|

Tuning into Greenspan

|

|

February 12, 2001: 6:33 p.m. ET

Investors keenly waiting for Fed chairman Alan Greenspan's speech

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - Investors and economists will be keenly tuning into Federal Reserve Chairman Alan Greenspan's testimony before the Senate Banking Committee Tuesday for signs that the Fed will remain aggressive with its interest rate policy.

Most analysts expect no surprise but rather a reiteration that the Fed will continue to be vigilant about monitoring the pace of the economy and will also be ready to act as needed.

"My guess is it won't be very exciting because he already told us three weeks ago what he thinks," said Ian Shepherdson, chief U.S. economist with High Frequency Economics. "He's certainly not going to say anything that suggests the Fed might be thinking about not cutting rates as soon as the market thinks but I don't think he'll want to give the impression that they're going to slash rates even more aggressively."

But concern about the slowing economy and its effect on corporate profitability has been keeping investors edgy since the start of February. Corporate revenue warnings and a murky economic picture have also weighed heavily on confidence levels. So analysts are hoping for soothing words from Greenspan.

"We're expecting him to mention consumer confidence numbers and consumer spending numbers and to come out and say we need to ensure that consumer confidence is bolstered," said Drew Matus, financial markets economist with Lehman Brothers. "We're expecting him to come out and basically let the markets know to expect a cut in March."

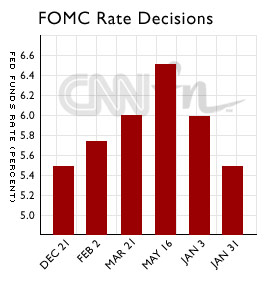

In fact, just last month, the Fed twice lowered interest rates by half a percentage point in an effort to keep the U.S. economy from slipping into recession. In fact, just last month, the Fed twice lowered interest rates by half a percentage point in an effort to keep the U.S. economy from slipping into recession.

But investors are still not sure how much faith to put into the Fed.

Greg Valliere, political economist with Charles Schwab Washington Research Group, said that investors were somewhat disgruntled that the Fed may have taken too long to react to the economic slowdown.

"He needs to restore investor confidence," said Valliere. "It's extremely unlikely he would say anything that would be viewed negatively by the markets. He's going to make it clear that we are not looking at the abyss and we are not looking at a major recession."

"I think everyone wants to see another rate cut in March," agreed Mark Donahoe, institutional equity sales trader with U.S. Bancorp Piper Jaffray. "But I'm not sure he's going to give much indication about his bias. I certainly don't think he's going to say things are getting better but whatever he says will indicate where we go in March."

Waiting for economic data

While recent data have offered credence to underlying investor optimism that the Fed would continue to be aggressive with its interest rate policy, negative news about several leading technology companies has unraveled some of the optimism about when an economic recovery would occur.

The tech beating in the first week of February was led by bellwether Cisco Systems (CSCO: Research, Estimates), which disappointed investors and analysts with its fiscal second-quarter results. In a rare miss, the networking equipment maker fell short of earnings targets by a penny a share and told analysts to be "more conservative" about their growth estimates in the future.

"That's the first time that we've heard somewhat of a negative comment on the second half," said Piper Jaffray's Donohoe. "It put a lot of doubt in my mind because Cisco is tied into so many companies. People want to hear him (Greenspan) say, if this continues, he will continue to have an interest rate cutting bias." "That's the first time that we've heard somewhat of a negative comment on the second half," said Piper Jaffray's Donohoe. "It put a lot of doubt in my mind because Cisco is tied into so many companies. People want to hear him (Greenspan) say, if this continues, he will continue to have an interest rate cutting bias."

Looking ahead, investors will focus on all the upcoming economic reports to try to gauge how the Fed will react. And they will have a great deal to chew on between now and the Federal Reserve's monetary policy meeting March 20.

| |

ECONOMIC CALENDAR ECONOMIC CALENDAR

|

|

| |

|

Click below for the latest economic reports

Economic Data

|

|

|

Upcoming economic reports include retail sales, producer price index, consumer price index, housing starts, consumer confidence, preliminary gross domestic product, a report from the National Association of Purchasing Manufacturers, and the unemployment rate.

"There's a lot of data that will show him (Greenspan) whether or not consumers are feeling safe," said Lehman's Matus.

And Bob McCooey, NYSE floor trader for Griswold Co. told CNNfn's Market Call that it will be critical for investors to get a sense that the Fed will not become complacent about cutting rates.(310K WAV) (310K AIFF)

|

|

|

|

|

|

|