LONDON (CNNfn) - Most Asian markets shot higher Thursday after the U.S. Federal Reserve sprang a rate cut on an unsuspecting market, but domestic issues depressed Japan's leading index.

In Tokyo's first trading day of the new year, the benchmark Nikkei 225 index closed down 94.20 points, or 0.7 percent, at 13,691.49, adding to last year's 27 percent drop as most big bank stocks slid.

"I thought there might be more of a rise, but I'm not surprised (the Nikkei) ended lower," said Kathy Matsui, market strategist with Goldman Sachs in Tokyo, referring to the effect of the Fed's surprise half-point reduction in its leading short-term interest rate Wednesday. "Domestic concerns are outweighing the external factors right now."

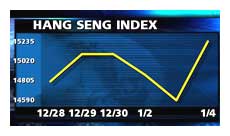

The Hang Seng index in Hong Kong, where the economy is tightly connected to that of the U.S., ended up 645.45 points, or 4.4 percent, at 15,235.03, marking the biggest one-day percentage advance in about three months. Top gainers included property firms: Sun Hung Kai Properties rose 9.2 percent and New World Development jumped 13 percent.

The Hong Kong Monetary Authority, whose policy is to keep Hong Kong's dollar pegged to the U.S. currency, followed the Fed rate cut with its own half percentage point reduction in the overnight discount rate that it offers banks, lowering it to 7.5 percent.

Singapore's Straits Times index rose 58.1 points, or 3.2 percent, to end at 1,920.75 points, as tech stocks led the way. Chartered Semiconductor rose 13.6 percent and electronics maker Venture Manufacturing leapt 17 percent.

In other leading Pacific Rim markets, Australia's S&P/ASX 200 index climbed 1.8 percent, with media conglomerate News Corp. jumping 11.5 percent. The Taiwan Weighted index in Taipei gained 4.9 percent and the KOSPI index in Seoul soared 7 percent.

John Schofield, market strategist with Prudential Bache Securities Asia, said the Fed's rate cut may be just the market medicine Asia has needed.

"I think that this is going to mark the big turning point that we've been looking for after a pretty horrific 2000," Schofield told CNN International.

In the currency market, the U.S. dollar rose against the Japanese yen to ¥114.12 per dollar from ¥113.60 in late New York trading the previous day.

Tokyo gets no lift from rate cut

Tokyo stocks made a weak start to 2001. The Fed's rate cut failed to inspire a new wave of enthusiasm for a market that has seen heavy losses, even though it triggered a 14.17 percent surge on the tech-heavy Nasdaq composite index in the U.S., while the Dow Jones industrial average rose more than 2.8 percent.

Among the considerations keeping Tokyo investors cautious, Goldman Sachs's Matsui said, are lingering concerns about the earnings outlook for Japanese companies and continued share sales as big corporations unwind cross-shareholdings in one another.

Among the banking sector losers was Tokai Bank, off 1.6 percent, while Sumitomo Bank and Sanwa Bank each shed 2.1 percent.

Arabian Oil, Japan's biggest oil company, slipped 5.3 percent while automaker Nissan Motor dropped 3.4 percent.

Some tech stocks were buoyed by the Nasdaq's rally. Tokyo Electron, a maker of semiconductor manufacturing equipment, jumped 12.9 percent and fiber-optics firm Furukawa Electric rose 7 percent. Consumer electronics company Sony rose 4.2 percent and chipmaker NEC added 1.4 percent.

Mobile-phone operator NTT DoCoMo, the market's largest issue by capitalization, rose 4.6 percent. Both Sony and NTT DoCoMo are down more than 50 percent from their peaks last March.

Traders said DoCoMo would probably continue to be weak ahead of an expected share sale. Nihon Keizai Shimbun newspaper reported last month that DoCoMo is planning to issue ¥1 trillion ($8.8 billion) in new shares in February to fund its overseas expansion.

Hong Kong stocks rally

Major banking, technology and property companies rallied in Hong Kong. Volume was heavy as advancers outnumbered decliners by more than four to one.

Global banking group HSBC Holdings, the Hang Seng index's largest stock by market capitalization, added 3.3 percent, while Dao Heng Bank rose 3.5 percent.

China's largest computer maker, Legend Holdings jumped 8.3 percent, China Mobile, mainland China's largest cell-phone company, gained 5.4 percent and rival China Unicom climbed 3.5 percent. Telecom and Internet company Pacific Century CyberWorks rose 6.2 percent.

Hong Kong-based firms that export to the U.S., which saw their shares badly hit on Wednesday, rebounded Thursday. Trading group Li and Fung was a top gainer, up 9.9 percent, and micro-motor maker Johnson Electric added 6.3 percent.

In the property sector, Sino Land rose 7.5 percent and Henderson Land jumped 10.3 percent.

In Sydney, Australia's largest telecom operator Telstra rose 1.9 percent, while mining company Broken Hill jumped 3.1 percent.

Tech stocks prospered in Taipei. Computer maker Acer jumped 6.9 percent, while among chipmakers, Taiwan Semiconductor climbed 5.6 percent and United Microelectronics added 4.6 percent.

Elsewhere in Asia, Jakarta's JSX index rose 1 percent, Manila's PHS composite climbed 1.7 percent, and the KLSE composite in Malaysia gained 1 percent, while Bangkok's SET jumped 2.5 percent and the BSE Sensex index in Mumbai tacked on 1.4 percent.

--from staff and wire reports

|