|

Gateway warns on 1Q

|

|

February 28, 2001: 5:38 p.m. ET

PC maker expects to break even, record substantial charges in the quarter

|

NEW YORK (CNNfn) - Personal computer maker Gateway said Wednesday it expects to break even on an operating income basis in the current quarter and will record a charge of as much as $275 million in connection with layoffs and other restructuring measures.

After the closing bell, Gateway (GTW: Research, Estimates) said its plans for growing its business in 2001, which include additional investment in customer satisfaction initiatives and competitive pricing, prompted a re-evaluation in its previous first-quarter estimates.

Most recently, analysts polled by earnings tracker First Call had generally expected Gateway to post an operating profit of 17 cents per share in the current quarter, which ends in March. The company also said it expects unit sales to be slightly down in the quarter from the same period last year.

"We expect to continue operating the business on a break-even basis through the first half of the year, with a planned return to profitability and unit growth on a year-over-year basis during the second half," Ted Waitt, Gateway's chairman and chief executive, said in a statement.

In the second quarter, analysts had expected Gateway's operating profit to rise to 20 cents per share, according to the First Call survey.

Gateway's estimate for two breakeven quarters exclude the impact of non-recurring charges. During the first quarter, the company expects to take a one-time charge of between $150 million and $275 million related to layoffs and other restructuring measures. Gateway's estimate for two breakeven quarters exclude the impact of non-recurring charges. During the first quarter, the company expects to take a one-time charge of between $150 million and $275 million related to layoffs and other restructuring measures.

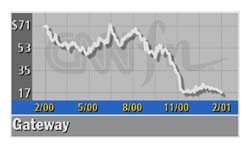

After rising 48 cents to $17.20 on the New York Stock Exchange ahead of the news, Gateway shares slid $1.20 to $16 in after-hours trade.

Wednesday's announcement was just the latest blast of bad news out of the San Diego-based company recently. Gateway executives already had reduced their growth targets for 2001 when they reported the company's fourth-quarter results last month.

Shortly after the company reported those results, which fell shy of analysts expectations, Waitt, the company's co-founder, returned to his previous role as CEO, succeeding Jeff Weitzen. Several other top executives also have left the company recently, including John Todd, who was replaced as chief financial officer by Joe Burke a day after Weitzen's departure.

Gateway, the No. 6 PC vendor, has been among the hardest hit by the slowdown in the U.S. economy. In the fourth quarter, the company revealed that its personal computer business had lost time for the first time ever.

Under Weitzen's stewardship, Gateway had been pursuing a "beyond-the-box" strategy of driving profit by selling computer peripherals and services as well as PCs. Earlier Wednesday, Waitt told analysts in San Diego that Gateway will refocus on selling computers.

"We have to have a successful box business if we are going to go beyond the box," Waitt said.

Gateway, host to an analysts meeting in San Diego Wednesday, also said it will restate its earnings for the first three quarters of 2000 to reflect the retroactive adoption of new accounting principles as well as a revision in the accounting treatment for certain items.

As a part of the revised results, the company increased by $75 million the fourth-quarter pre-tax charge to earnings related to the write-down of its investments in technology-based companies.

After adjusting the results to take into account the new accounting methods and write-downs, Gateway said it has lowered its full-year net income by about $74.5 million, or 22 cents per share.

As a result of the full-year changes, Gateway reported a fiscal 2000 profit of $241.5 million, or 73 cents per share, on revenue of $9.6 billion.

|

|

|

|

|

|

|