|

Stocks slide on Wall St.

|

|

January 12, 2001: 4:41 p.m. ET

Investors opt to cash in gains ahead of the U.S. holiday weekend

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stocks fell Friday as investors sought to take money off the table ahead of a U.S. holiday weekend, against the backdrop of further economic uncertainty.

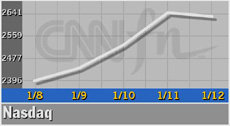

While money rotated away from "old economy" issues, the tech-heavy Nasdaq composite index didn't fare much better – swinging between a 2 percent gain and a 2 percent loss.

The sell-off sent the major indexes tumbling, although losses were tempered by the end of the day's trading session.

Earnings warnings from computer hardware makers Gateway and Dow Jones industrial average component Hewlett-Packard were shrugged off, but investors still hesitated to buy tech stocks with any conviction because of Monday's holiday. Earnings warnings from computer hardware makers Gateway and Dow Jones industrial average component Hewlett-Packard were shrugged off, but investors still hesitated to buy tech stocks with any conviction because of Monday's holiday.

"There's a little volatility on the downside ahead of the long weekend, so we're seeing money flowing out of the Dow and selectively going into the tech arena," said Peter Cardillo, director of research with Westfalia Investments. "Industrial stocks are not doing so well."

U.S. markets are closed Monday to commemorate the civil rights leader Martin Luther King Jr.

But it wasn't all bad news. Despite the day's modest losses, Nasdaq eked out a three-day gain this week, its first time since late August, and ended the week higher for the first time in more than a month, gaining 9 percent.

The Nasdaq fell 14.07 to 2,626.50. Since the start of the year, the composite has gained 5.9 percent.

And the Dow came back from triple-digit losses, losing only 84.17 points to 10,525.38. The blue chip closed the week down only 1.2 percent, while the S&P 500 shed 8.27 to 1,318.55 and ended the week with a 1.6 percent gain. And the Dow came back from triple-digit losses, losing only 84.17 points to 10,525.38. The blue chip closed the week down only 1.2 percent, while the S&P 500 shed 8.27 to 1,318.55 and ended the week with a 1.6 percent gain.

Market breadth was positive and volume was heavy. Advancers topped decliners on the New York Stock Exchange 1,463 to 1,401, as more than 1.26 billion shares changed hands. On the Nasdaq, winners outpaced losers 2,370 to 1,461, as more than 2.5 billion shares were traded.

In other markets, Treasury securities plunged amid interest rate concerns. The dollar was little changed against the euro but strengthened versus the yen.

Dow takes a tumble

As technology stocks continued to churn, the Dow took a hit from selling in many of its other issues, led by manufacturing stocks. The blue chip index may suffer further volatility next week, with 10 of its component companies due to report quarterly earnings.

DuPont (DD: Research, Estimates) fell $1.81 to $43.19, 3M (MMM: Research, Estimates) skidded $2.44 to $109.69, and United Technologies (UTX: Research, Estimates) plunged $3.19 to $70.69.

Financial stocks also were headed lower amid economic jitters. J.P. Morgan Chase (JPM: Research, Estimates) fell 81 cents to $53.31 and Citigroup (C: Research, Estimates) shed $1.88 to $53.13. Financial stocks also were headed lower amid economic jitters. J.P. Morgan Chase (JPM: Research, Estimates) fell 81 cents to $53.31 and Citigroup (C: Research, Estimates) shed $1.88 to $53.13.

"There's so much doubt out there ahead of this three-day weekend that many players are just selling into the market -- taking their cash and moving to the sidelines," said Alan Ackerman, senior vice president with Fahnestock & Co.

In the day's economic reports, wholesale prices were unchanged in December while retail sales rose 0.1 percent, according to government reports. But excluding food and energy, the "core" Producer Price Index rose 0.3 percent, which came in above Wall Street forecasts.

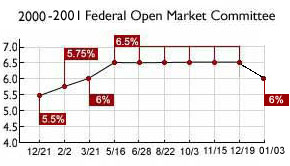

Friday's data sparked some concern that the Fed may not continue cutting interest rates. But analysts dismissed the concern, saying the Fed was more concerned with recession than inflation. Friday's data sparked some concern that the Fed may not continue cutting interest rates. But analysts dismissed the concern, saying the Fed was more concerned with recession than inflation.

Just last week, the Fed cut its rates by a half-percentage point and signaled it would cut rates further in a bid to give the economy a lift. Lower rates tend to spur spending by businesses and consumers, boosting economic growth and fattening corporate profits.

Gateway, Hewlett-Packard shrugged off

As bottom line warnings come into play, investors have been initially selling, only to return later in the session and snap up bargains.

"The market is going to shrug that off," said Art Hogan, chief market analyst at Jefferies & Co., about the cautionary tone. "We spent so much time pricing in so much bad news, we can actually move on now."

But the bearers of bad news were punished.

Gateway (GTW: Research, Estimates) fell $1.80 to $21.10 after saying that fourth-quarter earnings came in well below what analysts surveyed by First Call expected, and the computer maker warned that 2001 profit will be below expectations. As a result, the company is reducing its work force by more than 12 percent.

Hewlett-Packard (HWP: Research, Estimates) tumbled $1.69 to $30.69 after saying it will earn between 35 cents and 40 cents a share for the fiscal first quarter, ending this month, below the 42-cent consensus of analysts surveyed by First Call. Hewlett-Packard (HWP: Research, Estimates) tumbled $1.69 to $30.69 after saying it will earn between 35 cents and 40 cents a share for the fiscal first quarter, ending this month, below the 42-cent consensus of analysts surveyed by First Call.

Still, Frank La Salla, president of BNY Clearing International, told CNNfn's market coverage, that he expects to see more positive earnings surprises as the year progresses. (302K WAV) (302K AIFF)

Rambus (RMBS: Research, Estimates) plunged $3.94 to $44.94 after the computer-memory technology specialist reported a first-quarter profit that fell short of Wall Street's expectations -- partly because of a higher tax rate -- and warned about future royalty revenue from a type of memory chip.

Despite the warnings, other tech stocks made modest gains. IBM (IBM: Research, Estimates) gained 13 cents to $93.81, and Qualcomm (QCOM: Research, Estimates) rose $1.25 to $71.81.

Ariba (ARBA: Research, Estimates) fell $8.19 to $35.19 despite the business-to-business e-commerce software maker reporting fiscal first-quarter revenue and earnings that beat analysts' estimates, becoming the first "pure-play" B2B commerce company to report a profit.

The selling came after Ariba was downgraded by Deutsche Banc Alex. Brown, ABN Amro, SG Cowen, Wasserstein Perella, Robinson Humphrey and Friedman Billings.

There was at least one positive surprise in the technology sector. Internet ad company DoubleClick (DCLK: Research, Estimates) rose $3.44 to $14.69 after it broke even for the fourth quarter. Analysts expected a loss of about 2 cents a share. But DoubleClick forecast a loss of 7 cents-to-9 cents a share in the first quarter, a worse showing than the 6-cent loss originally projected, because of lower media revenue.

Stamp of approval for AOL Time Warner

America Online and Time Warner's newly completed marriage had little impact on investors, a day after federal regulators approved the groundbreaking merger following a year of wrangling over the future of competition in the Internet-related services arena.

Stock of the new company, named AOL Time Warner (AOL: Research, Estimates) and trading under the symbol "AOL," slid 87 cents to $46.36.

CNNfn is a unit of AOL Time Warner.

|

|

|

|

|

|

|