|

Core PPI, retail sales rise

|

|

January 12, 2001: 11:41 a.m. ET

December prices ex-food and energy rise 0.3%; retail sales gain 0.1%

|

NEW YORK (CNNfn) - Both retail sales and core wholesale prices rose in December, government reports released Friday showed, two signs for investors that the U.S. economy may not be hurtling toward recession and that the Federal Reserve may not lower interest rates as aggressively as expected.

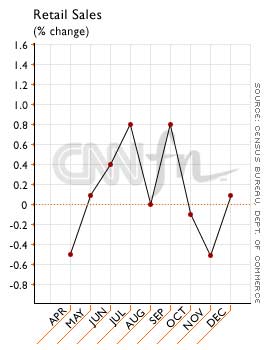

Retail sales edged up 0.1 percent in December, well above the revised 0.5 percent drop registered the month before and the 0.5 percent decline expected by analysts polled by Briefing.com. Excluding autos, sales were unchanged after falling 0.2 percent in November. Retail sales edged up 0.1 percent in December, well above the revised 0.5 percent drop registered the month before and the 0.5 percent decline expected by analysts polled by Briefing.com. Excluding autos, sales were unchanged after falling 0.2 percent in November.

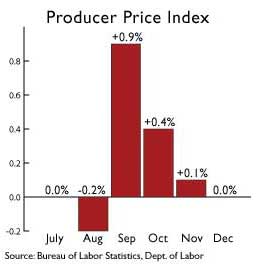

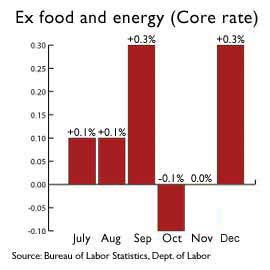

Separately, the Labor Department reported that overall wholesale prices were unchanged last month, countering expectations of a 0.1 percent rise. The "core" rate of inflation, however, which excludes food and energy costs, gained 0.3 percent, higher than the 0.1 percent gain expected. The core index rose 1.2 percent last year, compared with a 1.9 percent increase in 1999. The overall index rose 2.9 percent in 1999.

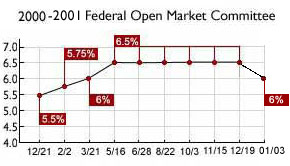

Together, the reports showed that while the U.S. economy is slowing, it may not be slowing as quickly as thought, a situation that may prompt policy makers at the Fed to think twice before cutting short-term interest rates again. The Fed lowered rates by a half-point to 6 percent in a surprise inter-meeting move Jan. 3.

Less certainty about the Fed

"Clearly, these headlines will assuage some of the fears of a consumer collapse, and they mean the Fed will wait till the meeting before easing again," said Ian Shepherdson, chief U.S. economist with High Frequency Economics. "We still look for at least a 25-basis-point easing on Jan. 31."

Stocks fell following the reports as investors expressed disappointment that the Fed may not lower rates as aggressively as first thought. Bond prices also declined as investors bet that faster inflation at the core level could erode the fixed value of their investments.

Wall Street currently expects the Fed to cut rates by as much as another half point at their Jan. 30-31 policy meeting. The implied yield on the February federal funds futures contract is currently 5.56 percent, almost a half percentage point below the current target. Wall Street currently expects the Fed to cut rates by as much as another half point at their Jan. 30-31 policy meeting. The implied yield on the February federal funds futures contract is currently 5.56 percent, almost a half percentage point below the current target.

However, today's reports led some investors to conclude that the Fed may hold off on taking more aggressive action at the end of the month.

"It raises the question as to how much of the slowdown was weather- and politically-related," said Tom Sowanick, global fixed income strategist with Merrill Lynch. "Maybe we're already starting to see the effects and the slowdown may not be as sharp as most had anticipated. It does calm the notion about recession."

No recession: Clinton

The numbers also came as President Bill Clinton unveiled the last economic report of his tenure, indicating that growth remains strong, inflation tame and that a soft landing, not a recession, looms on the horizon.

December's rise in retail sales was led by an unexpected 0.3 percent increase in purchases at auto dealers. Automaker statistics suggested sales at dealers would drop in December. General Motors Corp. (GM: Research, Estimates) and Ford Motor Co. (F: Research, Estimates) both reported that sales fell in December, pushing the annual pace of U.S. auto sales to 15.5 million, the slowest since November 1998.

Sales at clothing and accessory stores rose 0.9 percent in December after a 0.9 percent decline. Sales at food stores, including grocery stores, rose 0.8 percent in December after showing no change a month earlier. Sales at clothing and accessory stores rose 0.9 percent in December after a 0.9 percent decline. Sales at food stores, including grocery stores, rose 0.8 percent in December after showing no change a month earlier.

Sales at building materials, hardware, garden-supply and mobile home dealers fell 0.1 percent after falling 0.7 percent in November. Sales at restaurants and bars fell 0.4 percent in November after showing no change a month earlier.

Even with the unexpected increase, fourth-quarter retail sales were the weakest since 1990 -- an indication that consumer spending is faltering. For the year, retail sales gained 7.9 percent.

Prices remain subdued

"Although the retail sales report was not as weak as expected, it does not change the picture of slowing consumer spending growth, especially since the auto sales data do not reflect Detroit's reality," said John Ryding, senior economist with Bear Stearns.

On the inflation front, prices paid to factories, farms and other producers were unchanged in December as declining food, gasoline and oil costs outweighed soaring costs for natural gas. However, for all of last year, producer prices registered the largest increase in a decade.

Food prices fell 0.4 percent in December after rising 0.2 percent in November, reflecting lower costs for vegetables, poultry and pork. Energy prices fell 0.7 percent in December after rising 0.4 percent in November. Food prices fell 0.4 percent in December after rising 0.2 percent in November, reflecting lower costs for vegetables, poultry and pork. Energy prices fell 0.7 percent in December after rising 0.4 percent in November.

Prices of intermediate goods, including such items as lumber, flour, steel and paper boxes, rose 0.2 percent in December after falling 0.2 percent in November. Prices of intermediate goods excluding food and energy were unchanged after falling 0.1 percent the previous month.

Prices of crude goods, including such items as grains and livestock, crude oil and scrap metal, rose 8.7 percent in December after falling 2 percent in November. Crude goods prices excluding food and energy were unchanged after falling 2.3 percent.

|

|

|

|

|

|

|