|

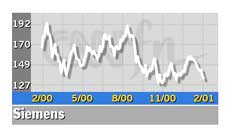

Siemens to buy Efficient

|

|

February 22, 2001: 9:06 a.m. ET

Siemens to pay $1.5 billion for Efficient, warns on the cell phone market

|

LONDON (CNN) - Germany's Siemens agreed on Thursday to buy U.S. broadband network company Efficient Networks for $1.5 billion in cash.

The Munich-based engineering and electronics company said it would pay $23.50 per share, a 90 percent premium to the Efficient's closing share price on Nasdaq on Wednesday. Efficient stock soared on the news, jumping $10.70 to $23.08 in before-hours trading Thursday.

In a statement to shareholders, Siemens warned that its expansion in the broadband and mobile phones sector would weigh on earnings in the immediate future.

| |

|

|

| |

|

|

| |

Siemens is feeling the effects of the current growth in the mobile phone market. Prognoses here are especially difficult at the moment.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Heinrich von Pierer

Siemens chief executive |

|

The company also said it had not been able to escape the gloom growing over the mobile phone sector. Weaker then expected mobile phone sales over the Christmas period resulted in higher inventories that must now be reduced, the company admitted.

Siemens' peers, Finland's Nokia and Motorola (MOT: Research, Estimates) of the U.S., downgraded their estimates for mobile phone sales growth late last year, and Sweden's Ericsson was forced into farming out production of its handset business after racking up billions in losses.

Siemens, the world's fourth-largest maker of mobile phone handsets, said it was "feeling the effect of the current dip in mobile the phone market. Prognoses here are especially difficult at the moment."

Still, Siemens Chief Executive Heinrich von Pierer told CNN the company overall would see double-digit growth in revenues and orders in 2001 and said earnings would grow faster than sales.

The acquisition will strengthen Siemens' position in the broadband access arena. Efficient's product range enables telecom operators to offer broadband access services to businesses and residential customers.

Dallas-based Efficient Networks (EFNT: Research, Estimates) had sales of $394 million in 2000, Siemens said. Dallas-based Efficient Networks (EFNT: Research, Estimates) had sales of $394 million in 2000, Siemens said.

Siemens also announced it was seeking shareholder approval for a two-for-one stock split in the second-quarter. Siemens said it is looking at plans to buy back its stock and may exchange its stock for chipmaker Infineon Technologies (FIFX), reducing its 71 percent stake in the semiconductor maker.

Siemens said it was making every effort to dispose of its remaining stake in Infineon.

Shares in Siemens (FSIE) fell 0.3 percent to  133.00 in early trading in Frankfurt. 133.00 in early trading in Frankfurt.

|

|

|

|

|

|

|