|

Wall St. focus on earnings

|

|

January 21, 2001: 7:00 a.m. ET

Investor confidence rising as corporate results signal better days ahead

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - One week down and two more to go before the major crux of corporate earnings reports are completed and analysts say investor confidence is rising.

U.S. stocks displayed resiliency last week as the earnings floodgates opened, as investors regained some optimism from many of the positive reports, especially in the technology sector.

"We got good reports from Microsoft, Sun Microsystems and Nortel with respect to the second half of the year so that's been pretty helpful," said Seth Martin, equities analyst with IDEAglobal.com.

| |

QUARTERLY REPORTS QUARTERLY REPORTS

|

|

| |

|

Click below for a complete list of companies reoporting this week

Corporate results

|

|

|

Earnings reports and the guidance that accompanies them will still be at the forefront this week but market sentiment that the Federal Reserve may continue its rate cuts when it meets at the end of the month will underpin the optimism

"Earnings will again be in focus this week," said Bryan Piskorowski, market analyst with Prudential Securities. "The idea is guidance going forward. At the same time, we endured four and a half months of downside going into this earnings period so the discounting has really taken hold."

Wall Street steps higher

Betting the worst may be nearing an end in the tech sector, investors started to return from the sidelines. "There are plenty more earnings to come but the market is getting a good idea of what the outlook really is for these major tech companies," said Martin. "Things are looking okay for the second half of this year."

| |

EARNINGS SCORECARD EARNINGS SCORECARD

|

|

| |

|

Click below to see how company results are faring

Corporate results

|

|

|

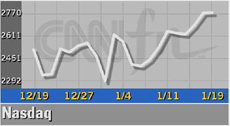

Last week, the tech-heavy Nasdaq composite index rose for three straight sessions to end the week 5.5 percent higher. Friday's modest 1.93 point gain to 2,770.42 marks the highest close since Dec. 13, when the index finished at 2,822.77.

The Dow fell 90.69 points to 10,587.59 but the blue chip index eked out a modes gain for the week, rising 0.6 percent. The S&P slid 5.42 to 1,342.55 Friday and gained 1.8 percent for the week. The Dow fell 90.69 points to 10,587.59 but the blue chip index eked out a modes gain for the week, rising 0.6 percent. The S&P slid 5.42 to 1,342.55 Friday and gained 1.8 percent for the week.

John Burnham, chairman and CEO of Burnham Securities, told CNNfn's "Talking Stocks" that the markets are poised to continue moving higher. (342K WAV) (342K AIFF)

Earnings roll on

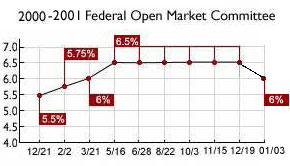

Analysts still expect some churning as quarterly results continue to be reported. And adding to the mix is the Federal Reserve's monetary policy meeting January 30-31 which is tempering investor enthusiasm.

"It's a pull and tug – on the front burner we have earnings and on the back burner we have the potential for a stronger economy in the second half (of the year)," said Prudential's Piskorowski. "That's what the market's dealing with."

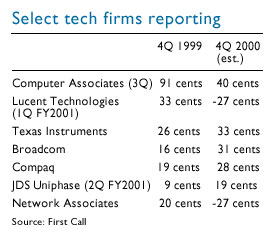

The steady pace of earnings will continue in the days ahead. Tech companies from Texas Instruments (TXN: Research, Estimates) to Lucent Technologies (LU: Research, Estimates) and JDS Uniphase (JDSU: Research, Estimates) are all reporting results for the December quarter. The steady pace of earnings will continue in the days ahead. Tech companies from Texas Instruments (TXN: Research, Estimates) to Lucent Technologies (LU: Research, Estimates) and JDS Uniphase (JDSU: Research, Estimates) are all reporting results for the December quarter.

Last week's results from IBM (IBM: Research, Estimates) and Microsoft (MSFT: Research, Estimates) gave the tech sector a well-needed boost.

"I really think the worst is over," Brian Finnerty, head of Nasdaq trading at C.E. Unterberg Towbin, told CNNfn's market coverage. "And IBM is the critical reason."

The positive results are setting the stage for buying interest to grow in the tech sector – one which has been struggling since the end of summer.

"We're looking for some sustained gains for tech stocks early in the week but there's going to be some value in the "old economy" stocks toward the end of next week," said IDEAglobal's Martin.

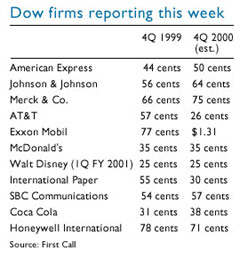

And it will be another big week for Dow companies with 11 firms posting results including AT&T (T: Research, Estimates), American Express (AXP: Research, Estimates) and Exxon Mobil (XOM: Research, Estimates). And it will be another big week for Dow companies with 11 firms posting results including AT&T (T: Research, Estimates), American Express (AXP: Research, Estimates) and Exxon Mobil (XOM: Research, Estimates).

Still, expectations for profit growth in the S&P 500 companies is expected to grow only 4.1 percent, according to First Call. That would make it the worst quarter since the third quarter of 1998, when earnings fell 3.1 percent.

ECI on tap

With the Fed meeting less than two weeks away, investors will have some economic data to chew on this week.

"We're not getting a tremendous amount of economic data so the market will be waiting for the Fed, the week after," said IDEAglobal's Martin. "My feeling is there will be some people waiting on the sidelines until they hear from the Fed."

While the economic calendar is light, the employment cost index (ECI) for the fourth quarter, said to be a favorite inflation indicator of Fed Chairman Alan Greenspan's, comes Thursday.

"It's one of the truest gauges of wage inflation," said Piskorowski. "It's one of the truest gauges of wage inflation," said Piskorowski.

According to analysts polled by Briefing.com, the ECI is expected to rise to 1.1 percent from 0.9 percent in the third quarter.

Analysts said investors were showing increased confidence that the Fed will step in and continue to temper the economy if warranted.

"We're sensing that there aren't totally clear signs that a recession is in place but there is some negative pressure in the economy," said Martin. "It's all really dependent on whether or not we get the interest rate cuts that can stimulate the economy, looking out six months or so."

At the start of the year, the Fed surprised the market by cutting its rates by a half percentage point and signaling it would cut rates further in a bid to give the economy a lift. Lower rates tend to spur spending by businesses and consumers, boosting economic growth and fattening corporate profits. At the start of the year, the Fed surprised the market by cutting its rates by a half percentage point and signaling it would cut rates further in a bid to give the economy a lift. Lower rates tend to spur spending by businesses and consumers, boosting economic growth and fattening corporate profits.

"With the Fed back on our side, we're optimistic for the first time in a while. We're seeing more broad based buying and there's a place in portfolios for defensive names as well as offensive names," said Prudential's Piskorowski.

Investors may gain some insight as to how friendly the Fed really is when Greenspan testifies about the economy to a Senate panel Thursday, just six days ahead of its monetary policy-making meeting.

|

|

|

|

|

|

|