NEW YORK (CNNfn) - The Nasdaq composite index rallied to its highest levels in more than a month Thursday as investors optimistic about strong earnings snapped up Sun Microsystems and Microsoft ahead of their quarterly profit reports.

If IBM is any guide, optimism was justified. The world's biggest technology company late Wednesday issued upbeat growth forecasts after topping fourth-quarter profit and sales forecasts.

Thursday's technology gains, which lifted the Dow Jones industrial average, handed the Nasdaq a double-digit advance for the year. That's a big turnaround from 2000, when the index suffered its worst year in history. Thursday's technology gains, which lifted the Dow Jones industrial average, handed the Nasdaq a double-digit advance for the year. That's a big turnaround from 2000, when the index suffered its worst year in history.

"I really think the worst is over," Brian Finnerty, head of Nasdaq trading at C.E. Unterberg Towbin, told CNNfn's market coverage. "And IBM is the critical reason."

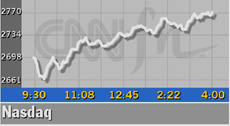

The Nasdaq rose 85.71 points, or 3.2 percent, to 2,768.49, its second straight advance. Thursday marks the Nasdaq's highest close since Dec. 13, when the index finished at 2,822.77.

But Friday brings a bigger test. If the Nasdaq closes higher that day, it would be only the second three-session gain for the index since early September.

"The issue here is: Is this a sucker's rally," Timothy Ghirskey, senior equity portfolio manager at Dreyfus Corp told CNN's Street Sweep.

The Dow gained 93.94, or nearly 1 percent, to 10,678.28, lifted by IBM. And the S&P 500 advanced 18.50, or 1.4 percent, to 1,347.97. The Dow gained 93.94, or nearly 1 percent, to 10,678.28, lifted by IBM. And the S&P 500 advanced 18.50, or 1.4 percent, to 1,347.97.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,627 to 1,290, on volume of 1.3 billion shares. Nasdaq winners beat losers 2,187 to 1,748, as 2.5 billion shares changed hands.

In other markets, Treasury securities gained. The dollar fell against the euro and yen.

Sun shines, Microsoft up

Sun Microsystems (SUNW: Research, Estimates) rose $2.50 to $34.88 ahead of its December quarter earnings report. After the close of trading, Sun ultimately posting a profit of 16 cents per share, meeting forecasts.

Microsoft (MSFT: Research, Estimates) jumped $2.56 to $55.50. The software maker later said its quarterly earnings were 47 cents per shares, also matching estimates.

But no large company gained more than IBM (IBM: Research, Estimates). Its shares surged $11.63, or 12 percent, to $108.31 after the company said fourth quarter profit rose to $1.48 per share from $1.12 in the year-earlier period, beating forecasts by two cents. But no large company gained more than IBM (IBM: Research, Estimates). Its shares surged $11.63, or 12 percent, to $108.31 after the company said fourth quarter profit rose to $1.48 per share from $1.12 in the year-earlier period, beating forecasts by two cents.

Perhaps more important, the biggest technology company in terms of revenue also said it was comfortable meeting Wall Street's forecasts going forward, bucking a trend.

"They have positives in their business," C.E. Unterberg Towbin's Finnerty said. "It tells us we're not seeing a disaster in the computer market."

Hewlett-Packard, Intel, Motorola and Lucent Technologies have all warned recently that profit or sales would disappoint investors.

But John Forelli, senior vice president and portfolio manager at Independence Investment Associates, says the worst news about earnings growth may be over.

Forelli expects double-digit gains for the market this year. "Tech stock were way oversold," Forelli said. "Now they look more attractive."

Apple Computer (AAPL: Research, Estimates) attracted buyers Thursday, rising $1.88 to $18.69. While the computer maker posted a wider-than-expected loss of $247 million last quarter, it also forecast a return to profitability this quarter.

Click here for a more comprehensive look at the day's earnings.

But Caterpillar (CAT: Research, Estimates) tumbled $2.88 to $41.75 after the heavy equipment maker said this year's earnings will decline 5 percent to 10 percent. In its quarterly earnings report, Caterpillar posted profit of 76 cents per share for the fourth quarter, ahead of expectations for earnings of 64 cents per share.

Ford Motor (F: Research, Estimates) rose 31 cents to $27.19 even after the carmaker said fourth-quarter profit dropped to $1.2 billion, or 64 cents per diluted share, matching forecasts. Income dropped from $1.8 billion, or 83 cents a share; the report came a day after General Motors also said earnings fell in the latest quarter.

More evidence emerged Thursday that the economy is cooling. A closely watched manufacturing survey conducted by the Federal Reserve Bank of Philadelphia slid this month to its lowest level in 10 years.

Separately, jobless claims fell last week and housing starts edged higher in December. But the Philadelphia index's drop to minus 36.8 from minus 4.2 is more aligned with a batch of other indicators on corporate hiring, consumer spending and industrial output that suggest the economy's best days are behind it.

The Philadelphia Fed numbers, said Tony Crescenzi, bond analyst at Miller Tabak & Co., "point to recession in both the manufacturing sector and the general economy." The Philadelphia Fed numbers, said Tony Crescenzi, bond analyst at Miller Tabak & Co., "point to recession in both the manufacturing sector and the general economy."

To reverse this trend, investors expect the Federal Reserve to cut interest rates by at least a quarter percentage point when its policy makers meet Jan. 30-31.

In an unusual move, the central bank slashed interest rates Jan. 3 by a half percentage point. And stocks appear to have responded. The Nasdaq is up 12 percent this year while the S&P 500, a broader market index, has advanced 2 percent. Only the Dow is lower, off 1 percent during the nearly three-week period.

Jon Burnham, chairman and CEO of Burnham Securities, told CNNfn's Talking Stocks that he sees more gains ahead. (342K WAV) (342K AIFF).

For investors, that would be welcome. The Nasdaq tumbled nearly 40 percent in 2000 for its worst annual performance on record.

|