|

U.S. stocks wait for Fed

|

|

February 28, 2001: 7:46 a.m. ET

Investors anxious about Greenspan testimony, chances for early rate cut

|

NEW YORK (CNNfn) - Wall Street waited and wondered Wednesday morning -- waited for Federal Reserve Chairman Alan Greenspan's testimony before a House committee and wondered if the central bank would cut interest rates sometime soon.

Investors were mixed ahead of Greenspan's remarks. Nasdaq-100 futures rose, pointing to a higher open for the Nasdaq market. Standard & Poor's futures were little changed, after taking fair value into account, pointing to a flat open for the S&P 500 and Dow Jones industrial average.

Normally, the second round of Greenspan's semi-annual monetary policy testimony has been a repeat of the first round. But earlier this week, Fed spokesmen indicated the chairman would modify his initial comments made to the Senate Banking Committee on Feb. 13, when he stressed that he didn't believe the nation was in a recession. Normally, the second round of Greenspan's semi-annual monetary policy testimony has been a repeat of the first round. But earlier this week, Fed spokesmen indicated the chairman would modify his initial comments made to the Senate Banking Committee on Feb. 13, when he stressed that he didn't believe the nation was in a recession.

Markets rallied late last week and early this week after former Fed governor Wayne Angell, now a Bear Stearns economist, forecast the Fed would cut rates by a half percentage point this week -- three weeks ahead of its scheduled policy meeting. Reinforcing the idea were three reports Tuesday pointing to unexpected weakness in the U.S. economy.

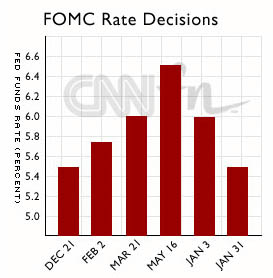

The Fed cut rates twice in January in a bid to prevent the country from spinning into recession.

Before markets opened Wednesday, the Commerce Department was to issue a revised reading on fourth-quarter gross domestic report data, the broadest measure of the nation's economy. Economists surveyed by First Call expect the annual growth rate to be revised down to 1.1 percent from the originally reported 1.4 percent.

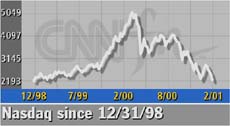

The Nasdaq composite index went into the session at 2,207.82, its lowest since New Year's Eve 1998, after a more than 4 percent drop Tuesday. The Dow Jones industrial average stood at 10,636.88 following a modest decline, while the S&P 500 starts at 1,257.94 after dropping nearly 10 points.

Weakness in Nasdaq's technology stocks spread Wednesday to Asia, as Tokyo's Nikkei index finished lower. There was also some carryover to European markets in early trading.

A Treasury rally on weak economic data continued into Wednesday, further lowering yields. The 10-year note yield slipped to 4.94 percent from 4.97 percent late Tuesday, while the 30-year bond yield dropped to 5.33 percent from 5.35 percent.

The dollar gained against the yen after the Bank of Japan lowered interest rates, but faded versus the euro. Brent oil futures advanced 27 cents to $26.29 a barrel in London.

Altera (ALTR: Research, Estimates), the semiconductor maker, warned late Monday that first-quarter revenue will be below expectations due to the kind of inventory buildup that has plagued tech companies in the slowing U.S. economy. Shares of Altera closed Tuesday at $23.37, down $2.06. Altera (ALTR: Research, Estimates), the semiconductor maker, warned late Monday that first-quarter revenue will be below expectations due to the kind of inventory buildup that has plagued tech companies in the slowing U.S. economy. Shares of Altera closed Tuesday at $23.37, down $2.06.

Intimate Brands (IBI: Research, Estimates), the parent of Victoria's Secret and Bath & Body Works, advised that earnings growth for its current fiscal year would be "modest" after meeting lowered forecasts for the fourth quarter. The company's shares fell 84 cents Tuesday to $16.11.

British American Tobacco, the world's No. 2 listed cigarette maker, posted an 11 percent rise in its full-year pretax profit Wednesday, reflecting a cost savings from integrating the Rothmans. BAT's (BTI: Research, Estimates) American depository receipts gained 72 cents to $16.10 Tuesday.

|

|

|

|

|

|

|