|

Asia dips on U.S. outlook

|

|

December 20, 2000: 5:56 a.m. ET

Techs, banks and property stocks fall as Fed issues warning on economy

|

LONDON (CNNfn) - Asian markets fell Wednesday, with technology, bank and property stocks crumbling after the U.S. Federal Reserve warned growth is slowing in the world's biggest economy.

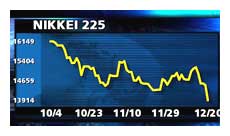

In Tokyo, the benchmark Nikkei 225 tumbled 217.94 points, or more than 1.5 percent, to close at a 22-month low of 13,914.43. The country's biggest mobile-phone company NTT DoCoMo and consumer electronics powerhouse Sony led the market lower.

"We are at a crossroads - stocks will slide further if the government just sits there doing nothing," said Masami Nagano, senior fund manager at Sanyo Investment Trust Management. "But this losing streak may force them to take things seriously and to take drastic measures, such as returning to a zero-interest-rate policy." "We are at a crossroads - stocks will slide further if the government just sits there doing nothing," said Masami Nagano, senior fund manager at Sanyo Investment Trust Management. "But this losing streak may force them to take things seriously and to take drastic measures, such as returning to a zero-interest-rate policy."

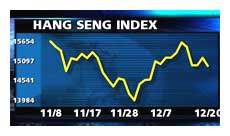

Hong Kong's Hang Seng dropped 257.32 points, or 1.7 percent, to end the session at 14,930.72, with global bank HSBC Holdings and China Telecom leading declines.

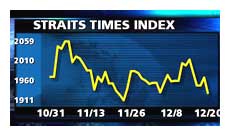

Singapore's Straits Times index fell 1.6 percent to 1,929.32 and the Taiwan Weighted index in Taipei slipped 1.8 percent, with chipmaker Taiwan Semiconductor Manufacturing slipping 3.5 percent.

In Sydney, the S&P/ASX 200 slipped 12.9 points, or 0.4 percent, to 3,245.2, led by Rupert Murdoch's media conglomerate News Corp., off 0.8 percent, and property developer Lend Lease, which slumped 16 percent, after it issued a profit warning. In Sydney, the S&P/ASX 200 slipped 12.9 points, or 0.4 percent, to 3,245.2, led by Rupert Murdoch's media conglomerate News Corp., off 0.8 percent, and property developer Lend Lease, which slumped 16 percent, after it issued a profit warning.

On the currency market, the yen weakened to ¥112.84 per U.S. dollar from ¥112.35 in late New York trading Tuesday.

Nasdaq's persistent declines and the Federal Reserve's warning that the U.S. economy may be weakening pounded the Tokyo stock market.

Mobile-phone operator NTT DoCoMo, the market's largest issue by capitalization, plunged 10.4 percent on speculation that the company will soon announce a big sale of new shares to finance its ambitious overseas expansion strategy. Nippon Telegraph and Telephone, which owns 60 percent of DoCoMo, was down 3.5 percent.

Vodafone lifts Japan Telecom

Japan Telecom rose 3.6 percent. U.K. mobile-phone company Vodafone Group agreed to acquire 15 percent of the company for $2.2 billion by buying shares from two railway companies.

Among technology stocks, Sony fell 2.4 percent, NEC, the country's biggest chipmaker, lost 4.1 percent, personal computer maker Toshiba dropped 1.5 percent and consumer electronics company Hitachi slipped 3.3 percent.

Shares in major banks fell on worries that continuing slides in Tokyo stocks are eroding the value of their vast shareholdings. Sakura Bank lost 2.6 percent, Sanwa Bank fell 3.3 percent, Tokai Bank declined 3.3 percent and Sumitomo Bank dipped 2.1 percent.

Disco slipped 5.5 percent, extending Tuesday's stumble after the leading maker of semiconductor grinding and cutting equipment, cut its group net profit forecast for the year to next March by 11 percent. Both Nomura Securities and Shinko Securities lowered their recommendations on Disco shares on Tuesday.

In Hong Kong, banks and property stocks gave up recent gains that had partly been inspired by hopes that the U.S. Federal Reserve would this week cut interest rates. In Hong Kong, banks and property stocks gave up recent gains that had partly been inspired by hopes that the U.S. Federal Reserve would this week cut interest rates.

Banking titan HSBC Holdings fell 1.3 percent, and Cheung Kong (Holdings), Hong Kong's biggest property company, fell almost 0.5 percent, with rival New World Development dipping 2.2 percent.

"Hong Kong has been outperforming other markets, but buying has mainly been of banking and property stocks and they could not hold at this level because global equities are going down," said Alex Wong, research manager at OSK Securities.

Telecom stocks were hurt by Nasdaq's slide. China Mobile, China's biggest cell-phone operator, was down 4.3 percent and ports-to-telecom conglomerate Hutchison Whampoa was 3 percent lower.

One of the few blue chips heading higher was Cathay Pacific Airways. The local carrier was up 1.5 percent after management and pilots reached an agreement, averting a strike over Christmas.

In Singapore, Creative Technology, which makes soundcards for computers, fell 3.5 percent after issuing a profit warning. Among other technology stocks, Chartered Semiconductor dropped 4.5 percent and electronic component maker Venture Manufacturing dived 5.1 percent. In Singapore, Creative Technology, which makes soundcards for computers, fell 3.5 percent after issuing a profit warning. Among other technology stocks, Chartered Semiconductor dropped 4.5 percent and electronic component maker Venture Manufacturing dived 5.1 percent.

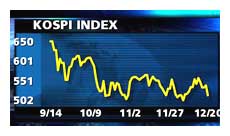

In other markets, Seoul's KOSPI index fell 3.1 percent, while the country's tech-laden Kosdaq plunged almost 7 percent to close at a record low of 58.98. Samsung Electronics, the world's biggest maker of memory chips for computers, fell 5.4 percent and SK Telecom, the nation's biggest mobile phone operator, declined 3.3 percent.

The KLSE composite in Kuala Lumpur fell 0.7 percent, Jakarta's JSX shed 0.9 percent, and the BSE Sensex in Mumbai declined 1.6 percent, while Bangkok's SET index slipped 0.4 percent. The KLSE composite in Kuala Lumpur fell 0.7 percent, Jakarta's JSX shed 0.9 percent, and the BSE Sensex in Mumbai declined 1.6 percent, while Bangkok's SET index slipped 0.4 percent.

In Manila, the PHS composite rose 2.4 percent as fund managers started buying blue chips to prepare their portfolios for the year end.

"There's window dressing, they (fund managers) are buying into blue chips," said Nina Carpio, trader of Orion-Squire Capital Inc. "The question is whether it's sustainable. The dampener will still be the focus on the (impeachment) trial" of President Joseph Estrada, she added.

--from staff and wire reports

|

|

|

|

|

|

|