LONDON (CNNfn) - Asian stocks dropped Thursday as concerns about blue-chip share sales dragged down key indexes in Tokyo and Hong Kong, the region's two largest markets.

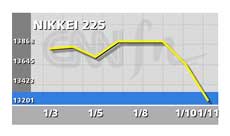

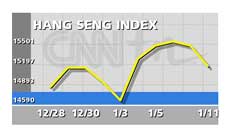

In Tokyo, the benchmark Nikkei 225 average fell 1.7 percent to 13,201.07, its lowest close since October 1998. In Hong Kong, the Hang Seng  slumped 2.2 percent, while Singapore's Straits Times index fell 2.8 percent to close at 1,915.02. slumped 2.2 percent, while Singapore's Straits Times index fell 2.8 percent to close at 1,915.02.

In the currency market, the U.S. dollar rose marginally against the Japanese yen to ¥116.95 from ¥116.44 in late trading in New York a day earlier.

U.S. markets ended higher Wednesday, with the blue-chip Dow Jones industrial average adding 0.3 percent to close at 10,604.27 while the technology-heavy Nasdaq composite index jumped 3.4 percent to 2,524.18.

Tokyo stocks slide

Tokyo stocks extended their losing streak for a third day amid persistent worries that an expected sale of new shares by mobile-phone operator NTT DoCoMo will create a supply glut.

The Tokyo market also came under pressure as banks and manufacturers stepped up sales of shares they hold in each other, known as cross-held shares, to help spiff up their books ahead of the end of the business year on March 31.

Selling is expected to be heavier this year because of a change in rules on how companies report the value of such investments, due to take effect in the next fiscal year.

DoCoMo, Japan's largest issue by market capitalization, finished down 3.5 percent at a 16-month low. The company will start marketing up to 460,000 new shares on Friday, aiming to raise about ¥900 billion ($7.7 billion), the Financial Times reported Thursday.

Traders said that would be an untimely damper on a market already battered by doubts over the strength of the economy.

With the unloading of cross-held shares gathering speed, shares in Toyota Motor fell 7.4 percent on speculation that banks will sharply reduce their holdings in the automaker.

"When large-cap issues like DoCoMo and Toyota lose ground this much, it really creates a 'sell' feeling for the entire market," said Tsuyoshi Segawa, general manager for equity derivatives at Sakura Securities.

Banks on the retreat

Sanwa Bank and Tokai Bank, which are to combine under joint holding company UFJ Holdings in April, each own 4.9 percent of Toyota. Tokai's stock fell 5.4 percent Thursday while Sanwa dropped 2.2 percent.

Mizuho Holdings, the world's largest banking group by assets, shed 2.5 percent.

Internet investor Softbank dived more than 12 percent - its seventh straight daily loss – as investors were rattled by an earnings warning from U.S. Web company Yahoo! Softbank holds a 22.6 percent stake in Yahoo! The Web portal's Japanese affiliate, Yahoo! Japan, in which Softbank owns more than 50 percent, slid 8.9 percent.

In Hong Kong, property stocks came under pressure amid talk that more blue-chip property developers plan to sell shares in the near future, said Jason Ho, director of sales at BNP Paribas Peregrine.

Sun Hung Kai Properties shares fell 2.5 percent, and rival Cheung Kong (Holdings) dropped 3.9 percent. Sino Land, which on Wednesday raised cash by selling 180 million shares, dropped 4.2 percent.

Conglomerate First Pacific plunged 16.3 percent after investment bank ING Barings said it sold First Pacific shares on behalf of First Pacific  Investment. First Pacific and First Pacific Investment are both controlled by Indonesia's Salim Group. Investment. First Pacific and First Pacific Investment are both controlled by Indonesia's Salim Group.

Internet and telecom firm Pacific Century CyberWorks shed 3.1 percent to close at its lowest level since it took over dominant Hong Kong telecom firm Cable & Wireless HKT. Traders said analysts were worried by the company's interest burden after it takes a $1.5 billion loan to fund its joint venture with Australian telecom operator Telstra.

Investors are also concerned that PCCW's major shareholder, Britain's Cable & Wireless PLC, will sell its PCCW shares acquired as a result of the HKT takeover when a lock-up period ends next month.

International bank HSBC Holdings, the most valuable stock on the Hong Kong market, fell 1.3 percent, while its affiliate, Hang Seng Bank, lost 1 percent.

Tech shares were lower in Singapore, with chipmaker Chartered Semiconductor Manufacturing losing 3.7 percent, Venture Manufacturing down 5 percent and Omni Industries shedding 3.4 percent.

In Taipei, the Taiwan Weighted index tumbled 1.2 percent to 5,369.24.

Chipmaker United Microelectronics fell 1 percent while rival Taiwan Semiconductor Manufacturing lost 1.5 percent.

Seoul's KOSPI rose 0.2 percent to end at 593.86. Hyundai Electronics Industries jumped 4.7 percent after plunging a day earlier on concerns about its debt obligations. The firm said Thursday it would ask state-run Korea Development Bank to purchase 240 billion won ($192 million) in debt maturing on Friday.

In Sydney, the benchmark S&P/ASX 200 index fell 0.4 percent to close at 3,225.6 as investors fretted over the impact of a slowing economy on corporate earnings.

Miner MIM Holdings slid 9.6 percent after warning it expected operating profit for the six months ended Dec. 31 to be below the A$52 million ($29 million) earned in the same period a year earlier, blaming losses in its European operations.

In other regional markets, Bangkok's SET index rose 0.5 percent, the JSX index in Jakarta was down 1.7 percent, and Kuala Lumpur's KLSE composite index lost 0.6 percent. In Manila, the PHS composite index ended 1.2 percent lower.

--from staff and wire reports

|