|

All eyes on confidence

|

|

February 26, 2001: 4:24 p.m. ET

Experts say consumer confidence holds the key to future of interest rates

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Job cuts are rising, stocks have wilted and energy prices remain high. It's no wonder, then, that the psyche of the American consumer may be in fragile shape.

The Conference Board, a private business research group, is scheduled to release its monthly report on consumer confidence Tuesday morning. Most economists predict further erosion in the index as consumers grow more worried about the outlook for the economy. And Wall Street also is expecting confidence to sag, with investors snapping up stocks Monday in hopes that another plunge in the index could spur the Federal Reserve to slash interest rates again this week.

Experts say consumers aren't panicking, but they are assessing the economy soberly after a rough month for stocks and more announcements about layoffs throughout Corporate America.

"Households have taken a clue from the drop-off in the stock market. The economy is weakening but not many of them have seen it in their own lives," said Russell Sheldon, an economist at BMO Nesbitt Burns. "Conditions are still fairly good, but there's a heightened awareness that the economy is at risk, and that can make people cautious."

| |

|

|

| |

|

|

| |

Conditions are still fairly good, but there's a heightened awareness that the economy is at risk, and that can make people cautious.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Russell Sheldon

Economist

BMO Nesbitt Burns |

|

Some experts say another round of weak consumer confidence data could help persuade Fed policymakers to cut interest rates again before their March 20 meeting – although others cautioned such hopes may be just wishful thinking.

However, it's no secret that Alan Greenspan and his colleagues at the Federal Reserve have centered on maintaining consumer confidence as a key weapon in warding off recession. The Fed slashed rates twice last month in an effort to inject life into the sluggish economy.

"It's extremely important," Michael Moran, chief economist at Daiwa Securities, said of Tuesday's confidence report. "I think it's going to have an important bearing on what the Fed decides to do with its monetary policy."

Earlier this month, inflationary data about January price increases at the wholesale and consumer level dampened hopes that the Fed would reduce interest rates again prior to its next scheduled meeting. But sentiment has grown in recent days that consumer confidence and stock prices have softened so much recently that a rate cut is needed now.

And Wall Street, for its part, appeared optimistic Monday that another rate cut could be on the way soon. The Dow Jones industrial average jumped 200 points, or 2 percent, to 10,642. The Nasdaq composite climbed 45 points to 2,308. And Wall Street, for its part, appeared optimistic Monday that another rate cut could be on the way soon. The Dow Jones industrial average jumped 200 points, or 2 percent, to 10,642. The Nasdaq composite climbed 45 points to 2,308.

"The Fed has identified consumer confidence as the most important concept right now," Sheldon said. "They are extremely worried that the problems in the stock market and the weakness in the manufacturing sector will lead to pessimism and lower spending."

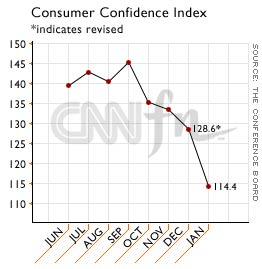

The consumer confidence index is expected to drop for the fifth consecutive month, slipping to a reading of about 111, after plunging 14 points to 114.4 in January, its lowest level in four years. The index is compiled through a survey of 3,500 respondents, who are polled on their attitudes about jobs, spending and other factors.

The index had jumped to an all-time high of 144 last year, but confidence has crumbled quickly. Consumer spending accounts for about two-thirds of the U.S. economy, making the gauge an important economic indicator.

Economists say there are several signs that consumer sentiment weakened further this month. Another gauge, the University of Michigan's consumer sentiment index, fell to a seven-year low in February. And major stock indexes have dipped to lows not seen for two years.

Meanwhile, a real estate group reported Monday that declining consumer confidence hurt existing home sales in January, despite lower mortgage rates that should have boosted home-buying activity.

The Conference Board report on consumer confidence isn't the only economic data that will be closely tracked this week. Wall Street also is awaiting a report on durable goods orders Tuesday, and another reading Wednesday on gross domestic product output in last year's fourth quarter. On Thursday, investors will be watching data on monthly auto sales, another gauge of consumer sentiment.

|

|

|

|

|

|

|