|

Here come the earnings

|

|

January 14, 2001: 7:00 a.m. ET

After months of waiting, the 4Q profit reports are here. But does anyone care?

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - They broke records. They broke hearts. And they are about to become breaking news.

But now that corporate America's worst batch of quarterly profits in more than two years is poised for release, Wall Street has moved on to something else.

"The bad earnings story is a thing of the past," said John Forelli, senior vice president at Independence Investment Advisors.

Thousands of companies in the weeks ahead post financial results for the final three months of 2000. A record number of them, more than 600, warned that those results will fall short of estimates, according to First Call.

No wonder profits among companies in the S&P 500 are expected to grow by a tepid 4.1 percent, said First Call, the worst quarter since the July-September period 1998, when earnings fell 3.1 percent.

But many analysts say the stock market, which has fallen steadily since Labor Day, has already priced in the worst news about corporate bottom lines.

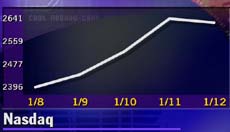

That appeared to be the case last week, a period when stocks mostly rose amid dozens of corporate warnings about financial shortfalls. The Nasdaq composite index rose 9 percent on the week while the S&P 500 gained 1.6 percent. The Dow Jones industrial average shed 1.2 percent over the last five sessions.

"Investors are starting to get the feeling that the Nasdaq has bottomed," Forelli said.

The most recent bottom of 2,291 hit on Jan. 2 does seem a long way away.

Forelli and others predict the worst may over for the riskier technology stocks which fell so sharply last year. He's betting on the economy accerating amid expectations that the Federal Reserve will cut interest rates in two weeks for the second time in a month.

The Nasdaq last week posted its first three-day gain since early September. The Nasdaq last week posted its first three-day gain since early September.

"I think were heading into next week with a head of steam we haven't seen for some time," said Charles Payne, head analyst at Wall Street Strategies.

Ned Riley, chief investments strategist at State Street Global Advisors, has been avoiding technology stocks for the past year. But he's warming up to companies such as Dell Computer, Intel and Microsoft whose valuations have come down sharply.

"Investors are starting to exercise one of the golden rules of investing," said Riley. "And that's buying when the news is the bleakest."

The news may not be that bleak for Sun Microsystems.

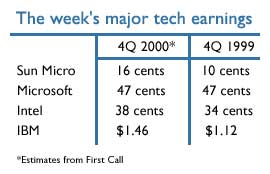

Sun Microsystems (SUNW: Research, Estimates), which makes computer and networking equipment, is seen posting profits of 16 cent per share, according to the consensus estimate of analysts surveyed by First Call, a 60 percent gain above the 10 cents per share last year.

Profits at Intel (INTC: Research, Estimates) are seen growing to 38 cents per share, up from 34 cents in the same quarter of 1999.

Earnings at IBM (IBM: Research, Estimates) are expected to come in at $1.46 per share, a gain from the $1.12 per share last year.

But profit at Microsoft (MSFT: Research, Estimates) should be flat, at 47 cents per share, if analysts' forecasts are correct.

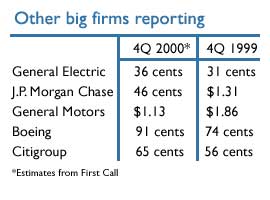

Citigroup (C: Research, Estimates) is expected to earn 65 cents per share, above the 56 cents in the year-ago period. Citigroup (C: Research, Estimates) is expected to earn 65 cents per share, above the 56 cents in the year-ago period.

But profits at the newly merged J.P. Morgan Chase (JPM: Research, Estimates) should fall. The company is expected to earn 45 cents per share, well below the $1.31 in the same quarter last year.

Analysts see Boeing (BA: Research, Estimates) posting earnings per share of 91 cents. That's after earning 74 cents in the quarter last year.

Car sales have fallen as the economy slows. Accordingly, General Motors (GM: Research, Estimates) is seen posting profits of $1.13, down from $1.86 per share in the year-ago period.

Caterpillar's (CAT: Research, Estimates) profits are expected to fall to 64 cents per shares from 67 cents in the same quarter of 1999.

But General Electric (GE: Research, Estimates), known for beating estimates, is seen recording a 36 cents per share profit, above the 31 cents last year.

Chuck Hill, director of research at First Call issued a reminder that even in this week of reports, all the fourth quarter profit warnings are not yet over.

"I don't think were through with the confession season yet," Hill told CNNfn's in the Money.

Inflation figures ahead

The week brings only a handful of significant economic indicators.

Among them, the Consumer Price Index, after rising 0.2 percent in November, is seen posting an identical gain in December, according to analysts surveyed by Briefing.com. The rise would continue a trend of modest advances for inflation.

And December housing starts, after coming in at an 1.562 million annual rate in November, are expected to slow to a 1.5 million annual pace.

Rather than economic indicators, Wall Street may pay closer attention to oil with an OPEC meeting in Vienna on Wednesday to set production policy. Oil prices traded in the $29 dollar range last week, above the $25 dollar range of late last year but l below the $37 hit during the fall. Rather than economic indicators, Wall Street may pay closer attention to oil with an OPEC meeting in Vienna on Wednesday to set production policy. Oil prices traded in the $29 dollar range last week, above the $25 dollar range of late last year but l below the $37 hit during the fall.

The 11 nation cartel, which produces about 40 percent of the world's oil, is expected to cut production by about 1.5 million barrels per day to keep prices from falling. But officials in the U.S. Energy Department, worried that steeper prices could harm an already slowing economy, are expected to pressure OPEC to keep production cuts small.

OPEC, whose member economies depend on oil, faces a delicate task. If prices rise too high, demand for the economically important commodity could falter, hurting a big source of OPEC countries' profits.

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|