|

Vodafone buys Japan stake

|

|

December 20, 2000: 7:38 a.m. ET

British cell-phone titan buys 15% of Japan Telecom for $2.2 billion

|

LONDON (CNNfn) - Vodafone Group PLC agreed to buy 15 percent of Japan Telecom Co. for $2.2 billion, increasing the possibility of a battle to control the country's third-largest phone company.

The acquisition gives the world's largest mobile-phone operator greater access to J-Phone, the Japanese company's cell-phone unit, as it rolls out keenly awaited email, Internet and video services.

| |

JAPANESE CELL-PHONE MARKET JAPANESE CELL-PHONE MARKET

|

|

| |

|

There are about 55.7 million mobile-phone users in a population of 127 million

Japan has the third largest subscriber base in the world, behind only the U.S. and China

NTT DoCoMo, Japan's biggest mobile phone operator, has 15.6 million users for its i-mode service

J-Phone, the No. 3 cell-phone company, has 3.9 million users with net access via its J-Sky service

|

|

|

However, Vodafone's strategy to gain control of Japan Telecom could be thwarted by domestic rival British Telecommunications PLC.

"Having been outsmarted once before by Vodafone over control for Spain's No. 3 mobile phone provider Airtel, this time expect more of a fight," analysts at Bear Stearns wrote in a note to clients.

After a battle for control of the Spanish company, BT and Vodafone agreed in June to carve up Airtel Móvil, giving Vodafone the right to increase its holding in Airtel to 55 percent, after which BT has the option to acquire the rest and to obtain an equal say.

The Newbury, England-based company will pay West Japan Railway Co. and Central Japan Railway Co. about ¥249.2 billion for their stakes in Japan Telecom. Japan Telecom owns 54 percent of mobile-phone operator J-Phone, while Vodafone (VOD) has 26 percent and BT the other 20 percent.

BT 'covets AT&T stake'

British Telecom is also hoping to raise its stake in Japan Telecom from almost 14 percent at present, according to analysts, who say the former U.K. phone monopoly wants to scoop up AT&T Corp.'s 15 percent.

BT "is believed to be involved in discussions with AT&T (T: Research, Estimates) but is thought to be wary about buying the entire stake, given the parlous state of its finances," Bear Stearns said.

AT&T has indicated it is willing to divest its stake following NTT DoCoMo's announcement that it will take a stake in AT&T Wireless for $9.8 billion. NTT DoCoMo is Japan's biggest mobile phone company with 27.1 million subscribers.

BT is under pressure to slash its debt mountain, which is expected to rise to about $30 billion by March 2001. Debt ratings agencies have lowered their ratings of the company's creditworthiness as investments and acquisitions sent its liabilities skyward.

"Taking on Vodafone will be a costly exercise and potentially negative for its rating," Bear Stearns said. "Cashing in its chips in Japan could raise anything up to £6 billion ($8.8 billion) and may prove to be the best strategy."

For Vodafone, the Japanese market represents a vital test bed for third-generation mobile-phone services, designed to provide customers with email, Internet access, voice and video images. 3G services begin next year in Japan, well before their availability in the rest of the world.

"The transaction demonstrates Vodafone's confidence in the future of the Japanese telecoms market and the future prospects of Japan Telecom and J-Phone, which we believe will be a powerful force in an increasing competitive Japanese marketplace," said Vodafone Chief Executive Chris Gent.

J-Phone, one of three Japanese firms licensed to offer 3G services, has 3.9 million users with access to its Web-enabled mobile Internet service, called J-sky. NTT DoCoMo has signed on 15.6 million users for its rival i-mode service. J-Phone, one of three Japanese firms licensed to offer 3G services, has 3.9 million users with access to its Web-enabled mobile Internet service, called J-sky. NTT DoCoMo has signed on 15.6 million users for its rival i-mode service.

Separately, Vodafone is expected to conclude an agreement, as early as this week, to buy Eircell, Ireland's largest mobile-phone operator, from telecom provider Eircom PLC for around  4.6 billion ($4.2 billion), the Wall Street Journal reported. 4.6 billion ($4.2 billion), the Wall Street Journal reported.

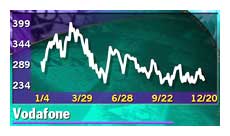

Share in Vodafone (VOD) fell 2.8 percent to 247 pence, while BT (BT-A) dipped 2.9 percent to 612 pence.

|

|

|

|

|

|

Vodafone

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|