|

Sellers swamp Wall St.

|

|

February 9, 2001: 4:24 p.m. ET

Major losses for U.S. stocks as investors digest news and worry about economy

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. major indexes erased virtually all their gains for the year Friday as investors found every reason to sell, from a lack of confidence about how much further the economy would slow to negative reports from several technology companies.

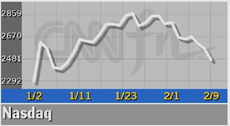

Negative reports on Lucent Technologies and Dell Computer sparked the tech sell-off, nearly wiping out all of the Nasdaq composite index's gains this year. The Nasdaq plunged 91.09 on Friday, or more than 3 percent, to 2,470.97, just 0.45 points shy of where it started the year. The index was down 7 percent for the week.

"News that Dell Computer will be cutting employees for the first time in history coupled with reports that Lucent Technologies' accounting practices may be under scrutiny set the negative tone," Larry Wachtel, market analyst with Prudential Securities, wrote in a note to clients. "But on a bigger picture basis, the technology stocks have a January bounce but do not have the fundamentals to sustain that bounce. Hence, the February disillusion." "News that Dell Computer will be cutting employees for the first time in history coupled with reports that Lucent Technologies' accounting practices may be under scrutiny set the negative tone," Larry Wachtel, market analyst with Prudential Securities, wrote in a note to clients. "But on a bigger picture basis, the technology stocks have a January bounce but do not have the fundamentals to sustain that bounce. Hence, the February disillusion."

The tech beating comes in a week already hurt by bellwether Cisco Systems (CSCO: Research, Estimates), which disappointed investors and analysts with its fiscal second-quarter results. In a rare miss, the networking equipment maker fell short of earnings targets by a penny a share and told analysts to be "more conservative" about their growth estimates in the future.

Shares of Cisco slid $1.81 to $28.19.

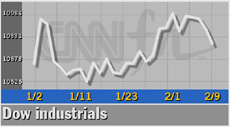

The negativity weighed also weighed on cyclical issues, erasing all of the Dow Jones industrial average's gains for the year. The Dow fell 99.10, or nearly 1 percent, to 10,781.45. The blue chip index started the year at 10,786 but fell only 0.76 percent this week. The S&P 500 shed 17.77 to 1,314.76, wiping out its gains for the year -- it started at 1,320. The S&P slipped 2.6 percent for the week. The negativity weighed also weighed on cyclical issues, erasing all of the Dow Jones industrial average's gains for the year. The Dow fell 99.10, or nearly 1 percent, to 10,781.45. The blue chip index started the year at 10,786 but fell only 0.76 percent this week. The S&P 500 shed 17.77 to 1,314.76, wiping out its gains for the year -- it started at 1,320. The S&P slipped 2.6 percent for the week.

Analysts say the lack of economic news is exacerbating an already waning confidence about what the Federal Reserve may do about its interest rate policy when it meets in late March.

"The trouble is we are seeing a lack of confidence and right now the market is driving on negative news," Joseph Parnes, president of Technomart Investment Advisors, told CNNfn's Talking Stocks. "Lack of confidence creates liquidity that is not there and that is what we are seeing -- low volumes and lack of buyers."

Market breadth was negative. On the New York Stock Exchange decliners beat advancers 1,663 to 1,400, as more than 1.05 billion shares were traded. Losers outpaced winners on the Nasdaq 2,368 to 1,351, as more than 1.86 billion shares changed hands.

In other markets, Treasury securities were higher. The dollar rose against the yen but weakened versus the euro.

Techs tumble

With little else to hang their hats on, investors focused on individual corporate stories as further reason to take money out of technology and sit on the sidelines for now.

Dell Computer (DELL: Research, Estimates) fell $2.56 to $23.50 after it was said to be mulling job cuts that could result in an 11 percent staff reduction in an effort to lower costs, according to the Wall Street Journal. The computer maker said the rumors that it will cut up to 4,000 jobs are untrue. The news comes amid weakening computer sales that have translated into disappointing earnings across much of the technology sector.

And the Securities and Exchange Commission is looking into allegations of accounting irregularities at troubled Lucent Technologies (LU: Research, Estimates), the Wall Street Journal reported separately Friday. Lucent shares tumbled $1.53 to $15.36. And the Securities and Exchange Commission is looking into allegations of accounting irregularities at troubled Lucent Technologies (LU: Research, Estimates), the Wall Street Journal reported separately Friday. Lucent shares tumbled $1.53 to $15.36.

"Lucent and Dell are not market leading but they're certainly not positive developments," said Peter Coolidge, senior trader with Brean Murray & Co. "We've sort of had a drag on tech stocks all week, and it's tough to garner a lot of excitement about the tech stocks based on the fact that we don't know how long this economic slowdown will be."

Shares of Motorola (MOT: Research, Estimates) shed 92 cents to $18.90 after it said it will cut 4,000 jobs in its semiconductor products division. The company said the cuts will come from ending the assignments of contract and temporary employees, attrition, and both voluntary and involuntary severance programs.

Power One (PWER: Research, Estimates) plunged $3.44 to $28.75. The power-conversion devices maker cut its revenue and earnings expectations for the year, saying the slowdown at some of its largest customers, networking leader Cisco in particular, is greater than previously expected.

Other techs weighing on the Nasdaq included Oracle (ORCL: Research, Estimates), down $3.56 to $23.56, Microsoft (MSFT: Research, Estimates), also a Dow component, down $3.13 to $59.13, and Qualcomm (QCOM: Research, Estimates), down $5.63 to $79.13. Other techs weighing on the Nasdaq included Oracle (ORCL: Research, Estimates), down $3.56 to $23.56, Microsoft (MSFT: Research, Estimates), also a Dow component, down $3.13 to $59.13, and Qualcomm (QCOM: Research, Estimates), down $5.63 to $79.13.

Network Appliance (NTAP: Research, Estimates) bucked the downward trend after the data storage hardware maker topped Wall Street's earnings forecasts after the bell Thursday. But at the same time, sales fell short of expectations. Shares of Network Appliance jumped $2.81 to $38.

Economic uncertainty

Concern about the slowing economy and its effect on corporate profits also kept investors nervous.

While recent data have offered credence to underlying investor optimism that the Federal Reserve would continue to be aggressive with its interest rate policy, negative news about several leading technology companies unraveled some of the optimism about when an economic recovery would occur.

Investors are now waiting to digest any upcoming economic reports and hoping the Fed will be ready to jump in if needed.

"You want to see what the bias is and if we have a further loosening bias, that will be bullish for the market," Mark Donahoe, institutional equity sales trader with U.S. Bancorp Piper Jaffray, told CNNfn's market coverage. "We're in a time period now where there's a lot of uncertainty and the market is very nervous."

And the nervousness spilled into cyclical issues on the Dow. Honeywell (HON: Research, Estimates) fell $1.58 to $47.20 and General Electric (GE: Research, Estimates) shed $1.48 to $45.66.

|

|

|

|

|

|

|