|

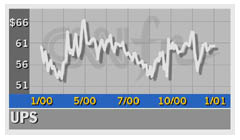

UPS tops lowered target

|

|

January 30, 2001: 11:08 a.m. ET

Carrier needs rebound in economy to meet '01 revenue, profit targets

|

NEW YORK (CNNfn) - United Parcel Service beat lowered fourth-quarter earnings forecasts despite weaker-than-expected revenue, and said it will take an improving economy in the second half of this year for it to reach Wall Street's estimates for 2001.

|

|

VIDEO

|

|

Scott Davis, CFO of UPS, chats with CNNfn about fourth-quarter earnings. Scott Davis, CFO of UPS, chats with CNNfn about fourth-quarter earnings. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

The world's largest transportation company earned $724 million, or 63 cents a diluted share, in the quarter. Analysts surveyed by First Call had dropped their earnings per share forecasts to 61 cents after the company warned Dec. 14 it would see 7-to-10 percent EPS growth, which translated into a range of 60 and 62 cents. The forecast before the warning stood at 64 cents a share. UPS earned $661 million or 56 cents a share in the year-earlier period, its first as a publicly-traded company. A lower effective tax rate saved the company $34 million, or about 3 cents a share.

Scott Davis, UPS's CFO warned analysts it will be difficult for the company to meet or top year earlier results in the first quarter, although that remains its goal. The company earned 56 cents a share in first quarter of 2000, and current forecasts called for it to earn 59 cents a share.

"We expect the first quarter to be a reasonably tough comparison versus last year," Davis told CNNfn's In the Money Tuesday. (325KB WAV) (325KB AIFF)

Revenue came in a $7.9 billion, which missed the First Call forecast of $8.3 billion for the period, but topped the $7.4 billion in revenue a year earlier. Revenue came in a $7.9 billion, which missed the First Call forecast of $8.3 billion for the period, but topped the $7.4 billion in revenue a year earlier.

For the full year the company earned $2.8 billion, or $2.38 a share, excluding special items, on revenue of $29.8 billion. The company said it now expects to see EPS growth of 9-to-11 percent this year, while revenue rises 8-to-10 percent. That would put 2001 EPS in the $2.59-to-$2.64 range, which would include the current First Call forecast of $2.63. Similarly, the 2001 revenue range would be $32.2 billion-to-$32.7 billion, which would again include the current forecast of $32.3 billion.

Click here for a look at transportation stocks

But the company said while it expects U.S. gross domestic product to rise only 1-to-2 percent in the first half, it is looking for 3-to-3.5 percent GDP growth in the second half. And without that growth, those estimates are at risk, Davis said in the company's conference call for investors and analysts.

"Certainly, the more heads up we get on it (slower growth), the better we can react. The holiday season, with the committed capacity, is the worst time to be surprised by a slowdown. But without that growth, there would be some risk to our estimates. We are looking for increases in the second half," Davis said.

Davis told analysts the growth in domestic volumes in January are up 2-to-3 percent, better than the company expected. But since January of 2000 was depressed by the rush to ship in December 1999 due to Y2K concerns, he said the company isn't sure what to make of that growth.

Shares of UPS (UPS: Research, Estimates) were up 60 cents to $61.40 in midday trading Tuesday.

|

|

|

|

|

|

|