|

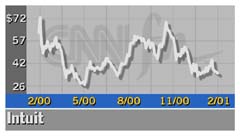

Intuit 2Q beats Street

|

|

February 20, 2001: 5:40 p.m. ET

Financial software maker tops forecasts despite weaker-than-expected revenue

|

NEW YORK (CNNfn) - Financial software provider Intuit beat fiscal second-quarter earnings estimates despite missing revenue forecasts.

The maker of leading accounting software Quicken and the popular tax-preparation software TurboTax earned $104.2 million, or 48 cents a diluted share, excluding goodwill and special charges, for the period ending Jan. 31. Analysts surveyed by earnings tracker First Call were looking for earnings of 45 cents a share, up from $91.4 million, or 44 cents a diluted share it earned on the same basis in the year-earlier period.

Including special items and charges, including a $72 million charge for the drop in value of some of its investments, the company saw net income fall to $26.6 million, or 12 cents a diluted share, from $57.3 million, or 27 cents a share, a year earlier.

Revenue of $457.6 million fell short of analysts' forecasts of $462.7 million in the period, but it was up from the $425.5 million it posted in the year-earlier period. Revenue of $457.6 million fell short of analysts' forecasts of $462.7 million in the period, but it was up from the $425.5 million it posted in the year-earlier period.

Company executives said sales of its QuickBooks small-business accounting software were slower than expected, due primarily to the relatively large number of customers who upgraded a year earlier due to Y2K concerns, cutting upgrade rates this time. The company said that tax preparation sales are also off to a somewhat slower-than-expected start, but they believe that the business is poised to show strong year-over-year growth and that momentum is picking up.

Click here for a look at software stocks

The company said it was keeping its guidance for third-quarter and full-year revenue in the same range, although the lower end of that range would put the company below current First Call forecasts. But it now believes its operating income will be stronger than expected.

The company's profit guidance is on an operating income basis rather than an earnings-per-share forecast. The range now stands at $205 million to $213 million for the fiscal year, which translates into about 93 cents to 97 cents on a per-share basis, and is a bit ahead of the First Call forecast of 83 cents before it beat second-quarter EPS estimates by three cents.

The company's third-quarter revenue range now stands at $455 million to $470 million, compared with the First Call forecast of $468.4 million. Its guidance for full-fiscal year revenue now stands at $1.32 billion to $1.34 billion, and Steve Bennett, the company's CEO, said it now looks like it will be in the lower end of that range. First Call's fiscal year-revenue forecast stands at $1.33 billion.

Shares of Intuit (INTU: Research, Estimates) gained $2.09 to $34.78 in after-hours trading after it lost $2.13 to close at $32.69 in regular-hours trading Tuesday ahead of the earnings report.

|

|

|

|

|

|

|