|

Energy crisis costs rise

|

|

January 19, 2001: 6:41 p.m. ET

Credit ratings hit; Feds order natural gas sales; state orders power stay on

|

NEW YORK (CNNfn) - California's energy crisis prompted orders Friday for out-of-state natural gas companies to sell gas to the state's nearly bankrupt utilities and for the utilities to continue to provide service to the 24 million customers they serve.

Meanwhile the continued default on bonds by the state's utilities and the state's effort to intervene prompted a new round of lowered credit ratings by Standard & Poors Friday.

The crisis has been prompted because the state's major utilities are caught between regulated retail electric rates and deregulated wholesale rates.

As of 3 p.m. PT (6 p.m. ET), the state had avoided a third day of rolling blackouts caused by energy shortages, although officials with the California Independent System Operator, the state's power manager, said such blackouts could not be ruled out before the end of the day.

Gas sales ordered

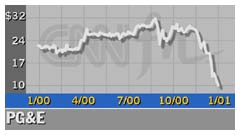

U.S. Energy Secretary Bill Richardson issued an order Friday requiring suppliers to sell fuel to PG&E (PCG: Research, Estimates), the state's largest utility, which warned Thursday that its supply of the fuel could run out in early February because suppliers were balking at providing more gas, fearing a bankruptcy.

Gas is not directly involved in the current energy crisis, which revolves around electric deregulation. But PG&E sells both gas and electricity which it purchases on a wholesale basis to its customers, and the gas providers are concerned that a bankruptcy would leave them on the hook for unpaid gas sales to the utility. Gas is not directly involved in the current energy crisis, which revolves around electric deregulation. But PG&E sells both gas and electricity which it purchases on a wholesale basis to its customers, and the gas providers are concerned that a bankruptcy would leave them on the hook for unpaid gas sales to the utility.

"The president has directed me to initiate the order," said Richardson. "There will be enforcement action if the order is not carried out."

The order stays in effect through 3 a.m. ET Wednesday, when the new Bush Administration will be in power. Richardson told reporters Friday that he has briefed Spencer Abraham, who has been nominated to succeed him, on the crisis.

"They are ready to act," Richardson said, though he declined to elaborate. Abraham is expected to be confirmed soon by the Senate, perhaps as soon as this weekend. He did not give details of what actions he or the new administration might take when questioned at his confirmation hearing earlier this week.

Bush advisor says Feds should keep hands off

An energy executive who has served as an advisor to Bush told reporters Friday that he believes the federal government should act in an advisory manner, and not intervene in the crisis directly.

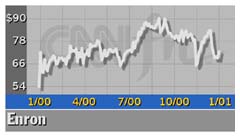

A proposal to cap prices for wholesale electricity in the West in hopes of easing California's power crisis "would start spreading the shortage around" to other states, said Ken Lay, chairman of Enron Corp. (ENE: Research, Estimates), and an adviser to the incoming Bush administration said on Friday.

"That is not even a short-term solution," said Lay.

Enron is the largest power marketer in the United States, and a cap would limit the prices it and other wholesalers could charge to utilities.

Click here to read CNN.com's coverage of the Calif. Energy crisis

Lay told reporters the federal government should limit itself to an advisory role, letting California leaders resolve a "pretty much self-inflicted problem." Wholesale power prices were deregulated under the landmark 1996 law but retail rates were not.

In the short term, Lay said, the state government will have to "buy the power to fill the short positions of the utilities." The longer-term solution will probably include longer-running contracts to take advantage of electric prices that are expected to fall later this year. In the short term, Lay said, the state government will have to "buy the power to fill the short positions of the utilities." The longer-term solution will probably include longer-running contracts to take advantage of electric prices that are expected to fall later this year.

"The biggest problem in California is consumers are not going to see the price signals. If they don't see the price signals, they are not changing behavior so the problem is going to get worse," Lay said.

Utilities attack state order

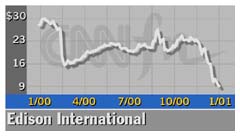

The California Public Utility Commission met in emergency session Friday and voted two-to-one for a temporary restraining order preventing Southern California Edison and PG&E from refusing to provide adequate service. The commission cited concerns that recent actions by the two utilities could severely undermine their legal service obligations.

The utilities denounced the action, calling it "an insult" to their employees and a publicity stunt.

"SCE has borrowed billions of dollars, which threatens the company's solvency, through eight and a half months of inaction and delay by the CPUC, in order to continue to serve its customers," said a statement from John Bryson, CEO of Edison International (EIX: Research, Estimates), the owner of SCE. "There was no reason for the CPUC to take this action, except for reasons of publicity. This decision undermines confidence in the fairness of the decision-making process at the CPUC."

Credit downgrades continue

Gov. Gray Davis Friday signed a $400 million emergency power purchase plan in another effort to keep the electricity flowing and prevent immediate utility bankruptcy.

Davis has set out a plan under which the state's Department of Water Resources will use the $400 million from the general fund to buy power on behalf of the utilities. But the move prompted credit rating agency Standard and Poors to place some of the state's debt on CreditWatch with negative implications.

"The CreditWatch placement results from uncertainties surrounding the ability of the state to fashion a long-term solution to its power supply crisis and the ensuing financial effect," said the rating agency.

"The possible necessity of continuing to purchase power on a long-term basis to avoid blackouts could substantially affect the state's currently ample general fund balance," continued S&P's statement. "While the state legislature's emergency appropriation on Jan. 17 of $400 million of general fund money to buy power does not in itself jeopardize the state's double-'A' GO credit rating, the potential exists for substantially greater ongoing appropriations.

Click here to track utility sector stocks

"Standard & Poor's believes there is currently no adequate funding source, absent rate hikes, other than the state to purchase enough power to avoid such blackouts," said the agency's statement. It pointed out that SCE and PG&E have lost about $2 billion a month since last summer.

S&P Friday also lowered its commercial paper rating on SCE to "D" from "C," which is already considered junk bond status, following the company's failure Thursday to redeem $32 million of maturing commercial paper. SCE also announced its intention to suspend payment on $223 million of commercial paper coming due between Friday and the end of January. But the rating agency raised the short-term corporate credit rating of Edison International to "C" from "D," in a move it termed a correction, S&P Friday also lowered its commercial paper rating on SCE to "D" from "C," which is already considered junk bond status, following the company's failure Thursday to redeem $32 million of maturing commercial paper. SCE also announced its intention to suspend payment on $223 million of commercial paper coming due between Friday and the end of January. But the rating agency raised the short-term corporate credit rating of Edison International to "C" from "D," in a move it termed a correction,

The SCE default came two days after PG&E also defaulted on short-term debt. The defaults on the utilities' commercial paper are only the third and fourth by U.S. companies in the last six years.

Much of their existing long-term debt trades at around 50 cents on the dollar, investors said, after trading at near face value before the crisis hit.

In addition, SCE said the California Power Exchange, which arranges the purchase of power in the state, plans to suspend the company's power-trading privileges. The exchange plans the same step against Pacific G&E.

Suspension would force the utilities to trade in the over-the-counter market, where they have no credit standing.

Earlier this week, SCE failed to make a $200 million principal and $6 million interest payment on 5.875 percent notes maturing this week, and missed about $24 million of interest payments on its 6.375 percent notes maturing in 2006 and its 7.625 percent notes maturing in 2010.

SCE and its parent said the missed principal payment put them in default of their bank credit lines, and that they are talking with their banks about a possible "limited waiver or forbearance" as to the default.

In trading Friday shares of PG&E gained 44 cents to $10.19, while shares of Edison International slipped 6 cents to $8.94.

-- from staff and wire reports

|

|

|

|

|

|

|