|

Brocade lowers targets

|

|

February 21, 2001: 6:04 p.m. ET

Fiber-optic switch maker edges 1Q estimates, lowers guidance

|

NEW YORK (CNNfn) - Brocade Communications Systems, a supplier of fiber-optic switches that link computer storage networks, logged fiscal first-quarter profit and revenue Wednesday that beat expectations but lowered its growth targets for the current quarter and remainder of the fiscal year.

After the closing bell, Brocade said it earned $32.5 million, or 13 cents per share during the quarter ended Jan. 27. Analysts surveyed by earnings tracker First Call had generally expected Brocade to report a profit of 12 cents per share. During the same period a year earlier, Brocade reported earnings of 3 cents per share.

At $165 million, Brocade's first-quarter revenue rose more than 286 percent from $42.7 million during the same quarter a year earlier and exceeded the $162.21 million analysts had expected to see on the company's top line, according to the First Call survey.

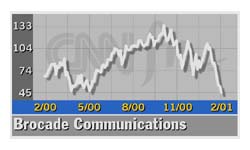

Shares of Brocade (BRCD: Research, Estimates) fell 19 cents to $44.69 on Nasdaq ahead of the earnings results, which were released after the closing bell. They plunged $7.12  to $37.56 in after-hours trade. to $37.56 in after-hours trade.

In a teleconference with analysts Wednesday evening, Brocade chief financial officer Mike Byrd said revenue growth would be flat or show a "very modest" rise in the second quarter over the first, and there would be sequential rises of 19 percent in the third and

fourth quarters.

For the full fiscal year, which ends in October, Brocade is now targeting total revenue growth of roughly 100 percent. Most recently, analysts had expected Brocade's total revenue for the year to come in at about $830 million, suggesting a 152 percent increase over the $329 million in sales it reported last year.

"The greatest factor clouding our vision is conservative forecasting on the part of our [sales] channel and our field," said Greg Reyes, Brocade's chief executive. "I also think there is a smattering of segments that were strong last year that aren't strong this year."

That news came on the heels of a downward revision from one of Brocade's main competitors.

Last week, Emulex (EMLX: Research, Estimates), which offers a similar product line to Brocade's, warned investors that its latest quarterly results will fall short of previous expectations, blaming customer order delays.

Merrill Lynch analyst Tom Kraemer boosted Brocade earlier in the session Wednesday, telling clients in a research note that the Emulex does not signal a deceleration in demand for data-storage systems and should not be taken as a sign of weakness for Brocade.

"The news from Emulex should not be interpreted as a sign of coming weakness from Brocade," Kraemer said, noting that Emulex's problems appear to be tied to a manufacturer of network servers. Emulex's products are also used in network servers.

Brocade makes the hardware and related software used to connect storage area networks, also called SANs. The company sells its products primarily in the U.S., which accounts for nearly 80 percent of its total revenue, through systems integrators and equipment manufacturers. Among its top customers are Compaq (CPQ: Research, Estimates) and EMC (EMC: Research, Estimates), which collectively account for roughly half the company's sales.

The company's shares have taken a beating amid the recent downturn for technology stocks, declining more than 42 percent since the start of the year.

-- Reuters contributed to this report

|

|

|

|

|

|

|