|

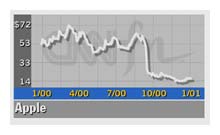

Apple falls short

|

|

January 17, 2001: 5:59 p.m. ET

Computer maker's quarterly loss, first in three years, is deeper than expected

|

NEW YORK (CNNfn) - A huge revenue shortfall in last year's holiday season caused Apple Computer to record its first quarterly loss in three years -- a loss that was deeper than analysts had expected following an earnings warning from the company last month.

After the close Wednesday, Apple (AAPL: Research, Estimates) reported a fiscal first-quarter net loss of $247 million, or 73 cents per share, versus net income of $123 million, or 78 cents, in the same period last year. The results for both periods don't include gains from asset sales or accounting changes. The mean analyst estimate for this year's first quarter was a loss of 65 cents per share, according to First Call/Thomson Financial.

Apple's revenue plunged 57 percent to $1 billion from $2.34 billion in last year's first quarter. The company's revenue was even with what analysts had forecast, according to First Call.

Apple ended last year with about 11 weeks worth of inventory – much more than its normal level. The company said Wednesday that it had reduced that inventory level to a normal five-and-a-half weeks using rebates and other forms of promotion.

"We took our medicine last quarter and brought our channel inventories back down to about five and a half weeks," said Steve Jobs, Apple's CEO, in a statement. "We're starting this year with a bang -- shipping our new PowerBook G4 in January, our new 733 MHz Power Mac G4 in February, and Mac OS X in March." Mac OS X is the company's new operating system, which has been long-awaited by Apple fans.

"Our cash position remains very strong at over $4 billion, and we are planning a return to sustained profitability beginning this quarter," said Fred Anderson, Apple's CFO.

On a conference call with analysts, Anderson said that Apple expects "a slight profit" in the March quarter and revenue of about $6 billion for all of fiscal 2001, which ends Sept. 30 The revenue projection matches analysts' current forecast for the fiscal year.

December earnings warning

Last month, Apple announced that it had experienced significantly slower-than-expected sales during October and November. The company said at the time that it expected to report revenue of about $1 billion and a net loss, excluding investment gains, of between $225 million and $250 million. Before that bombshell, analysts had expected Apple to report a profit of about $10 million, or 3 cents per share, on revenue of about $1.6 billion in the fiscal first quarter ending Dec. 30.

In a conference call with analysts last month, Apple placed much of the blame for the revenue shortfall on its own strategic errors. Apple CEO Steve Jobs said that the company's machines face a "megahertz gap" with their competitors, a problem it has since addressed by introducing models with faster processors.

Apple also has slipped to number two in education sales behind Dell Computer (DELL: Research, Estimates). The education market used to be an unquestioned stronghold for Apple. Sales of the Power Mac G4 Cube -- which Apple calls "a supercomputer miraculously engineered into an eight-inch cube, suspended in a stunning crystal-clear enclosure" – have been far below what the company had planned for initially.

Apple also suffered because none of its machines came with writable CD-ROM drives. Those drives are popular with users who like to create their own CDs of music downloaded from the Web. The company addressed this shortcoming at its Macworld Expo last week by announcing that all of its new Power Macs will come with writable drives. With Apple's new iTunes software, Power Mac G4 users will be able to burn their own standard audio CDs.

In the fiscal first quarter, Apple's sales of iMacs plunged 46 percent to 308,000 units, Power Mac G4 Cube sales dove 73 percent to 29,000 units, and Power Mac G4 sales plummeted 36 percent to 173,000 units. Apple ended the quarter with about $4 billion in cash and investments, equal to about $12 per share.

|

|

|

|

|

|

|