|

Picking the ripe stocks

|

|

January 26, 2001: 2:43 p.m. ET

For a smart tech pick, watch out for names experiencing insider buying

By Lisa Meyer

|

SAN FRANCISCO (www.redherring.com) - One way to detect attractive stocks in the current sickly mess of the technology market is to check if a company's employees are actually putting their money where their mouths are and investing in the place where they work.

Even though such insider stock purchases don't guarantee that a share price will bounce back, they can indicate that those involved in the company feel confident in its fundamentals.

Of course, the more senior the employee who is doing the buying, the better the indicator. And since the current pall over the tech sector has pulled good companies down with the bad, there are certainly many opportunities for insiders to pluck up bargains in their own companies' shares.

Some of these insiders are exercising options. But, in a greater show of confidence, a large number are purchasing company shares on the open market. Several highly ranked executives at Nortel Networks (NT: Research, Estimates) and semiconductor company Chippac (CHPC: Research, Estimates), for example, bought shares even after their firms reported disappointing news.

To help investors discover attractive technology stocks that have the added benefit of recent insider buying, we ran a screen using Thomson Financial/Baseline, a stock analysis database.

The first thing we set up our screen to find were tech companies where there had been two or more insider purchases than insider sales over the last three months. And by insider, we refer not only to employees but also to directors of a company and individuals who own more than 10 percent of a company's shares.

Next, to ensure that these stocks were in fact bargains with solid fundamentals, we then screened for companies that had a price-to-earnings ratio (P/E) based on 2001 earnings of 50 or less and expected earnings growth of at least 20 percent this year. We also looked for stocks that were at least 40 percent off their 52-week highs. Finally, to weed out the smaller players we set up a market capitalization minimum of $300 million. Data as of January 24 was used to generate the screen.

The list

Thirteen companies made it through our screening process. Of that group, it isn't surprising that nine are associated with the telecommunications sector in some way, since telecom stocks have been beaten down over the last few months due to spending cuts among carriers. That has created some bargains. The nine telecom-related stocks that made our cut are Remec (REMC: Research, Estimates), Nortel, Advanced (AEIS: Research, Estimates), Chippac, Xilinx (XLNX: Research, Estimates), Viasystems (VG: Research, Estimates), Safeguard (SFE: Research, Estimates), Pericom (PSEM: Research, Estimates), and Integrated (ISSI: Research, Estimates).

Interestingly, two companies in one of the most beaten-down subsectors of technology -- Internet consultants -- showed up on our screen: eLoyalty (ELOY: Research, Estimates) and Marchfirst (MRCH: Research, Estimates). The list also included Net services software company Novell (NOVL: Research, Estimates) and image capture provider Concord (LENS: Research, Estimates).

We decided to focus on three of the companies that looked particularly intriguing: Nortel, Chippac, and Marchfirst.

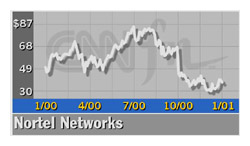

Nortel insiders bet on a rebound

Nortel had the highest level of insider buys among the companies on our screen, with 19 purchases during the last three months. The company's chief executive officer, chief financial officer, and chief operating officer were just three of the insiders that reported stock purchases during the last three months. But these top-level employees didn't just exercise options. They bought shares on the open market.

On November 17, COO Clarence Chandran reported buying 304 shares at $32.75, then five days later reported purchasing an additional 9,696 shares at the same price. On November 20, CFO Frank Dunn reported buying 400 shares in the range of $54.75 to $54.80, and on October 30, CEO John Roth reported purchasing 33,000 shares at $60.45.  Indeed, despite the scare Nortel gave the technology market by recording slowing sequential revenue growth in its optical systems division during the third quarter, the company met its numbers in the fourth quarter. Nortel's senior employees reported stock purchases after the market punished the company's shares due to disappointing third-quarter results. Indeed, despite the scare Nortel gave the technology market by recording slowing sequential revenue growth in its optical systems division during the third quarter, the company met its numbers in the fourth quarter. Nortel's senior employees reported stock purchases after the market punished the company's shares due to disappointing third-quarter results.

Even though the day these employees reported purchases might not coincide with the actual day the shares were bought, we think such activity shows that several of Nortel's senior people had enough confidence in the company's fundamentals over the long haul to invest in the stock, despite near-term concerns about telecom spending.

Closing Thursday at $37.63, Nortel's stock is currently trading at 41 times its estimated 2001 earnings and is 53 percent off its 52-week high of $89. With expectations of 31 percent earnings growth in 2001, we agree with many of Nortel's executives. The stock's a bargain.

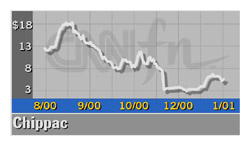

Putting their chips on the table

The telecommunications sector downturn has also caused a sell-off in the stock of Chippac, a provider of semiconductor packaging and test services. Currently trading at $5, or 74 percent below its 52-week high of $19.50, the company reported eight insider purchases and no sales during the past three months.

On November 29, CFO Robert Krakauer reported purchasing 10,000 shares in the range of $2.81-to-$2.88, and CEO Dennis McKenna reported buying 25,000 shares in the range of $2.69-to-$2.81 -- a day after Chippac issued a fourth-quarter profit warning and the company's stock got whacked.

Analysts think that once the demand for semiconductors reaccelerates, Chippac's customer orders should increase and the stock -- valued at just 12.7 times 2001 earnings estimates despite expected earnings growth next year of 24 percent -- could generate significant upside for investors.

At first glance, investors might not think Marchfirst, an Internet consulting firm beset by layoffs and budget cuts, would come back. But a few high-level company personnel believe differently. At first glance, investors might not think Marchfirst, an Internet consulting firm beset by layoffs and budget cuts, would come back. But a few high-level company personnel believe differently.

According to Baseline, Marchfirst had two insider buys and no sales during the past three months. On October 27, COO Thomas Metz reported purchasing 100,000 shares at $4.99, and director Barry Moore reported buying 20,000 shares at $1.81.

Having lost customers due to the dot.com crash, the company is currently undergoing a transition to become less of a front-end Web shop consulting firm and more of a back-end Internet software and technology integration adviser.

"Marchfirst is one of the few newer companies that has potential to survive because it has expertise in implementing new software and a customer base among Global 500 companies," pointed out Drake Johnstone, an analyst at Davenport & Co.

Trading at $2.91, or 95 percent below its 52-week high of $56.50, and at a P/E of 25.7 times estimated 2001 earnings, Marchfirst's stock might be worth the risk.

Credit Suisse First Boston reinstated coverage with a Buy rating on Monday. And fears about the company running out of cash have subsided since it landed a $150 million investment from private equity firm Francisco Partners. Analysts are expecting earnings growth of 24 percent this year.

Of course, insider buying activity does not guarantee a future spike in a company's stock price. But when you can find beaten-down stocks with strong fundamentals that insiders are investing in, you can't help think that it's a good sign.

Discuss stock market trends in our Market Watch forum, or check out forums, video, and events at the Discussions home page.

© 1997-2000 Red Herring Communications. All Rights Reserved.

|

|

|

|

|

|

|