|

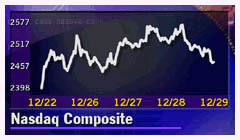

Shaky week for Wall St.

|

|

January 1, 2001: 7:00 a.m. ET

As the new year begins, investors may not clean the slate of profit warnings

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The U.S. stock market, which suffered its worst performance in a generation last year, faces 2001 with a familiar problem: Earnings warnings.

When Wall Street goes back to work Tuesday, analysts foresee more trouble for stocks as another round of companies pre-announce disappointing financial results.

"I think there'll be more pain and suffering," said Chuck Hill, director of research at First Call.

History is one his side. Hill said that last year, 43 percent of the companies warning about earnings shortfalls for the October-December quarter did so in January.

"I'm expecting more of the same," Larry Wachtel, market analyst at Prudential Securities, told CNNfn's market coverage.

More of the same would not be good. The three major indexes all fell in 2000 for the first time since 1990.

On the week, the Dow Jones industrial average lost 1.8 percent, the Nasdaq composite index fell 1.4 percent, and the S&P 500 index declined 1.1 percent.

Expect more warnings

It was nearly a year ago next week, on Jan. 6, 1999, when Lucent Technologies (LU: Research, Estimates) began what became a string of earnings warnings that sheared more than 80 percent off the company's market value.

As companies close their books on 2000, a year when the economy slowed, more warnings are expected ahead of the fourth-quarter earnings reporting period in late January and February.

First Call's Hill sees further trouble for the markets until Wall Street figures out when earnings growth is going to bottom. First Call's Hill sees further trouble for the markets until Wall Street figures out when earnings growth is going to bottom.

The fourth quarter isn't looking good. Average profits at S&P 500 companies are expected to risen by 4.7 percent, according to First Call. That's a sharp cool-down from 1999, when earrings grew by 21.3 percent in the last three months of the year.

Only a handful of companies trot out their financial results in the days ahead.

Among them, profit at Bear Stearns (BSC: Research, Estimates) is seen falling to $1.11 per share, according to analysts surveyed by First Call, from $1.26 per share in the year-earlier period

But earnings at Lehman Brothers (LEH: Research, Estimates) are forecast to rise to $1.26 per share from $1.14 in the year-earlier period.

The two brokers share more than a common business. Both Lehman and Bears Stearns have been considered takeover targets in the rapidly consolidating financial services industry.

That partially explains their strong stock performance. Bear Stearns gained more than 20 percent in 2000 while Lehman surged over 75 percent.

Job market loosens?

In the economic data highlight of the week, Friday brings the all-important December jobs report. The unemployment rate, after rising to 4 percent in November, is expected by economists at Briefing.com to have crept up to 4.1 percent in December.

Payrolls are seen coming in at 110,0000 for the last month of 2000, following the creation of 94,000 job in November.

Mike Moran, chief economist at Daiwa Securities, sees the jobs report showing a gradually weakening labor market.

"The numbers will be consistent with [the] view that the economy is slowing down and the labor market is losing its vigor," he said. "The numbers will be consistent with [the] view that the economy is slowing down and the labor market is losing its vigor," he said.

Moran is looking for the unemployment rate to tick up to 4.1 percent with 125,000 new jobs being added to the payrolls in December.

Economists agree that the job market is not as tight as it was. Companies from Whirlpool, Chase Manhattan and Gillette have announced layoffs in recent weeks. And the number of American filling for unemployment benefits has been rising.

Paradoxically, Wall Street may be looking for signs of a looser labor market. Rising unemployment could give the Federal Reserve more ammunition to cut interest rates later next month.

"I think they will ease policy at that time," Moran said of the Fed's Jan 30-31 meeting. "The question is whether its will be" a quarter percentage point or a half percentage point, he said.

In other economic indicators this week, Tuesday brings a key read on the manufacturing sector when the National Association of Purchasing Management issues it December index. After hitting 47.7 in November, the NAPM index is seen dropping to 46 in December.

In addition to the jobs report, Friday also brings November new home sales, which fell to an annual rate of 928,000 in October. The November number is expected to come around 940,000.

|

|

|

|

|

|

|