|

Wholesale prices jump

|

|

February 16, 2001: 10:45 a.m. ET

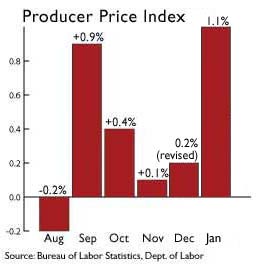

Producer price index surges in January, well above forecasts

|

NEW YORK (CNNfn) - Wholesale inflation surged last month at its fastest pace in more than a decade, the U.S. government reported Friday, stoking fears that a renewed threat of inflation may discourage the Federal Reserve from aggressively slashing interest rates again to energize the slowing economy.

The producer price index rose 1.1 percent, a much bigger increase than analysts' predictions of a 0.2 percent gain and a revised 0.2 percent increase in the previous month. The Labor Department attributed the jump to rising costs for fruits and vegetables, as well as a jump in prices for cigarettes, cars and energy.

The increase was the largest since a 1.3 percent gain in September 1990.

The "core" rate, which excludes the volatile food and energy sectors, rose 0.7 percent in January, the biggest increase since a 1 percent gain in December 1998.

The core rate well exceeded forecasts of a 0.1 percent increase and a similar 0.1 percent gain in December. The core rate well exceeded forecasts of a 0.1 percent increase and a similar 0.1 percent gain in December.

The government also released a slew of other economic data, presenting a mixed bag about the health of the economy.

The U.S. Commerce Department reported that housing starts jumped 5.3 percent in January to a 1.7 million annual rate, compared with a 0.3 percent gain in December. The housing sector has managed to hold up well despite the slowdown hitting the rest of the U.S. economy.

Meanwhile, industrial production fell 0.3 percent in January, the government said. Wall Street had expected a stronger showing, following a sharp 0.5 percent decline in December.

Also Friday, the University of Michigan's twice-monthly barometer of consumer confidence fell again in February to its lowest level in more than seven years, market sources told the Reuters news agency. The report is directly released to subscribers only.

The economic data, along with more worrisome news about corporate earnings in the technology sector, dragged down stocks in early trading. The Dow Jones industrial average tumbled about 65 points, while the Nasdaq composite lost more than 100 points. Bond prices also dropped, pushing yields higher.

| |

|

|

| |

|

|

| |

This is really not an inflation story.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

James Glassman

Senior U.S. economist

J.P. Morgan Chase |

|

Many analysts said the latest PPI numbers likely were an aberration, but they said the data could complicate the case for the Federal Reserve to cut interest rates again if there are signs that inflation is popping up.

"This is really not an inflation story," James Glassman, senior U.S. economist at J.P. Morgan Chase, told CNNfn's Before Hours. "If you look deeper beyond the shock value of all of this – tobacco prices, vegetable prices, energy prices -- there really are a lot of disinflation forces in place here."

The Fed cut rates twice last month by half a percentage point each time, and many economists have predicted a further half-point rate cut in March. But, in statements accompanying last month's rate cuts, the Fed made clear to point out that it saw inflation being in check. If inflation appears to be making a comeback, the Fed could be dissuaded from rate reductions that could trigger even higher prices.

However, many experts still predict the Fed will slash rates again at its next policy makers meeting in March. More significant than the PPI data was the industrial production report, which showed the fourth consecutive month of declines, said Larry Wachtel, a market analyst at Prudential Securities.

"I think we're in a manufacturing recession and the Fed has to act against that particular phenomenon," he told CNNfn's Market Call. "I think what the Fed is acting against is that manufacturing is contracting, and that's why I think they'll cut again."

-- from staff and wire reports

|

|

|

|

|

|

|