|

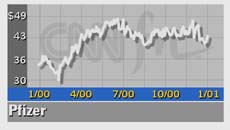

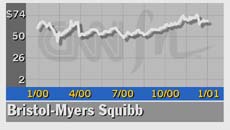

Pfizer, Bristol post gains

|

|

January 24, 2001: 2:02 p.m. ET

Pfizer projects 25% profit growth through 2002; Bristol drug fails trial

|

NEW YORK (CNNfn) - Pfizer Inc., the largest U.S. drugmaker, posted a 20 percent increase in fourth-quarter earnings Wednesday on rising sales of cholesterol treatment Lipitor and other drugs, while Bristol-Myers Squibb Co. reported a 10.5 percent quarterly profit gain.

The results come a day after pharmaceutical heavyweights Merck & Co. Inc. (MRK: Research, Estimates) and Johnson & Johnson (JNJ: Research, Estimates) also reported double-digit earnings gains for the quarter.

New York-based Pfizer earned $1.76 billion, or 27 cents per diluted share, for the three months, up from $1.47 billion, or 23 cents per share, in the corresponding period in 1999. The results exclude special items and one-time costs associated with the company's acquisition of Warner-Lambert Co. last year.

The results matched the First Call consensus estimate of analysts.

Including merger costs, net income fell 3 percent to $1.42 billion, or 23 cents per share, from $1.47 billion, or 23 cents per share, in the year-earlier period.

Click here for more on drug stocks

Total revenue rose 8 percent to $8.1 billion, including both pharmaceuticals and animal health products.

Sales of Lipitor rose 26 percent to $1.43 billion. Sales of heart drug Norvasc gained 15 percent to $928 billion. Sales of male impotence treatment Viagra, the company's best-known drug, rose 37 percent to $380 million.

Alliance revenue surged 63 percent to $348 million. The company has lucrative joint marketing arrangements with Pharmacia Corp. (PHA: Research, Estimates) for painkiller Celebrex and Aricept, an Alzheimer's disease medication developed by Japan's Eisai Co. Ltd.

However, the consumer product unit posted a 3 percent decline in sales, to $1.38 billion.

"2000 was truly an outstanding year for Pfizer," Chairman William C. Steere Jr. said. "With remarkable speed and focus, we have rapidly integrated the industry's two fastest-growing companies while more than doubling our initially forecast year 2000 merger savings to about $430 million." "2000 was truly an outstanding year for Pfizer," Chairman William C. Steere Jr. said. "With remarkable speed and focus, we have rapidly integrated the industry's two fastest-growing companies while more than doubling our initially forecast year 2000 merger savings to about $430 million."

For the full year, net income totaled $6.49 billion, an increase of 25 percent, or $1.02 per share.

The company said it anticipates 25 percent earnings growth through 2002. Revenue is projected to post a double-digit increase this year.

But Pfizer gave earnings guidance for full-year 2001 and 2002 that falls slightly short of analysts' consensus expectations. The company projects earnings of at least $1.27 per share this year, and $1.56 in 2002.

Analysts polled by earnings tracker First Call Corp. had expected earnings of $1.30 per share in 2001 and $1.59 per share in 2002.

Shares of Pfizer (PFE: Research, Estimates) edged up 6 cents to $42.94 at 4 p.m. ET Wednesday on the New York Stock Exchange.

Bristol beats forecast

Bristol-Myers Squibb (BMY: Research, Estimates) the third-largest U.S. pharmaceutical firm, exceeded analysts' forecasts for the fourth quarter by a penny per share.

But the company disclosed in a conference call with analysts that an experimental stroke treatment, Maxi-Post, failed a late-stage clinical trial.

The company plans to carry out another trial on the drug this year. According to some estimates, the drug could achieve sales of roughly $300 million.

The New York-based drugmaker earned $1.16 billion, or 59 cents per share, up from $1.05 billion, or 52 cents per share, in the 1999 period.

Sales rose 8 percent to $5.5 billion. Sales of Pravachol gained 11 percent to $502 million, while sales of diabetes treatment Glucophage rose 15 percent to $386 million.

As expected, sales of cancer drug Taxol declined following the loss of patent protection for the medication late last year. Taxol sales fell 9 percent to $377 million for the quarter, amid new competition from generic drug maker Ivax Corp. (IVX: Research, Estimates).

"Our strong focus on growth paid off with an array of achievements that brought critical medical advances to patients around the world while delivering excellent value to our shareholders," Chairman and CEO Charles A. Heimbold Jr. said. "Our strong focus on growth paid off with an array of achievements that brought critical medical advances to patients around the world while delivering excellent value to our shareholders," Chairman and CEO Charles A. Heimbold Jr. said.

The company announced in September that it planned to divest its Clairol beauty products and Zimmer medical devices businesses in an effort to focus on its core pharmaceuticals business.

Bristol-Myers stock fell $1.38 to $64.88 at Wednesday's close.

|

|

|

|

|

|

|