LONDON (CNNfn) - European bourses fell Wednesday, with telecom and tech stocks tumbling on concerns a downturn in the U.S. economy will crimp profits.

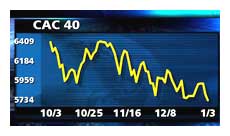

The blue-chip CAC 40 in Paris tumbled 114.85 points, or almost 2 percent, to an 11-month low of 5,684.05, led by computer consultant Cap Gemini, which dropped of 6.2 percent.

London's benchmark FTSE 100 index dropped 134.8 points, or 2.2 percent, to 6,039.9, with search software maker Autonomy (AU-) tumbling more than 17.3 percent, joined on the list of leading decliners by information technology consultants. London's benchmark FTSE 100 index dropped 134.8 points, or 2.2 percent, to 6,039.9, with search software maker Autonomy (AU-) tumbling more than 17.3 percent, joined on the list of leading decliners by information technology consultants.

Frankfurt's late-trading electronic benchmark index, the Xetra Dax, shed 1.1 percent to reach 6,220.55. Chipmaker Infineon Technologies (FIFX) slumped more than 6.7 percent and an array of banking stocks careered lower for a second day.

"It's the (U.S.) economy, and we're going to have to wait and see whether it turns around," Justin Urquhart Stewart of Barclays Stockbrokers told CNNfn, referring to a report Tuesday that showed weaker-than-expected U.S. manufacturing activity last month. "For the first half of the year...we're going to be on thin ice. And we've got to be careful about the defensive stocks -- some are actually quite expensive."

In other leading European markets, the AEX index in Amsterdam fell 0.7 percent and Milan's MIB 30 fell 2.2 percent. The SMI in Zurich slipped 0.2 percent as digital encryption company Kudelski – the Swiss market's technology darling – tumbled 12.3 percent.

In other leading European markets, the AEX index in Amsterdam fell 0.7 percent and Milan's MIB 30 fell 2.2 percent. The SMI in Zurich slipped 0.2 percent as digital encryption company Kudelski – the Swiss market's technology darling – tumbled 12.3 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, shed 1.5 percent. Its information technology hardware sub-index was down 7.1 percent, while the computer services and software sector dropped 6.3 percent.

Tech-orientated European indexes were battered for a second day, with the Neuer Markt index in Germany down 7.2 percent – a day after hitting an all-time closing low -- while the pan-European Easdaq index tumbled 8 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

U.S. markets rose Wednesday. The Nasdaq composite rose 0.7 percent to 2,307.03, after plunging 7.2 percent in the previous session amid fears about the outlook for corporate earnings. The blue-chip Dow Jones industrial average slipped 0.1 percent to 10,635.99.

In the currency market, the euro fell to 94.75 U.S. cents after surging to six-month high of 95.46 cents in early London trade, following Tuesday's weak figures on U.S. manufacturing activity.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

Technology shares across Europe tumbled again. In Germany, software maker SAP (FSAP) dropped 5.3 percent, extending the previous session's losses after rival Intershop (FAISH) shocked the market with a profit warning. Intershop plunged 15.2 percent.

Engineering and electronics company Siemens (FSIE), the parent of Infineon Technologies, fell 3.8 percent and electronic component maker Epcos (FEPC) dropped 5.8 percent.

British chip designer ARM Holdings (ARM) fell 6.7 percent, and in London's computer services sector, Logica (LOG) dropped 10 percent, Misys (MSY) dived 12.3 percent, CMG (CMG) lost 11.7 percent and accounting software company SAGE Group (SGE) dipped 8.9 percent.

Among Paris technology, media and telecom stocks, chipmaker STMicroelectronics (PSTM) fell 5.8 percent, network equipment firm Alcatel (PCGE) fell 5.2 percent, and recently formed media powerhouse Vivendi Universal (PEX) shed 0.7 percent.

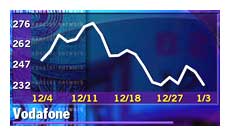

Finnish cell-phone maker Nokia was one of the telecom sector's biggest casualties, falling 8.8 percent in Helsinki and accounting for most of the 7.1 percent drop on the HEX General index. Swedish rival Ericsson fell 6.7 percent and U.K. mobile-phone services heavyweight Vodafone Group (VOD) dropped 6.8 percent. Finnish cell-phone maker Nokia was one of the telecom sector's biggest casualties, falling 8.8 percent in Helsinki and accounting for most of the 7.1 percent drop on the HEX General index. Swedish rival Ericsson fell 6.7 percent and U.K. mobile-phone services heavyweight Vodafone Group (VOD) dropped 6.8 percent.

But French telecom and construction company Bouygues (PEN) jumped 2 percent, up for a second day amid speculation it may be close to selling its oil services business.

Its rival France Telecom (PFTE) fell 0.9 percent, while Deutsche Telekom (FDTE) added 2.6 percent in Frankfurt.

Shares of Italian Internet service provider Tiscali were suspended after they fell more than the bourse's 10 percent limit as investors sold telecoms, media and technology shares.

French Internet service provider Liberty Surf soared 10.9 percent after French daily Le Figaro said the ISP is in talks with Belgian national telecom operator Belgacom about combining their Web activities.

News and financial information company Reuters (RTR) fell 5.5 percent. Investment bank Schroder Salomon Smith Barney cut its recommendation on Reuters to "outperform" from "buy".

German banks slumped for a second day. Dresdner Bank (FDRB) shed 3.6percent and Commerzbank (FCBK) lost 3.2 percent.

Other banking stocks headed lower across the continent, included Banco Bilbao Vizcaya Argentaria, which fell 1.5 percent on concerns a downturn in the U.S. economy will have a domino effect on Latin American markets, where its has major businesses.

Swiss banks with U.S. operations also were wounded by the gloomy stateside economic outlook. UBS fell 1.7 percent and CS Group dipped 1.9 percent.

Franco-German life sciences company Aventis (PAVE) fell 5.9 percent in Paris after announcing it will sell its controlling stake in Messer Griesheim, an industrial gases maker, to the private equity arm of German insurer Allianz (FALV) and securities firm Goldman Sachs Group (GS: Research, Estimates), for an undisclosed price.

General retailing stocks, which until the second half of 2000 had suffered a four-year bear market, remained upbeat in London. Electronics vendor Dixons Group (DXNS) rose 6.3 percent while catalog-based retailer Great Universal Stores (GUS) added 0.7 percent. General retailing stocks, which until the second half of 2000 had suffered a four-year bear market, remained upbeat in London. Electronics vendor Dixons Group (DXNS) rose 6.3 percent while catalog-based retailer Great Universal Stores (GUS) added 0.7 percent.

In Frankfurt's retail sector, Metro (FMEO) added 2 percent and Karstadt Quelle (FKAR) climbed 0.7 percent, while Carrefour (PCA) also gained 2 percent in Paris.

"There has been a belief that Christmas trading was strong," Ian McDougal, a retail analyst with Williams de Broe in London, told CNNfn.com. "For now, however, it's purely anecdotal. We have no hard numbers to go on. We'll get those next week."

Other defensive stocks making their mark included, British American Tobacco (BAT), which rose 2.1 percent. A U.S. District Court in South

Carolina denied class-action status for a lawsuit against cigarette manufacturers, marking the second time in a week that class-action status was denied in a smoking-related case. Imperial Tobacco Group (IMT) climbed 2.6 percent.

Belgium's Interbrew, the maker of Stella Artois beer, fell 25.3 percent after the British government rejected the company's $3.5 billion acquisition of Bass Brewers, and told it to sell on the recently bought unit to an acceptable party. Dutch brewer Heineken, which is seen as a likely buyer, climbed 2 percent.

-- from staff and wire reports

|