|

Record year for VC

|

|

February 16, 2001: 8:21 a.m. ET

VCs still raising, spending record amounts

|

NEW YORK (CNNfn) - The year 2000, in spite of the stumbling stock market, was another robust year for venture capitalists.

By the end of 2000, venture capitalists had raised $69.1 billion, twice the $34.5 billion they raised in the previous 12 months, according to a recent survey conducted by VentureOne, a San Francisco research firm. A stunning 18 funds made their way into the billion dollar club during 2000, whereas only three funds raised $1 billion or more in 1999. Three funds: TA Associates and New Enterprise Associates, both of Menlo Park, Calif., and Boston-based Summit Partners, each closed on funds larger than $2 billion.

Those figures, according to John Gabbert, director of research at VentureOne, indicates that institutional investors still find venture capital investing attractive.

"These firms have repeatedly demonstrated considerable investing acumen and they adapt their strategies to suit the economic landscape, whether that means anticipating emerging technologies or looking further afield to overseas opportunities," said Gabbert.

Investing, too, reaches new record

Likewise, it was a record year for venture capital investing in startup companies. Total investment, according to a survey conducted by PricewaterhouseCoopers and VentureOne, reached $68.8 billion, an 80 percent increase over venture-backed investing in 1999.

"Perspective is important here," said Tracy T. Lefteroff, managing partner of PricewaterhouseCoopers' venture capital practice. "Despite the dot.bombs of 2000, and despite the turmoil in the public markets, venture capital investments were the highest in history."

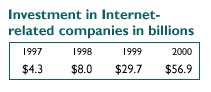

Venture capitalists remained fairly optimistic about the future of some Internet-related businesses in 2000. Investment in that sector increased 92 percent in 2000, to $56.9 billion, over 1999. E-commerce companies, following many high-profile bankruptcies in that sector, experienced the biggest drop in funding. Investment in e-commerce declined 92 percent in 2000 and now accounts for only 1 percent of all Internet-related investments.

|

|

|

|

|

|

|