|

Fed makes surprise rate cut

|

|

January 3, 2001: 5:04 p.m. ET

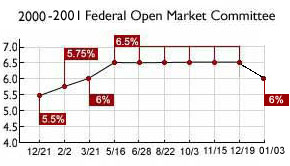

Cites signs of economic slowdown; cuts fed funds rate to 6%

|

NEW YORK (CNNfn) - In a surprise move, the Federal Reserve slashed short-term interest rates Wednesday and signaled it is ready to make further cuts to keep the U.S. economy from sliding into a recession.

The move, which came nearly four weeks ahead of the Fed's regularly-scheduled policy meeting, caught most investors off guard, triggering a mighty rally on Wall Street with the Nasdaq composite posting its best day ever and the Dow industrials surging nearly 3 percent.

Citing weakening sales, production and lower consumer confidence for its decision, the central bank lowered the fed funds rate, the rate banks use for overnight loans, to 6 percent from 6.5 percent. The Fed cut the discount rate, which it uses when it loans funds to banks, to 5.75 percent from 6 percent.

| |

|

|

| |

|

|

| |

We raised a glass of water to Mr. Greenspan for taking that action, and we all think it's in the right direction.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

John (Jack) Welch, CEO of General Electric |

|

This is the first time in more than two years the Fed has cut interest rates in between policy meetings, and should virtually overnight make it easier for consumers to obtain financing for automobiles, homes and other big ticket items. It should also encourage more spending at stores. Consumer spending accounts for about two-thirds of the U.S. economy.

"I'm pleased the Fed has cut interest rates. I believe the cut was needed. It's a strong statement to ensure our economy does not go into a tailspin," President-elect George W. Bush said at a news conference following the announcement.

Click here to see what the Fed's move means for investors and consumers.

Top U.S. business leaders also applauded the decision.

"We had a chance to all rejoice a little bit at Mr. Greenspan's aggressive actions here at lunch. We raised a glass of water to Mr. Greenspan for taking that action, and we all think it's in the right direction," General Electric CEO Jack Welch said. Welch was part of a group of business leaders meeting with Bush at an economic forum in Austin, Texas.

The Federal Open Market Committee, the Fed's policy arm which instituted the cuts, also said it stands ready to approve a further reduction of a quarter of a percentage point in the discount rate to 5.5 percent on the requests of regional Federal Reserve Banks.

"The Committee continues to believe that, against the background of its long-run goals of price stability and sustainable economic growth and of the information currently available, the risks are weighted mainly toward conditions that may generate economic weakness in the foreseeable future," The Fed said in a statement. "The Committee continues to believe that, against the background of its long-run goals of price stability and sustainable economic growth and of the information currently available, the risks are weighted mainly toward conditions that may generate economic weakness in the foreseeable future," The Fed said in a statement.

Insurance against a recession

That statement led many economists to believe the Fed continues to be extremely worried about the risk of a recession and that the rate cuts were meant as an insurance policy against such a downturn.

"I think this is clearly the Fed saying 'we're willing to take out an insurance policy, we're not willing to risk recession'," Diane Swonk, Chief Economist at Bank One told CNNfn's "Market Coverage." "We have a very activist Fed."

| |

|

|

| |

|

|

| |

I think this is clearly the Fed saying 'we're willing to take out an insurance policy, we're not willing to risk recession'

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Diane Swonk, Chief Economist at Bank One |

|

She was joined by Wayne Ayers, chief economist at Fleet Boston Financial Corp., who said the fact that so many sectors of the economy are slowing down simultaneously must have gotten the central bank very concerned.

"I don't think anyone has seen this happen so quickly. I don't think Alan Greenspan has seen it happen so quickly. So he's taking out an insurance policy for himself," Ayers said. "My best guess is that they (The Fed) are running scared. At this point we've seen such pronounced weakness across all areas of the economy that I think they're fearful this downturn is going to be very different than any in the past."

The move comes less than a month after the Fed indicated it was leaning toward a rate cut, moving away from its previous anti-inflationary stance.

Al Goldman, chief market strategist at A.G. Edwards, told CNNfn's "Market Coverage" he expects further rate cuts by March. (329K WAV) (329K AIFF)

Click here to read the Federal Reserve's statement.

An unexpected cut

Some economists had expected Fed Chairman Greenspan to cut rates before the Jan. 30-31 FOMC meeting, following a spate of reports indicating the economy was cooling off much faster than anticipated, with drops in retail sales, consumer confidence and productivity.

But many revised that outlook after some indicators such as sales of existing homes, showed that the economy was not in a nosedive and likely could hold out until the end of January.

However, a series of severe declines in the markets over the last several weeks driven by increasing fears over earnings shortfalls, high energy prices and disappointing holiday season sales, apparently pushed the Fed into acting earlier. A report Tuesday which showed manufacturing at its weakest level in almost a decade and forecasts for an equally disturbing employment report, due Friday, may also have tilted the FOMC's scale.

Moving away from their usual practice of instituting interest rate changes at regularly scheduled FOMC meetings, members of the committee conducted a conference call at 11 a.m. ET Wednesday during which they agreed to cut the fed funds rate.

Immediately after the conference call, members of the Federal Reserve's board of governors held a meeting and voted 5-0 to lower the more symbolic discount rate.

The Fed issued the rate cut announcement shortly after 1 p.m. EST.

The last time the central bank lowered rates was in November 1998, the third of a string of rate cuts aimed at combating the credit crunch in the wake of the Russian debt crisis and the Long Term Capital Management hedge fund collapse.

The last time the Fed made a surprise rate cut in between FOMC meetings, was Oct. 15 1998.

The series of rate cuts were followed by six interest rate increases between June 1999 and May 2000.

Markets cheer the news

Wall Street responded immediately with one of its strongest rallies on record. The Dow Jones industrial average soared almost 300 points to 10,946, while the Nasdaq composite index rocketed 325 points to 2,617.

"Something like this news is the sort of catalyst that ought to spark a terrific rally now, but the question is will it sustain itself? And that's not at all clear. Certainly in '98 when the Fed did this you had a rally that lasted a year or two. I think we're going into a rally right now," Jim Melcher, founder and president of Balestra Capital told CNNfn's "Market Coverage" Wednesday. (554K WAV) (554K AIFF) "Something like this news is the sort of catalyst that ought to spark a terrific rally now, but the question is will it sustain itself? And that's not at all clear. Certainly in '98 when the Fed did this you had a rally that lasted a year or two. I think we're going into a rally right now," Jim Melcher, founder and president of Balestra Capital told CNNfn's "Market Coverage" Wednesday. (554K WAV) (554K AIFF)

Some of the nations largest banks began cutting their prime lending rates minutes after the Fed's announcement.

"This is one of the more surprising moves the Fed has made in a long time," Henry Willmore, chief U.S. economist at Barclays Capital Group told Reuters Wednesday. "I'm a little bit puzzled by this."

Lower interest rates usually spur consumer confidence, making people more likely to go ahead and buy that minivan or dream house, further bolstering the economy with increasing demand for products. The Fed's move will allow banks to ease interest rates they charge consumers and businesses for different types of loans, allowing for faster corporate growth and more consumer spending.

-- from staff and wire reports

|

|

|

|

|

|

|