|

Conseco sells asset, warns

|

|

December 19, 2000: 6:33 p.m. ET

Insurance and finance company takes next restructuring step

|

NEW YORK (CNNfn) - Cash-strapped insurance and finance company Conseco Inc. announced plans Tuesday to sell one of its key assets and warned that it will fall short of the Street's current fourth-quarter-profit expectations.

Conseco (CNC: Research, Estimates), which was hurt by a brief foray into the personal loan business, said it has reached an agreement with Argosy Gaming Co. to sell its 29 percent stake in the Argosy riverboat gaming facility at Lawrenceburg, Ind.

In a statement, Conseco said the two parties have agreed to a price of $260 million to be paid on March 1, 2001. Conseco said its original equity investment in the Argosy riverboat was roughly $20 million.

The riverboat sale is part of a broader effort by the Indianapolis-based company to sell up to $2 billion of its non-core assets to pay down debt.

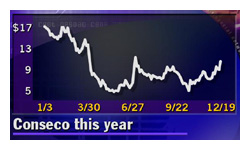

Shares of Conseco rose $1.56, or 17 percent, to $10.56 on the New York Stock Exchange Tuesday. Conseco's stock had collapsed from highs around $56 two years ago, brought down by problems stemming from its $6 billion purchase of personal loan firm Green Tree Financial. Shares of Conseco rose $1.56, or 17 percent, to $10.56 on the New York Stock Exchange Tuesday. Conseco's stock had collapsed from highs around $56 two years ago, brought down by problems stemming from its $6 billion purchase of personal loan firm Green Tree Financial.

After announcing the sale of the Argosy riverboat investment, which had been postponed by legal wrangling between the two companies regarding the process for that deal, Conseco also announced that its fourth-quarter and 2001 financial performances will fall below Wall Street's expectations.

In a teleconference with analysts and investors Tuesday afternoon, Conseco chief executive Gary Wendt said the company's fourth-quarter operating profit will be about $70 million, or 13 cents per share.

That's well below the Street's expectation for a profit of 25 cents per share during the quarter, according to a survey of analysts by earnings tracker First Call.

For all of 2000, Wendt said, profits would be about 42 cents per share, compared with expectations of 61 cents, according to the First Call survey.

"I continue to tell anyone who will listen to pay no attention to earnings in the turnaround year of 2000," Wendt said, focusing instead on targets for 2004.

In 2001, Wendt said, the firm expects profits of between $330 million and $405 million, or 90 cents to $1.10 per share, including goodwill amortization but excluding one-off items. That is in line with analysts' consensus estimate of 94 cents.

-- from staff and wire reports

|

|

|

|

|

|

Conseco

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|