|

Vodafone deal faces hurdle

|

|

December 22, 2000: 8:20 a.m. ET

Regulator could block a Vodafone bid for Australian mobile firm C&W Optus

|

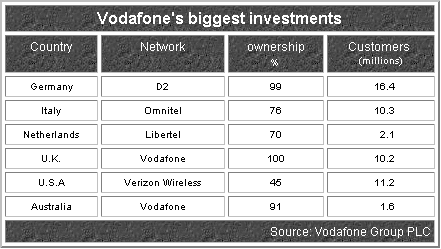

LONDON (CNNfn) - Vodafone Group PLC faces a struggle convincing Australian regulators they should let it buy Cable & Wireless Optus Ltd., analysts said Friday.

The Australian newspaper said Vodafone offered A$18 billion ($10 billion) for the company, which has been put up for sale by 52 percent shareholder Cable & Wireless PLC of the U.K.

Analysts said they are not convinced a deal between Vodafone, the third-largest mobile-phone operator in Australia, and second-ranked C&W Optus would get regulatory approval.

"It's a tough sale," Matthew Lewis, an analyst at Daiwa SBCM Europe, told CNNfn.com. "But its a buyer's market, and few companies have the spending power of Vodafone."

Optus has had a tough time on the stock market recently, buffeted by selling pressure among "new-economy" stocks and worries that a takeover would fail to offer shareholders a significant premium.

Australia's competition watchdog told the newspaper he had serious misgivings about any company forging a position where it accounts for more than half the country's 9.2 million mobile-phone subscribers.

"There's a massive overlap in their networks," said Lewis, and raised another matter that might bother the U.K. bidder: "Does Vodafone really want to lose its brand at a time when it's starting to roll out its name across all its holdings?"

Vodafone has already been on a seasonal spending spree, snatching Ireland's biggest mobile-phone operator Eircell for $4.5 billion on Thursday and a 15 percent stake in Japan Telecom for $2.2 billion on Wednesday.

The Newbury, England based company "has a hole in Asia and South America, it's got the money to spend and that's where we can expect the next acquisitions," Lewis said.

Competing bidders?

Optus said Friday it has received "a number of serious expressions of interest", and the auction would continue. Analysts said other parties that might be interested included Japan's dominant mobile-phone company NTT DoCoMo, Singapore Telecommunications Ltd. and the Telecom Corporation of New Zealand.

An acquisition by NTT DoCoMo might face the same regulatory objections as Vodafone, because Hutchison Whampoa, in which NTT DoCoMo has a stake, recently began offering cell-phone services in Australia.

"DoCoMo is planning to raise billions through a share sale to pay for its stake in AT&T's (T: Research, Estimates) wireless business and would have to extricate itself from Hutchison," Lewis said.

Britain's Cable & Wireless PLC is seeking to divest a number of non-core telecom assets, and called in September for interested parties to lodge non-binding offers for Optus.

The newspaper said Vodafone had offered between A$18 billion and A$25 billion, greater than Optus's current enterprise value (equity plus debt) of A$15 billion.

The report gave Optus stock a boost Friday, driving it up 2.6 percent to A$3.50. Vodafone, which declined to comment on the report, slipped 0.8 percent to close at 232.5 pence, while Cable & Wireless dropped 3.1 percent to end the session at 897.5 pence in London.

|

|

|

|

|

|

|