|

Yahoo!'s Koogle upbeat

|

|

January 11, 2001: 1:32 p.m. ET

Exec says Yahoo! to expand fee-based revenue, continue acquisitions

|

NEW YORK (CNNfn) - Yahoo! Chairman and CEO Timothy Koogle remains upbeat about the Web portal's outlook, even though the company warned Wednesday that its revenue and earnings this year will be well below previous analyst expectations.

In an interview on CNNfn's Market Call, Koogle said that he views the consolidation of the dot.com industry, with the widespread failure of weaker players, as an opportunity to take market share away from competitors. He also said that Yahoo! plans to extend its fee-based services to reduce the company's dependence on Web advertising, which now accounts for about 90 percent of its revenue.

|

|

VIDEO

|

|

Tim Koogle, chairman & CEO of Yahoo!, chats with CNNfn about how he plans to revive company's stock. Tim Koogle, chairman & CEO of Yahoo!, chats with CNNfn about how he plans to revive company's stock. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

"When industries go through consolidation cycles, those companies that have scale, that have leverage, that have good management and great financial strength can use it to their advantage," Koogle said. "We are doing that and we intend to take market share."

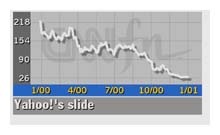

Yahoo! (YHOO: Research, Estimates) said after the close Wednesday that slowing advertising sales and weaker economic conditions will cause its first-quarter earnings to fall as much as 60 percent below what it reported in the same period last year. It would be the first time ever the Web portal has reported a negative quarter-to-quarter earnings comparison. For the full year, Yahoo! expects its earnings per share could be 42 percent below current analyst estimates. In Thursday morning trading, Yahoo! shares fell $5.25, or 17 percent, to $25.25.

For the full year 2001, Yahoo! expects revenue of $1.2 billion-to-$1.3 billion, with advertising accounting for 80 percent-to-85 percent of revenue and business services growing to 15 percent-to-20 percent. The revenue forecast as much as 15.5 percent lower than the current mean analyst revenue estimate of $1.42 billion.

For information on other Web stocks, click here

In his Market Call interview Thursday, Koogle indicated that the company's forecast may turn out to be too conservative. In fact, some securities analysts have issued revised earnings estimates that are higher than what Yahoo! guided after the close Wednesday.

"It's just prudent management to lay in some numbers that are conservative relative to the third party analysts' expectations out there," Koogle said. "If the analysts are right about the market growth being higher, then Yahoo! should benefit because we are investing to build market share."

Koogle also noted that in the fourth quarter, the company was highly profitable, had a strong balance sheet, and finished with 180 million unique users of its site. [284KB WAV, 284KB AIF]

The Yahoo! chief said that the company will continue to make acquisitions of other Web properties. Yahoo! acquired eGroups in June 2000, Broadcast.com in July 1999, and GeoCities in January 1999.

"We have been acquisitive, and we will continue to be acquisitive - you can count on that," Koogle said. "We will be selective; there are some companies that could benefit from partnership with us."

Reduce dependence on advertising

Yahoo! is trying to reduce its dependence on advertising, especially advertising from financially weak dot.coms, by broadening its commerce partnerships and fee-based services. It wants to double its revenue from business services from about $110 million in 2000 to $212 million this year. If it hits that target, those services would account for 15-to-20 percent of total revenue.

"Consumers are signaling to us that we have become increasingly essential to their lives," Koogle said. "They are also signaling to us that they would be willing to pay for some premium services that we launch across our network." "Consumers are signaling to us that we have become increasingly essential to their lives," Koogle said. "They are also signaling to us that they would be willing to pay for some premium services that we launch across our network."

The Web portal plans to unveil fee-based services in personal finance, commerce, and digital entertainment over the coming year. Yahoo! recently announced that it will charge fees for listing items on Yahoo! Auctions, which competes with eBay (EBAY: Research, Estimates). However, unlike eBay, Yahoo! still doesn't charge a fee based on the final selling price of items sold on its auction site. Yahoo! Auctions now has about 1.5 million items listed in the United States, although that number is expected to drop dramatically when listing fees are imposed.

Last June, Yahoo! announced plans to build corporate intranet portals. Corporate Yahoo! allows businesses to integrate proprietary corporate information with the features of My Yahoo! Companies pay Yahoo! a licensing fee and per seat charges for this service.

Lehman's Becker is skeptical

While Koogle was upbeat about his company's outlook, Lehman Brothers analyst Holly Becker issued a research note Thursday that gave a pessimistic outlook for the portal. Becker is skeptical that Yahoo! can diversify its revenue base as quickly as it plans, and she said the effectiveness of online advertising remains in question.

"Even after a 90 percent decline, we still think the stock is expensive, trading at 91 times 2001 earnings per share and 45 times earnings before interest, taxes, depreciation and amortization," Becker wrote. She estimates that Yahoo! shares are worth $18.

"Thus far, Yahoo! has had limited success in diversifying its revenue base beyond advertising, which continues to hover in the 90 percent range," Becker wrote.

The Lehman analyst said that prices for online advertising remain high, especially when compared to traditional media. Yahoo! only began catering its advertising sales towards the needs of traditional companies about six months ago, she said.

"While they have made impressive progress, we believe that the sales cycle can be as long as two years given the inertia inherent in many large marketing organizations," Becker wrote.

Prudential Securities analyst Mark Rowen also has a negative outlook on Yahoo! On Thursday he lowered his rating on the stock to "hold" from "strong buy" and slashed his price target to $20 from $90.

"With 2001 revenue growth rates now expected to be in a range of 9 to 18 percent and earnings per share growth expected to be negative 12 to 33 percent, we believe Yahoo!'s price-earnings multiple will contract until the company is able to demonstrate significantly higher growth rates," Rowen said in a research note.

|

|

|

|

|

|

|