|

Retailers post sales gains

|

|

February 8, 2001: 11:30 a.m. ET

Wal-Mart, Sears, Kmart same-store January sales up; Penney, Gap decline

|

NEW YORK (CNNfn) - The nation's biggest retailers reported mostly higher same-store sales in January, but that doesn't necessarily translate into higher profits, as sales were driven by big markdowns to clear holiday inventories.

Wal-Mart Stores Inc., K Mart, Federated Department Stores, Target Corp. and Kohl's Corp. all reported increased sales in January. However, J.C. Penney, Gap Inc. and Limited Inc. all saw declining sales.

Coming off a disappointing year in which a slowing economy and high fuel prices pinched consumer spending, retailers offered steep discounts in January to clear out higher than average leftover holiday inventory.

The discounts will erode profits, industry analysts said. The discounts will erode profits, industry analysts said.

"Most retail sales were relatively decent, but were achieved with the help of deep markdowns which will show up as heavy pressure on gross margins, and that is going to be reflected in the earnings," said Kurt Barnard, president of Barnard's Retail Trend Report in Upper Montclair, N.J.

Bear Stearns Retail Analyst Dana Telsey agreed. Consumers will be much more calculating about how they spend their money in 2001, searching out good bargains, the right fashions and colors at the right prices, she told CNNfn's "In the Money" Thursday. (256K WAV) (256K AIFF)

Big chains see modest gains

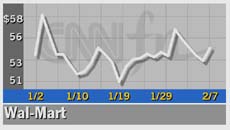

Bentonville, Ark.-based Wal-Mart (WMT: Research, Estimates), the nation's biggest retailer, reported sales at stores open at least a year, a closely watched figure known as same-store or comparable-store sales, rose 6 percent in January. Total sales increased 13.3 percent to $14.74 billion.

Sears Roebuck & Co. (S: Research, Estimates), the No. 2 U.S. retailer, said same-store sales increased 2.6 percent in January and overall domestic sales increased 3.9 percent, on strength in appliances, electronics and sporting goods.

Kmart (KM: Research, Estimates), which is in the midst of a major restructuring under new CEO Chuck Conaway, reported a 4.3 percent same-store sales increase in January and a 2.4 percent increase in overall sales.

Federated Department Stores Inc. (FD: Research, Estimates), owner of Macy's and Bloomingdale's, said January same-store sales increased 3.7 percent and total sales grew 14.5 percent to $1.1 billion. In addition, Federated said it plans to close all of its Stern's department stores, converting most of them to Macy's and Bloomingdale's and selling others.

Kohl's Corp. (KSS: Research, Estimates) reported a 7.1 percent increase in January same-store sales and a 27.5 percent increase in total sales.

Target Corp. (TGT: Research, Estimates) said same-store sales increased 2.1 percent in January, and total sales increased 8.3 percent.

Penney's, Gap, Limited sales down

J.C. Penney (JCP: Research, Estimates), based in Plano, Texas, said January same-store sales at its department stores fell 6.2 percent. Catalog sales plummeted 17.8 percent, primarily because of the elimination of several sale and specialty catalogs. Total company sales, including Penney's Eckerd drugstores, fell 2.4 percent to $2.2 billion.

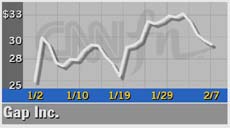

And Gap Inc. (GPS: Research, Estimates), owner of Gap, Old Navy and Banana Republic stores, reported a 12 percent drop in January same-store sale as it warned fourth-quarter results will fall short of expectations. The company now expects to report earnings of 30 cents or 31 cents a share in the quarter compared with 47 cents a year ago. Analysts were expecting 33 cents a share, according to earnings tracker First Call.

Specialty retailers also reported mixed results. One prominent chain, Limited Inc. (LTD: Research, Estimates), reported a 5 percent increase in same-store sales, and said it expects fourth-quarter earnings to be between 53 cents and 57 cents a share. Analysts on average had expected earnings of 55 cents a share, according to earnings tracker First Call. Specialty retailers also reported mixed results. One prominent chain, Limited Inc. (LTD: Research, Estimates), reported a 5 percent increase in same-store sales, and said it expects fourth-quarter earnings to be between 53 cents and 57 cents a share. Analysts on average had expected earnings of 55 cents a share, according to earnings tracker First Call.

Sluggish retail sales and waning consumer confidence contributed to the Federal Reserve's decision last month to slash interest rates by half a percentage point. Although encouraged by the Fed's move, analysts said it will take months before it has any impact and warned of a sluggish first half of 2001.

"Consumer spending is going to be more restrained than it had been early last year," Barnard said. "They will be buying things they need. They will not buy on impulse and will not buy frivolously. They will buy what they need and look for bargains."

Check out other retail stocks

But Credit Suisse First Boston Retail Analyst Michael Exstein said the numbers are basically in line with expectations, and that they reveal nothing about the remainder of 2001.

"We've been very cautious on the group. We think the industry is not in good shape," Exstein said, adding that January sales were also helped by consumers' return to a normal cyclical buying pattern following last year's Y2K fears.

People stocked up on batteries, food and equipment in anticipation of the potential Y2K computer glitch last December, so January sales were flat as those fears never materialized and consumers had surplus goods.

Now that those supplies have run out, people historically spent at a more normal level this January, Exstein said.

Wal-Mart shares slumped $2.58 to $52.08 in trading Thursday. J.C. Penney shares slipped $94 cents to $14.47, and Sears shares shed$1.53 to $37.32.

K Mart shares edged down 34 cents to $8.55 Thursday, while Federated shares slipped $1.92 to $44.02.

Shares of Kohl's were down $1.14 cents to $67.12.

Gap shares nose-dived $3.06 to $26.50, and Limited's stock fell 96 cents to $18.81 Thursday.

|

|

|

|

|

|

|