|

Big 3 December sales drop

|

|

January 3, 2001: 4:40 p.m. ET

Chrysler shuts more plants; GM, Ford sales plunge as importers gain

|

NEW YORK (CNNfn) - A record year for auto sales ended with a whimper for the industry's Big Three as General Motors Corp., Ford Motor Co. and DaimlerChrysler all reported a sharp drop in December sales.

For the second straight month DaimlerChrysler used the sales announcement to unveil a series of plant shutdowns in North America as it tried to adjust to falling sales at its troubled Chrysler Group, its U.S. unit. But overseas automakers, led by No. 4 Toyota Motor Corp., saw solid gains in the month and the year at the expense of the Big Three.

Click here for more on auto sales

from CNN Detroit Bureau Chief Ed Garsten

Chrysler will shut five plants next week, one plant the week after that, three plants during the week of Jan. 22 and five the last week of the month. The company had already extended a holiday-week shutdown to close four plants during the current week.

"In December, industry sales mirrored the weather in the Midwest -- cold," said a statement from Dieter Zetsche, the German CEO of Chrysler Group, who was put in that job in late November. "At this time, we are all experiencing a painful combination of a softening market and excess inventory." "In December, industry sales mirrored the weather in the Midwest -- cold," said a statement from Dieter Zetsche, the German CEO of Chrysler Group, who was put in that job in late November. "At this time, we are all experiencing a painful combination of a softening market and excess inventory."

Chrysler Group's U.S. sales fell 15 percent in December to 167,672, and total-year sales ended down 4 percent to 2.5 million. Its light truck sales fell 11 percent in the month to 129,382, as gains in sport/utility vehicle sales could not make up for a drop of more than a third in minivan sales. Car sales dropped 25 percent to 38,290.

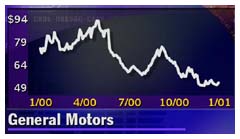

Industry leader GM sold 4.95 million vehicles in the United States during the year, off 1 percent from the 5.02 million sold in 1999. December sales plunged to 337,972 vehicles, off 18 percent from the strong sales it posted the same month of 1999.

Ford, the world's second-largest automaker, set a company record for annual sales with 4.20 million U.S. vehicles sold during the year, edging past its previous record of 4.16 million a year earlier. But December sales of 275,756 were down 14 percent from the 1999 month.

The latest figures include the Land Rover division, which Ford acquired July 1, and Volvo, which it acquired April 1, 1999. Both acquisitions helped the company's overall comparisons with year-ago figures. In fact, if the pre-Ford sales of Volvo and Land Rover are included, annual sales slipped slightly from the 1999 totals.

Overseas automakers see gains

Meanwhile, Toyota Motor Sales Inc. reported a 14.2 percent increase in December U.S. sales to 133,993 vehicles by its Toyota and Lexus brands. That brought full-year sales to a record 1.6 million U.S. vehicles, up 9.7 percent from 1999. But even Toyota officials said they expect a somewhat slower year ahead.

"The economy is downshifting from delirious to deliberate and we have just passed a sign saying 'Proceed with Caution,'" said Jim Press, the executive vice president of the U.S. arm of the Japanese automaker. "Last year was great; this year will be merely good."

Japanese competitor American Honda saw a more modest December gain, rising 2.7 percent to 88,035 vehicles sold by its Honda and Acura brands. For the year, sales increased by 7.6 percent to 1.16 percent.

Importers from Europe and Korea, including Volkswagen, BMW, Audi and Hyundai, also reported gains in December as well as strong gains for the year.

GM admits results were below expectations

Even though a weak December was forecast for U.S. automakers, GM (GM: Research, Estimates) admitted to being disappointed with its results in the period. But it said that it is not ready to cut production in the first quarter below recently lowered levels.

"The operative word is we remain cautiously optimistic," Paul Ballew, general director, global market and industry analysis for GM, told analysts Wednesday. "There are risks. Head winds are clearly present. We are seeing slower growth and seeing some erosion in consumer confidence. But we want to stress, as we look at November and December, we should not overreact to those factors." "The operative word is we remain cautiously optimistic," Paul Ballew, general director, global market and industry analysis for GM, told analysts Wednesday. "There are risks. Head winds are clearly present. We are seeing slower growth and seeing some erosion in consumer confidence. But we want to stress, as we look at November and December, we should not overreact to those factors."

GM's light truck sales fell nearly 20 percent in December to 174,786, while car sales fell 15 percent to 161,608. For the year, light truck sales slipped 0.2 percent to 2.4 million, while car sales fell 2.3 percent to 2.5 million.

Ford sees biggest hit on cars

Ford's sales of light trucks, such as pickups, minivans and sport/utility vehicles, fell 7 percent from December a year earlier to 172,398, but for the year sales in that sector were up 2.3 percent to 2.5 million. But the S/UV sector saw a deep hit, with the Explorer, the industry's best-selling S/UV, showing a 22.4 percent decline in the month, while the Expedition, Excursion and Mountaineer S/UVs had drops of 35-to-49 percent.

The Explorer and Mountaineer were hit by the August recall of 6.5 million Firestone tires used on the vehicles, as well as production shutdowns to free up replacement tires and the pending debut of a newly designed version of those models. The Explorer and Mountaineer were hit by the August recall of 6.5 million Firestone tires used on the vehicles, as well as production shutdowns to free up replacement tires and the pending debut of a newly designed version of those models.

Sales of passenger cars were particularly hard hit, as the company shifted some of its capacity from cars to light trucks. Car sales fell 24 percent in the month to 103,358, and slid 1.1 percent for the full year to 1.7 million. All six of Ford's makes had sales declines in December, but only Land Rover and Mercury had full-year declines.

Ford (F: Research, Estimates) said it believes 2001 will be a strong sales year for the industry overall, although it said the current weakness is likely to continue through the first half of the new year, providing difficult comparisons to the industry's white-hot sales at the start of 2000.

Officials from Ford and GM said that even with the surprise decision by the Federal Reserve Wednesday to cut short-term interest rates, it believes the first quarter will see much slower sales than a year earlier.

"There is a lag factor," said George Pipas, a sales analyst for Ford. "A year ago, even six months ago, we were sitting here wondering when consumers would sense that interest rates were going up. I don't think this significantly affects the first quarter."

Shares of GM climbed $2.63 to close at $54.81 Wednesday and Ford gained 81 cents to $25.13 following the Fed rate cut. American depositary receipts of DaimlerChrysler rose $1.84 to $44.14, while Toyota (TM: Research, Estimates) rose $2.42 to $65.50 in U.S. trading; Honda (HMC: Research, Estimates) gained $2 to $76.

|

|

|

Ford cuts 4Q target, 1Q production - Dec. 21, 2000

Analyst says hard landing hitting autos - Dec. 15, 2000

GM cuts jobs, Oldsmobile division - Dec. 12, 2000

Auto sale fall hits profits, production - Dec. 1, 2000

GM cuts November sales target - Nov. 20, 2000

Daimler lowers Chrysler forecast - Nov. 17, 2000

Ford Explorer sales off - Oct. 31, 2000

|

|

|

|

Ford Motor Co.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|