|

Nasdaq dives 3%

|

|

January 25, 2001: 4:43 p.m. ET

Corning guidance renews concern about tech growth as money moves to Dow

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Nasdaq composite index plunged more than three percent Thursday after revenue caution from fiber-optics maker Corning sparked broad selling among U.S. tech stocks.

The index has been chugging higher during the past week amid strong profit reports, and is still up around 11 percent from the start of the year. So analysts said it is not surprising to see some money move out of the tech-heavy index.

"The Nasdaq, which is largely driven by tech stocks, has soared 24 percent in the past three-week period, so today we're seeing some profit-taking as the market is refreshing," said Al Goldman, chief market strategist with A.G. Edwards. "The Nasdaq, which is largely driven by tech stocks, has soared 24 percent in the past three-week period, so today we're seeing some profit-taking as the market is refreshing," said Al Goldman, chief market strategist with A.G. Edwards.

But it wasn't just profit-taking that pushed money out of the tech sector and into the blue chips. Money rotated into the cyclical issues as investors reacted to Federal Reserve Chairman Alan Greenspan's modest endorsement of tax cuts.

Greenspan said nothing specifically about interest rates in his testimony on fiscal challenges before the Senate Budget Committee. But his comment that the U.S. economic slowdown has reduced growth "very close to zero" raised concerns that tax cuts may limit the pace of possible interest rate cuts.

"Greenspan's comments did little to build confidence," said Alan Ackerman, senior vice president of Fahnestock & Co. "The main catalyst today was to back away from risk and try to buy a bit of stability."

The Nasdaq composite index fell 104.87, or 3.67 percent, to 2,754.28. The Dow Jones industrial average rose 82.55 to 10,729.52 – its highest level in nearly three weeks -- while the S&P 500 shed 6.79 to 1,357.51. The Nasdaq composite index fell 104.87, or 3.67 percent, to 2,754.28. The Dow Jones industrial average rose 82.55 to 10,729.52 – its highest level in nearly three weeks -- while the S&P 500 shed 6.79 to 1,357.51.

Cautious guidance from Corning may just be the start of pain for the fiber-optics sector.

After the close, networking equipment maker JDS Uniphase (JDSU: Research, Estimates) reported a quarterly profit of 21 cents a share, beating expectations by a penny and up from the 9 cents earned a year earlier. But the company issued cautious guidance, citing uncertainties in capital spending and inventory adjustments.

Shares of JDS tumbled more than 12 percent, falling $7.88 to $55.19, before its results were reported.

Market breadth was positive on the New York Stock Exchange as advancers beat decliners 1,596 to 1,236, with more than 1.25 billion shares were traded.

In other markets, the dollar was little changed against the euro but weaker versus the yen. Treasury securities were mostly higher.

Corning cracks techs

Investors were quick to react to any negative guidance from companies as quarterly results continued to roll in, and the hardest hits were in the technology sector.

Fiber-optics maker Corning (GLW: Research, Estimates) tumbled $13.88 to $56.25 after it posted fourth-quarter earnings that were higher than analysts expected, but warned that revenue in the first quarter might be soft because of weakness in the telecom industry.

"Once again, it's not what you do, it's what you say," said Art Hogan, chief market analyst with Jefferies & Co.

| |

CORPORATE RESULTS CORPORATE RESULTS

|

|

| |

|

Click below for a full list of companies posting quarterly results today

Earnings Calendar

|

|

|

PMC Sierra (PMCS: Research, Estimates) fell $7.25 to $95.88. The chipmaker is posting results after the close and expected to earn 34 cents a share, up from the 15 cents a share earned a year earlier.

Outside technology, two major drug manufacturers posted quarterly results, which fell in line with expectations.

Eli Lilly (LLY: Research, Estimates) gained 31 cents to $83.06 after it reported net income of 70 cents a share, down from 71 cents a year earlier. The results matched the analysts' consensus forecast compiled by earnings tracker First Call. Eli Lilly (LLY: Research, Estimates) gained 31 cents to $83.06 after it reported net income of 70 cents a share, down from 71 cents a year earlier. The results matched the analysts' consensus forecast compiled by earnings tracker First Call.

Schering-Plough (SGP: Research, Estimates) advanced $1.69 to $53.63 after it reported net income of 39 cents a share, up from the 34 cents a share earned a year earlier. Sales at the Kenilworth, N.J.-based maker of Claritin and other drugs rose 6 percent to $2.4 billion.

Other drug makers followed suit. Merck (MRK: Research, Estimates) gained $2.94 to $81.88 and Johnson & Johnson (JNJ: Research, Estimates) advanced $1.19 to $91.75.

"The markets are really treading water today and there's some profit-taking going on," said Peter Coolidge, senior trader with Brean Murray & Co. "Money doesn't seem to be flowing out of the market but more into some of the cyclical stocks that haven't participated in 2001 so far." "The markets are really treading water today and there's some profit-taking going on," said Peter Coolidge, senior trader with Brean Murray & Co. "Money doesn't seem to be flowing out of the market but more into some of the cyclical stocks that haven't participated in 2001 so far."

As money rotated away from technology, other cyclical issues gained, leading the Dow higher. United Technologies (UTX: Research, Estimates) surged $2.56 to $75.56, Caterpillar (CAT: Research, Estimates) gained $1.13 to $43.31, and 3M (MMM: Research, Estimates) rose $2.38 to $109.50.

Gauging Greenspan

While he made no direct mention of the Fed's intention toward interest rates, analysts said Greenspan's comments about tax cuts suggested he'd be receptive to rate cuts.

"What Greenspan had to say is very bullish -- he's saying let's have tax cuts sooner rather than later," said Brian Finnerty, head of Nasdaq trading with C.E. Unterberg Towbin. "If he's saying that, it leads me to believe he's going to give us a 50 basis point cut (half-percentage point). That means he thinks this economy needs all the stimuli it can get."

But one analyst said investors shouldn't read too much into Greenspan's comments.

"He's (Greenspan) not going to tip his hand," said Jefferies' Hogan. "Regardless of whether he hints toward further monetary policy easings or he hints towards his acceptance of tax cuts being OK for the current economy, anything he says is going to be anticlimactic."

The Fed chief's appeared receptive to tax cuts, given the size of current and projected budget surpluses. Still, he warned that lowering taxes, the hallmark of President Bush's campaign, aren't always the most dependable way to stimulate the economy because they take time to implement.

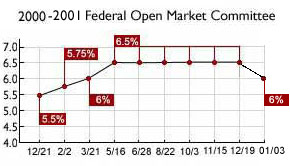

The Federal Reserve's monetary policy-making body meets in five days and investors are hoping for more rate cuts. At the start of the year, the Fed surprised the markets by cutting rates by a half-percentage point.

Lower rates tend to spur spending by businesses and consumers, boosting economic growth and fattening corporate earnings.

In the day's economic news, the Employment Cost Index, a key gauge of U.S. labor costs, rose 0.8 percent in the fourth quarter versus a 0.9 percent gain in the prior quarter, according to the Labor Department. The ECI was well below Wall Street's forecasts of an 1.1 percent increase.

Another economic report showed home sales in December fell to an annual rate of 4.87 million units, according to the National Association of Realtors, below Wall Street expectations for a 5.07 million unit rate.

|

|

|

|

|

|

|