|

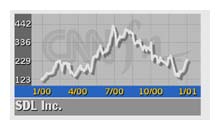

SDL beats by 4 cents

|

|

January 24, 2001: 5:10 p.m. ET

Optical networking gear maker sees profit zoom, JDS merger on tap for Feb.

|

NEW YORK (CNNfn) - SDL Inc., an optical networking components maker, beat Wall Street expectations by 4 cents Wednesday and announced that its pending merger with JDS Uniphase should close in February.

San Jose, Calif.-based SDL (SDLI: Research, Estimates) reported fourth quarter pro forma net income of $48.2 million, or 53 cents a diluted share, compared to $12.8 million or 17 cents a share for the same time period in 1999. Earnings tracker First Call had expected 49 cents a share.

Including expenses related to its merger with JDS Uniphase, also of San Jose, and other charges, SDL posted a net loss of $122.8 million, or $1.41 a share for the quarter.

Fourth quarter revenue tripled to $175.6 million from $58.7 million. Fourth quarter revenue tripled to $175.6 million from $58.7 million.

The JDS-SDL merger is now expected to close in February "because of the time required to complete the regulatory approval process," the companies said in a joint statement. Special stockholders meetings were pushed to Feb. 12 from Jan. 26.

In July, JDS Uniphase agreed to buy SDL in a $41 billion stock deal, swapping 3.8 of its shares for each SDL share. The deal was originally scheduled to close in late December but was delayed due to regulatory issues.

JDS (JDSU: Research, Estimates) said Wednesday that it has submitted to the U.S. Department of Justice a remedy to concerns raised by regulators.

An after hours drop

JDS plunged in after hours trading Wednesday, falling $3.44 to $59.62 on Instinet, while SDL dropped $13.16 to $218.97.

Anthony Muller, JDS's chief financial officer, blamed the drop on an announcement from Corning Inc., the world's leading supplier of fiber-optic cable. Corning (GLW: Research, Estimates) is expecting some softness in first quarter as telecommunications services providers work through "ongoing issues with capital availability."

"We believe the drop [in share price] is because of Corning," Muller said. "We and Corning are both in the fiber optic market."

Muller declined to comment on the solution submitted to the DOJ and expressed his confidence that the JDS-SDL merger will close in February.

"This is the second rescheduling of the stockholders meeting. But this time we announced a remedy and that is something that we have not said before," Muller said.

|

|

|

|

|

|

|