|

U.S. indicators jump

|

|

February 22, 2001: 11:41 a.m. ET

Private business group says January data show no recession on horizon

|

NEW YORK (CNNfn) - A key index of U.S. economic activity jumped in January after three consecutive months of declines, suggesting that the economy is rebounding and no recession is on the horizon, according to a report by a private business research group Thursday.

The New York-based Conference Board said its index of leading economic indicators climbed 0.8 percent to 109.4 last month, following a revised 0.5 percent decline in December. The latest gain is double what analysts had expected.

The data indicate "that the pace of economic activity is moderating, with no clear sign of a recession looming on the horizon," the Conference Board said. Despite the latest jump, the gain does not recover the losses of the previous three months, the group said. The data indicate "that the pace of economic activity is moderating, with no clear sign of a recession looming on the horizon," the Conference Board said. Despite the latest jump, the gain does not recover the losses of the previous three months, the group said.

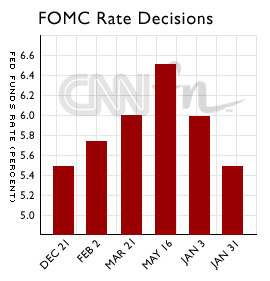

The report suggests that the economy is "just kind of muddling along at a moderate pace and not dipping into recession," said Steve Cochrane, an economist at Economy.com, a forecasting and consulting firm. If that's the case, he said, "there is less of an impetus for the Fed to be aggressive in lowering interest rates."

But, even though the data indicate a slight economic rebound, the report helped unnerve Wall Street. The Dow Jones industrials dropped about 50 points to 10,472 in late morning trading, while the Nasdaq composite lost 27 points to 2,242.

Investors are nervous because financial markets already have factored in expectations that the Federal Reserve will lower short-term interest rates again next month to stimulate the economy. But many experts now say that after two interest rate reductions last month, the central bank may take a more cautious approach amid signs of moderate economic growth and evidence that inflation is returning to the economic picture.

The index tracks previously reported data including building permits, capital goods orders, average workweek and consumer goods orders. Even though the data has been reported before, economists closely monitor the monthly index because it signals the outlook for business activity down the road, instead of looking at the economy in the rear view mirror.

The report comes after several mixed signals about the health of the economy. On Wednesday, the government said consumer prices in January rose at the fastest pace in 10 months, raising worries about inflation pressures. That report followed a report last Friday that showed a big jump in inflation at the wholesale level.

In another worrisome sign, the Conference Board said last month that consumer confidence plunged in January to its lowest level in four years.

But there are some signs of strength in the economy, notably in the housing sector, which has seen housing starts increase despite the slowdown in other sectors.

Separately Thursday, new jobless claims rose 4,000 last week, the Labor Department reported, after dropping slightly the previous week.

|

|

|

|

|

|

|