|

Holiday sales disappoint

|

|

January 3, 2001: 6:04 p.m. ET

Federated and Walgreens see only modest sales growth last month

|

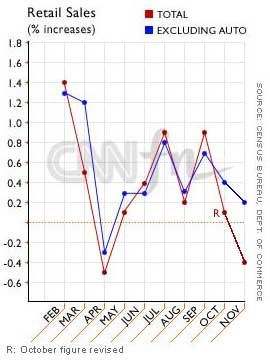

NEW YORK (CNNfn) - Retail sales edged up a modest 2.7 percent in December, according to data released Wednesday. Separately, a handful of major retailers reported lackluster holiday sales, reflecting a tough selling environment sparked by declining consumer confidence.

Federated Department Stores, Walgreen Co. and Family Dollar Stores all reported disappointing same-store sales for December, or sales at stores open at least a year. More December sales results are expected Thursday from Wal-Mart Stores Inc. (WMT: Research, Estimates), Sears (S: Research, Estimates) and other major retailers.

Bucking the trend, specialty retailer American Eagle Outfitters Inc. (AEOS: Research, Estimates) reported an 11.8 percent increase in December same-store sales. However, that's still below the 17 percent gain posted during the same period a year ago.

Retailers' overall 2.7 percent growth in same-store sales for December is significantly slower than the 5.8 percent gain reported in the December 1999 period, according to the TeleCheck Retail Index. TeleCheck is a leading check acceptance company that tracks sales through the number of checks written by consumers.

TeleCheck senior economic advisor William Ford blamed the sluggish sales growth on a slowing economy, heavy discounting of merchandising and unusually severe weather throughout much of the country in December.

Reinforcing that report were early same-store sales reports from a handful of major retailers.

Federated Department Stores, the owner of Macy's, Bloomingdale's and other chains, said its same-store sales edged up a "disappointing" 1.2 percent in December. The company's total sales for December, including sales at new stores, fell 0.6 percent to $3.29 billion.

"Our December department store sales were disappointing, which we think is attributable at least in part to heightened consumer concerns over a slowing economy," Federated Chairman James Zimmerman said.

Despite a last-minute rush for holiday gifts, many retailers expected December sales to fall short of forecasts as consumers cut back on spending. Despite a last-minute rush for holiday gifts, many retailers expected December sales to fall short of forecasts as consumers cut back on spending.

Sales growth is expected to be much lower than last year, which combined with discounts and heavy promotions could have a sharp effect on company earnings.

Cincinnati-based Federated said sales for the first 48 weeks of its fiscal year grew 3.3 percent to $17.3 billion.

Excluding new stores, sales grew 2 percent.

Federated (FD: Research, Estimates) stock gained $3.31 to $37.69 in Wednesday trading.

Specialty retailer American Eagle, which caters to 16-to-34 year-olds, said December same-store sales increased 11.8 percent, compared with a 17 percent gain a year ago.

Total sales increased 45.1 percent to $231.8 million, from $159.8 million in November.

Shares of American Eagle gained $6.06, or nearly 15 percent, to $47.69.

Drug store chain Walgreen (WAG: Research, Estimates) reported a modest 3 percent increase in December same-store sales, blaming a tough comparison to last year's strong December, which was helped by an early flu season, fears over Y2K computer failures and mild weather.

However, Walgreen's overall sales increased 9 percent to $2.5 billion. Full fiscal year sales rose 14 percent to $8 billion.

Walgreen shares shed $1.56 to $39.25.

Discount chain Family Dollar Stores said same-store sales decreased 0.5 percent in December, but the company reported a 13.3 percent increase in fiscal first-quarter profit, matching lowered forecasts. Shares of Family Dollar (FDO: Research, Estimates) lost 56 cents to $20.50.

-- from staff and wire reports

|

|

|

|

|

|

|