|

OPEC cuts output 5%

|

|

January 17, 2001: 11:09 a.m. ET

Ministers agree to trim production 1.5 million barrels a day, as expected

|

LONDON (CNNfn) - OPEC officials agreed at a meeting in Vienna Wednesday to lower oil output by 5 percent, or 1.5 million barrels per day.

Ministers backed a proposal from Saudi Arabia to lower output for the 10 members to 25.2 million barrels a day, Reuters reported.

"This agreement will keep oil prices stable and not harm producers or consumers," Reuters quoted Libya's OPEC representative Ahmed Abdulkarim as saying.

Higher crude prices eventually will lead to higher prices at the pump for consumers. A spokesman for British oil company BP (BP-) told CNNfn.com that prices for drivers have been coming down from their November peak, but "pump prices reflect the international price of petrol," so costs likely will increase.

U.S. Energy Secretary Bill Richardson called OPEC's decision "disappointing."

"As both the United States and the European Union expressed, we remain concerned that any cut in production has the potential to lower stock levels and contribute to volatility in the market," Richardson said Wednesday.

Richardson, who is stepping down from his post, urged his successor to "act quickly to meet" with OPEC ministers.

High fuel prices caused an unprecedented show of public dissent in Europe, particularly Britain, last year, with blockades by disgruntled truckers and farmers causing tremendous disruption across the continent.

OPEC secretary general Ali Rodriguez-Araque of Venezuela said he thought the cartel could cut another 1 million barrels per day at its next meeting in March, Reuters reported.

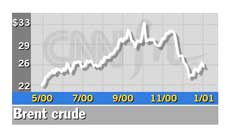

Brent crude futures for March delivery was down 37 cents to $25.15 in afternoon trading on the International Petroleum Exchange in London Wednesday.

Some more hawkish OPEC members, such as Iran, had demanded a 2 million barrel cut.

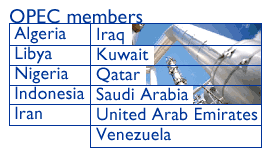

The output cuts by the 11-nation cartel, which accounts for 40 percent of global oil production, come despite a recent bid by Richardson and European officials to moderate the size of a reduction. The output cuts by the 11-nation cartel, which accounts for 40 percent of global oil production, come despite a recent bid by Richardson and European officials to moderate the size of a reduction.

Richardson is concerned that higher crude oil prices will lead to inflationary pressures and curb growth at a time the U.S. economy, the world's largest, is showing signs of slowing down.

Crude oil prices have been extremely volatile over the past two years, swinging from just below $10 per barrel to more than $34.

The fluctuations have kept OPEC very busy. The cartel boosted production four times last year, attempting to rein in the galloping price.

High oil prices have raised fears of inflation in the western world and caused concern the global economy could be blown off course. The situation has reversed itself in recent months, with OPEC members fearing a glut of oil could send prices sharply lower. High oil prices have raised fears of inflation in the western world and caused concern the global economy could be blown off course. The situation has reversed itself in recent months, with OPEC members fearing a glut of oil could send prices sharply lower.

Normally, the cartel meets just twice a year, in March and September, but the rapid switches in the market have forced it into a series of extraordinary meetings to discuss the state of the market.

OPEC's aim is to keep the price of a basket of its crudes between $22 and $28. The basket price was $24.59 Tuesday.

The agreement reached at the Vienna meeting will not apply to Iraq, the cartel's third-biggest producer, which is subject to United Nation sanctions that were imposed after its invasion of Kuwait.

-- from staff and wire reports

|

|

|

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|