Greenspan and others at the central bank have made public comments recently leading most on Wall Street to expect the central bank will discard its Nov. 15 stance that the "risks continue to be weighted mainly toward conditions that may generate heightened inflation" and turn an eye to slashing rates early next year, the paper said.

But, the report said, Fed insiders suggest the policy-makers are discussing moving more aggressively to prevent the economy from sinking into recession.

There is some concern inside the Fed that the economy is slowing more rapidly than it should be, the report noted, pointing out that many companies have reported an abrupt drop in sales and orders. The U.S. economy grew at the slowest rate in four years in the third quarter, and consumer confidence has also dipped sharply. Consumer confidence is watched closely by policy-makers and analysts since spending by Americans to buy goods and services fuels two-thirds of the world's largest economy.

The federal-funds rate, an overnight bank lending rate that is the Fed's main tool for influencing the economy, stands at 6.5 percent. The central bank raised rates six times starting in mid-1999 in a bid to slow the economy and ward off inflation. But it has held rates steady at its last four meetings amid mounting evidence that the economy is slowing. The federal-funds rate, an overnight bank lending rate that is the Fed's main tool for influencing the economy, stands at 6.5 percent. The central bank raised rates six times starting in mid-1999 in a bid to slow the economy and ward off inflation. But it has held rates steady at its last four meetings amid mounting evidence that the economy is slowing.

The report comes after the Washington Post said last week that the Fed would not cut rates this week but would shift their stance to neutral from leaning toward raising rates. The story, by reporter John M. Berry, known for his close coverage of the Fed, cited interviews with Fed officials.

|

|

|

|

|

|

|