|

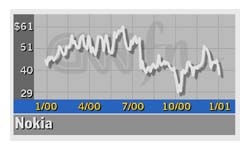

Nokia sales disappoint

|

|

January 9, 2001: 1:51 p.m. ET

Shares plunge after mobile phone maker's sales miss analysts' expectations

|

NEW YORK (CNNfn) - Signaling that demand for wireless handsets is weakening, Nokia Corp., the world's largest supplier of such handsets, said it sold fewer of them in 2000 than some on Wall Street had expected.

The news send Nokia's stock tumbling. In early afternoon New York Stock Exchange Trade, Nokia American depositary receipts were down $4.94, or 11.5 percent, at $38.19.

In a brief statement released before the U.S. markets opened, the Helsinki, Finland-based company said it sold more than 128 million mobile phones last year. Although that's a 64 percent increase from the number it sold in 1999, it's short of the 140 million units some analysts had expected.

The company made no comment regarding pricing or profitability. Analysts are expecting the company to report a fourth-quarter profit of 21 cents per share and 72 cents per share for the year, according to a survey conducted by earnings tracker First Call. The company made no comment regarding pricing or profitability. Analysts are expecting the company to report a fourth-quarter profit of 21 cents per share and 72 cents per share for the year, according to a survey conducted by earnings tracker First Call.

J.P. Morgan analyst Edward Snyder said he expected Nokia to report sales of 135 million-to-140 million phones for 2000. "They did grow faster than the market at 64 percent versus 45 percent for the market, but this is a significant miss," Snyder said on a conference call Monday.

Snyder added that he expects Nokia's report to weigh on the entire mobile-phone sector over the next week or so.

While worldwide demand for handsets rose 45 percent last year, most analysts expect that growth rate to slow to about 35 percent this year. At the same time, however, Nokia is expected to continue to gain market share against its competitors, having picked up 4.5 percentage points of market share in 2000.

|

|

VIDEO

|

|

CNNfn's Jack Cafferty takes a peek at Nokia shares. CNNfn's Jack Cafferty takes a peek at Nokia shares. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Although he could not comment specifically on Nokia's financial results, citing the so-called "quiet period" that precedes corporate earnings releases, Nokia spokesman Tapio Hedman told CNNfn's In the Money Monday that the company remains optimistic for growth in the mobile-phone industry.

Nokia expects the total number of mobile-phone subscribers worldwide to rise from about 700 million currently to more than 1 billion during the first half of 2002, Hedman said. (253K WAV) or (253K AIFF)

Merrill Lynch analyst Adnaan Ahmad said he remains upbeat on Nokia this year, although he noted that the weakening global economy does increase the company's risks.

"We continue to believe that the 2001 global market for handsets will be 550 million units and that Nokia will continue to gain share and achieve our 35 percent market share objective," Ahmad said in a research note.

"Clearly, the risk has increased, particularly with the current economic situation," Ahmad added. "However, we believe that Nokia's superior supply-chain management and its ability to reach the end market will keep it ahead of its peers."

Crédit Lyonnais Securities analyst Susan Anthony said forecasts for mobile-phone unit sales in 2000 at the top end of the previously expected range had been "far too high." Nokia's sales growth was in line with her expectations, she said.

Even so, Nokia's sales report rekindled concerns about slowing growth in demand for wireless handsets and telecommunications equipment, placing pressure on the stocks of competing phone and wireless infrastructure equipment makers.

Click here to see how wireless stocks are doing

Motorola (MOT: Research, Estimates) shares were down 94 cents, or 4.3 percent, at $20.81. Ericsson (ERICY: Research, Estimates) fell 88 cents to $10.50, a 7.7 percent decline. Alcatel (ALA: Research, Estimates) slipped $2.69, or 4.5 percent, to $56.94.

Motorola report to shed more light

Motorola, the world's No. 2 maker of mobile telephones and a leading supplier of semiconductors, is scheduled to report its fourth-quarter financial results Wednesday, which will give mobile phone investors more insight into the industry's condition.

In early December, the Schaumburg, Ill.-based company lowered its guidance, telling the Street that weakening conditions in the global chip market would create a revenue-and-earnings shortfall.

At that time, Motorola executives said they expected to log fourth-quarter sales of $10 billion and earnings per share of 15 cents. That compares with earlier guidance of $10.5 billion in sales and earnings of 27 cents per share. Analysts are expecting revenue to come in a bit short of what the company told them to expect, at about $10.2 billion, according to First Call.

Nokia is slated to report fourth-quarter and annual earnings Jan. 30.

-- CNNfn.com's London bureau contributed to this report.

|

|

|

|

|

|

Nokia

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|