|

Rx firms match forecasts

|

|

January 25, 2001: 2:50 p.m. ET

AHP to take higher-than-expected charge; Eli Lilly, Schering Plough post gains

|

NEW YORK (CNNfn) - American Home Products Corp., the fifth largest U.S. drugmaker, reported a 17 percent increase in fourth-quarter earnings Thursday, but the company took a higher-than-expected charge related to the "fen-phen" diet-drug settlement. Eli Lilly and Co. and Schering Plough Corp. also posted quarterly gains.

Madison, N.J.-based AHP took a charge of $7.5 billion in the fourth quarter for the diet drug settlement, in addition to $4.75 billion in charges previously announced. The company said the charge should be the last one associated with the product liability case.

"Although it will cost more than we originally expected, we believe it is clearly in the best interest of AHP shareholders to resolve the diet drug litigation quickly," Chairman and CEO John R. Stafford said in a statement.

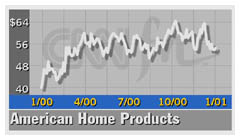

Investors were hearted by the news that uncertainty over the massive settlement may be over. AHP shares surged  $2.89, or 5 percent, to $57.64 at 4 p.m. ET on the New York Stock Exchange. $2.89, or 5 percent, to $57.64 at 4 p.m. ET on the New York Stock Exchange.

AHP (AHP: Research, Estimates) reached a settlement in late 1999 with former users of the diet drugs Pondimin or Redux, which were combined with an appetite suppressant called Phentermine to make the fen-phen cocktail. AHP recalled Pondimin and Redux in 1997 after some of the 6 million Americans who took the weight loss remedy developed heart problems, including leaky valves. Phentermine, which is made by another company, has not been linked to health problems.

Including the charge and other special items, the company posted a loss of $3.82 billion, or $2.91 for the fourth quarter, compared with income of $602.7 million, or 46 cents per share, in the year-earlier period.

Click here for more on the drug sector

Excluding charges, AHP earned $704.3 million, or 53 cents per share, in the October-December period. The results matched the First Call consensus estimate of analysts.

AHP, maker of female hormone replacement therapy Premarin, said pro forma revenue for the quarter rose 15 percent to $3.5 billion. The company credited the gains to sales of Prevnar, a vaccine that prevents bacterial diseases in children, antidepressant Effexor XR and other products.

Lilly's profit rises

Eli Lilly and Co., the eighth-largest U.S. drug company, earned $767 million, or 70 cents a share, up 14 percent from $671.7 million, or 61 cents per share, in the 1999 period.

The results matched the First Call estimate.

But net income dipped slightly when one-time gains in the year-earlier period are included. Net income for the 1999 fourth quarter totaled $786 million, or 71 cents per share.

The Indianapolis-based maker of antidepressant Prozac said sales rose 9 percent to $3 billion.

Lilly said it expects to report first-quarter earnings of 71-to-73 cents a share, versus an average forecast of 73 cents, according to First Call, which tracks Wall Street forecasts. Lilly said it expects to report first-quarter earnings of 71-to-73 cents a share, versus an average forecast of 73 cents, according to First Call, which tracks Wall Street forecasts.

For all of 2001, the company expects earnings of $2.75-to-$2.85 a share versus forecasts of $2.83. The 2001 forecast assumes the generic version of Prozac will become available this summer.

For all of 2000, the company reported net income of $3 billion, or $2.83 a share, up from $2.7 billion, or $2.50 a share, in 1999. Sales rose to $10.8 billion from $10 billion.

Click here to check drug stocks

Sales of Prozac and Sarafem, a form of Prozac used to treat severe pre-menstrual symptoms, increased 4 percent to $670 million in the quarter.

But Prozac sales outside the United States fell 40 percent to $83.7 million as prescriptions for generic versions in the United Kingdom grew.

During the quarter, the Food and Drug Administration extended the company's exclusive U.S. marketing rights for Prozac by six months beginning Feb. 2, when the original marketing agreement expires. Eli Lilly is appealing the decision, hoping to extend the agreement through 2003.

Sales of Zyprexa, a schizophrenia treatment, rose 22 percent to $695.8 million, becoming the company's best-selling product.

Shares of Eli Lilly (LLY: Research, Estimates) gained 31 cents to $83.06 at Thursday's close.

Claritin boosts Schering-Plough

Schering-Plough Corp., maker of blockbuster allergy treatment Claritin, reported a 13 percent increase in quarterly profit, in line with Wall Street forecasts.

The Kenilworth, N.J.-based drugmaker earned $571 million, or 39 cents a share, from $506 million, or 34 cents a share, in the 1999 period.

Sales rose 6 percent to $2.4 billion. Claritin sales jumped 15 percent to $662 million. Sales rose 6 percent to $2.4 billion. Claritin sales jumped 15 percent to $662 million.

Shares of Schering-Plough (SGP: Research, Estimates) finished the day up $1.69 at $53.63.

|

|

|

|

|

|

|